Motorola 2015 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2015 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

margin, partially offset by lower SG&A and R&D expenditures as a result of cost savings actions taken to lower variable

compensation expenses.

Reorganization of Businesses

During 2015 we implemented various productivity improvement plans aimed at continuing operating margin improvements

by driving efficiencies and reducing operating costs. In 2015, we recorded net reorganization of business charges of $117 million

relating to the separation of 1,100 employees, of which 900 were indirect employees and 200 were direct employees. The $117

million of charges in earnings from continuing operations included $9 million recorded to Cost of sales and $108 million recorded

to Other charges. Included in the aggregate $117 million are charges of: (i) $74 million for employee separation costs, $31

million for the impairment of the corporate aircraft, (iii) $10 million for exit costs, and (iv) a $6 million building impairment charge,

partially offset by $4 million of reversals for accruals no longer needed.

During 2014, we recorded net reorganization of business charges of $96 million relating to the separation of 1,200

employees, of which 900 were indirect employees and 300 were direct employees. Of these charges, $23 million related to

discontinued operations. The remaining $73 million of charges in earnings (loss) from continuing operations included $9 million

recorded to Cost of sales and $64 million recorded to Other charges. Included in the aggregate $73 million are charges of: (i)

$67 million for employee separation costs and (ii) $7 million related to charges for exit costs, partially offset by $1 million of

reversals for accruals no longer needed.

During 2013, we recorded net reorganization of business charges of $133 million relating to the separation of 2,200

employees, of which 1,400 were indirect employees and 800 were direct employees. Of these charges, $47 million related to

discontinued operations. The remaining $86 million of charges in earnings from continuing operations included $16 million

recorded to Cost of sales and $70 million recorded to Other charges. Included in the aggregate $86 million are charges of: (i)

$94 million for employee separation costs and (ii) $2 million related to charges for exit costs, partially offset by $10 million of

reversals for accruals no longer needed.

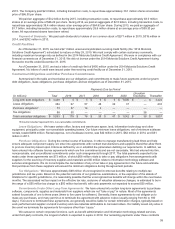

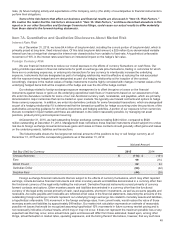

The following table displays the net charges incurred by business segment:

Years ended December 31 2015 2014 2013

Products $84$48$57

Services 33 25 29

$ 117 $73$86

Cash payments for exit costs and employee separations in connection with these reorganization plans were $71 million,

$148 million, and $59 million in 2015, 2014, and 2013, respectively. The cash payments included $5 million in 2015, $50 million

in 2014, and $20 million in 2013 related to employees of discontinued operations. Of the $60 million reorganization of

businesses accrual remaining at December 31, 2015, $51 million relates to employee separation costs that are expected to be

paid in 2016 and $9 million relates to exit costs.

Liquidity and Capital Resources

We decreased the aggregate of our cash and cash equivalent balances by $2.0 billion from $4.0 billion as of December 31,

2014 to $2.0 billion as of December 31, 2015. The decrease is primarily due to $3.5 billion of capital returned to shareholders

through share repurchases and dividends paid and an investment of $401 million in United Kingdom treasury securities used to

partially offset our British Pound Sterling foreign currency risk associated with the purchase of Airwave that we closed in

February 2016, offset by $1.0 billion of cash provided by operating activities and $971 million of proceeds raised by the issuance

of the Senior Convertible Notes (net of issuance costs paid).

As highlighted in the consolidated statements of cash flows, our liquidity and available capital resources are impacted by

four key components: (i) cash and cash equivalents, (ii) operating activities, (iii) investing activities, and (iv) financing activities.

Cash and Cash Equivalents

At December 31, 2015, $1.1 billion of the $2.0 billion cash and cash equivalents balance was held in the U.S. and $838

million was held by the Company or its subsidiaries in other countries, with approximately $495 million held in the United

Kingdom. At both December 31, 2015 and December 31, 2014, restricted cash was $63 million.

We continue to analyze and review various repatriation strategies to efficiently repatriate cash. In 2015, we repatriated

approximately $249 million in cash to the U.S. from international jurisdictions. Undistributed earnings that we intend to reinvest

indefinitely, and for which no U.S. income taxes have been provided, aggregate to $1.4 billion at December 31, 2015. We

currently have no plans to repatriate the foreign earnings permanently reinvested. If circumstances change and it becomes

apparent that some or all of the permanently reinvested earnings will be remitted to the U.S. in the foreseeable future, an

additional income tax charge may be necessary.

Where appropriate, we may also pursue capital reduction activities; however, such activities can be involved and lengthy.

While we regularly repatriate funds, and a portion of offshore funds can be repatriated with minimal adverse financial impact,