Motorola 2015 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2015 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

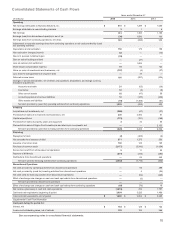

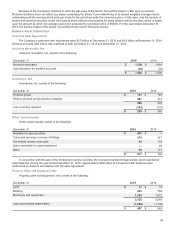

Other Assets

Other assets consist of the following:

December 31 2015 2014

Intangible assets $49$23

Long-term receivables 47 31

Defined benefit plan assets 128 —

Other 88 91

$312$145

Defined benefit plan assets at December 31, 2015 included the overfunded status of the United Kingdom pension plan of

$105 million, compared to a net liability position in previous periods.

Accrued Liabilities

Accrued liabilities consist of the following:

December 31 2015 2014

Deferred revenue $ 390 $355

Compensation 241 190

Billings in excess of costs and earnings 337 358

Tax liabilities 48 91

Dividend payable 71 75

Trade liabilities 135 131

Other 449 506

$1,671$ 1,706

Other Liabilities

Other liabilities consist of the following:

December 31 2015 2014

Defined benefit plans $1,512$ 1,611

Postretirement health care benefit plan 49 49

Deferred revenue 113 139

Unrecognized tax benefits 50 54

Other 180 158

$1,904$ 2,011

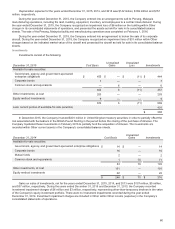

Stockholders’ Equity Information

Share Repurchase Program: Through actions taken on July 28, 2011, January 30, 2012, July 25, 2012, July 22, 2013,

and November 3, 2014, the Board of Directors has authorized the Company to repurchase in the aggregate up to $12.0 billion of

its outstanding shares of common stock (the “share repurchase program”). The share repurchase program does not have an

expiration date.

On August 4, 2015, the Board of Directors authorized the Company to commence a modified "Dutch auction" tender offer

to repurchase up to $2.0 billion of its outstanding shares of common stock. The repurchase of these shares was authorized

under the existing share repurchase authority, as outlined above. The tender offer commenced on August 7, 2015 and expired

on September 3, 2015. The Company paid $2.0 billion, including transaction costs, to repurchase approximately 30.1 million

shares at a tender price of $66.50 per share.

During 2015, the Company paid an aggregate of $3.2 billion (including the Dutch auction tender offer), including

transaction costs, to repurchase 48.0 million shares at an average price of $66.22 per share. During 2014, the Company paid an

aggregate of $2.5 billion, including transaction costs, to repurchase 39.4 million shares at an average price of $64.63. During

2013, the Company paid an aggregate of $1.7 billion, including transaction costs, to repurchase 28.6 million shares at an

average price of $59.30. As of December 31, 2015, the Company had used approximately $11.0 billion of the share repurchase

authority, including transaction costs, to repurchase shares, leaving $1.0 billion of authority available for future repurchases.

Payment of Dividends: On November 17, 2015, the Company announced that its Board of Directors approved an increase

in the quarterly cash dividend from $0.34 per share to $0.41 per share of common stock. During the years ended December 31,