Motorola 2015 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2015 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

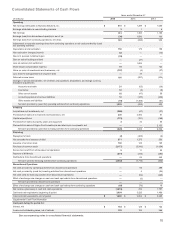

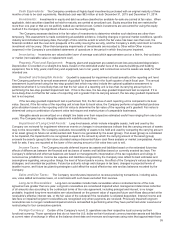

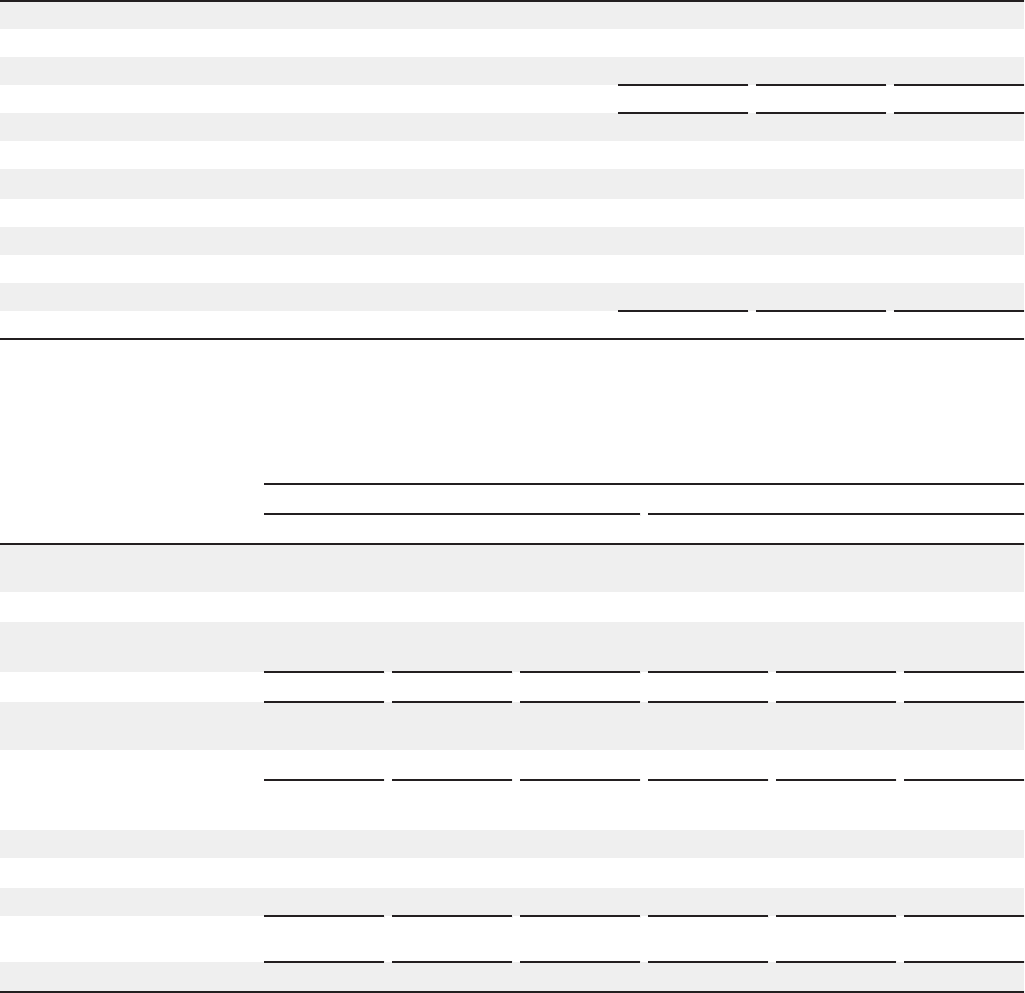

Other Income (Expense)

Interest expense, net, and Other both included in Other income (expense) consist of the following:

Years ended December 31 2015 2014 2013

Interest expense, net:

Interest expense $(186)$ (147) $ (132)

Interest income 13 21 19

$(173)$ (126) $ (113)

Other:

Loss from the extinguishment of long-term debt $—$(37)$ —

Investment impairments (6) —(3)

Foreign currency loss (23) (3) (17)

Gain (loss) on derivative instruments 7(4) 8

Gains on equity method investments 616 10

Other 5(6) 11

$(11)$(34)$ 9

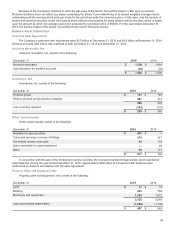

Earnings Per Common Share

Basic and diluted earnings per common share from both continuing operations and net earnings attributable to Motorola

Solutions, Inc. is computed as follows:

Amounts attributable to Motorola Solutions, Inc. common stockholders

Earnings (loss) from Continuing Operations Net Earnings

Years ended December 31 2015 2014 2013 2015 2014 2013

Basic earnings per common

share:

Earnings (loss) $ 640 $ (697) $ 933 $ 610 $1,299$1,099

Weighted average common

shares outstanding 199.6 245.6 266.0 199.6 245.6 266.0

Per share amount $3.21$ (2.84) $ 3.51 $3.06$5.29$4.13

Diluted earnings per

common share:

Earnings (loss) $ 640 $ (697) $ 933 $ 610 $1,299$1,099

Weighted average common

shares outstanding 199.6 245.6 266.0 199.6 245.6 266.0

Add effect of dilutive securities:

Share-based awards 2.1 —4.52.1 —4.5

Senior Convertible Notes 0.1 ——0.1 ——

Diluted weighted average

common shares outstanding 201.8 245.6 270.5 201.8 245.6 270.5

Per share amount $3.17$ (2.84) $ 3.45 $3.02$5.29$4.06

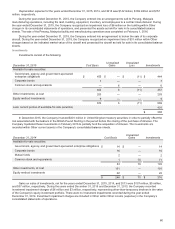

In the computation of diluted earnings per common share from continuing operations and on a net earnings basis for the

year ended December 31, 2015, the assumed exercise of 2.7 million options and the assumed vesting of 0.3 million RSUs were

excluded because their inclusion would have been antidilutive. For the year ended December 31, 2014, the Company recorded

a net loss from continuing operations and, accordingly, the basic and diluted weighted average shares outstanding are equal

because any increase to the basic shares would be antidilutive, including the assumed exercise of 6.3 million stock options and

the assumed vesting of 1.1 million RSUs. In the computation of diluted earnings per common share from continuing operations

and on a net earnings basis for the year ended December 31, 2013, the assumed exercise of 5.6 million stock options and the

assumed vesting of 0.2 million RSUs were excluded because their inclusion would have been antidilutive.

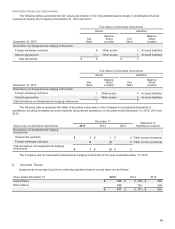

On August 25, 2015, the Company issued $1.0 billion of 2% Senior Convertible Notes (the "Senior Convertible Notes")

which mature in September 2020. The notes are convertible based on a conversion rate of 14.5985 per $1,000 principal amount

(which is equal to an initial conversion price of $68.50 per share). See discussion in Note 4. In the event of conversion, the

Company intends to settle the principal amount of the Senior Convertible Notes in cash.