Motorola 2015 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2015 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.5

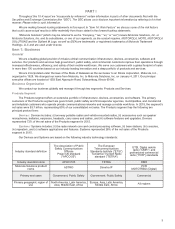

Our strategy includes leveraging our products and services for markets outside of the public safety and commercial

markets we traditionally serve. A portion of our new product introductions in recent years include products which may also be

used in the hospitality, mining, military, transportation, education, and utility vertical markets ("verticals").

Geographical diversification is accelerated by our investments supporting: (i) different regional interfaces, (ii) multiple

languages, (iii) tailored form factors, and (iv) unique feature sets.

In addition to organic development opportunities and growth, we continually evaluate opportunities for inorganic growth

through acquisitions or targeted investments in innovative technology companies that align with our strategic initiatives.

Our Customers and Contracts

We address the communication needs of government agencies, state and local public safety and first-responder agencies,

and commercial and industrial customers who utilize private communications networks and manage a mobile workforce. Our

customer base is fragmented and widespread when considering the many levels of governmental and first-responder decision-

makers that procure and use our products and services. Serving this global customer base spanning federal, state, county,

province, territory, municipal, and departmental independent bodies, along with our commercial and industrial customers,

requires a significant go-to-market investment.

Our sales model includes both direct sales by our in-house sales force, which tends to focus on our largest accounts, and

sales through our channel partner program. Our trained channel partners include independent dealers, distributors, and

independent software vendors around the world. The dealers and distributors each have their own sales organizations that

complement and extend the reach of our sales force. The independent software vendors offer customized applications that meet

specific needs in the verticals we serve.

Our largest customer is the U.S. federal government (through multiple contracts with its various branches and agencies,

including the armed services), representing approximately 8% of our consolidated net sales in 2015. The loss of this customer

could have a material adverse effect on our revenue and earnings over several quarters as some of our contracts with the U.S.

federal government are long-term. All contracts with the U.S. federal government, and certain other government agencies, are

subject to cancellation at the customer’s convenience. For a discussion of risks related to government contracting requirements,

please refer to “Item 1A. Risk Factors.”

Net sales in North America continued to comprise a significant portion of our business, accounting for 65%, 61% and 63%

of our consolidated net sales in 2015, 2014, and 2013, respectively.

Payment terms with our customers vary worldwide. Generally, contractual payment terms range from 30 to 45 days from

the invoice date within North America and typically do not exceed 90 days from the invoice date in regions outside of North

America. A portion of our contracts include implementation milestones, such as delivery, installation, and system acceptance,

which generally take 30 to 180 days to complete. Invoicing the customer is dependent on completion of the milestones. We

generally do not grant extended payment terms. As required for competitive reasons, we may provide long-term financing in

connection with equipment purchases. Financing may cover all or a portion of the purchase price.

Generally, our contracts do not include a right of return, other than for standard warranty provisions. Due to customer

purchasing patterns and the cyclical nature of the markets we serve, our sales tend to be somewhat higher in the fourth quarter.

Competition

The markets in which we operate are highly competitive. Key competitive factors include: performance, features, quality,

availability, warranty, price, vendor financing, availability of service, company reputation and financial strength, partner

community, and relationships with customers. Our strong reputation with customers and partners, trusted brand, technology

leadership, breadth of portfolio, product performance, and specialized support services position us well for success.

We experience widespread competition from a growing number of existing and new competitors, including large system

integrators and manufacturers of private and public wireless network equipment and devices. Traditional Land Mobile Radio

competitors include: Harris, Airbus, Kenwood, Hytera, and Sepura.

As demand for fully integrated voice, data, and broadband systems continue to grow, we may face additional competition

from public telecommunications carriers and telecommunications equipment providers. As we continue to evolve our Integration

services and Managed & Support services strategy, we may work with other companies on a consortium or joint venture basis as

customers' delivery needs become more complex to fulfill.

Several other competitive factors may have an impact on our future business including: evolving spectrum mandates by

government regulators, increasing investment by broadband and IP solution providers, and new low-tier competitors.