Motorola 2015 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2015 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.43

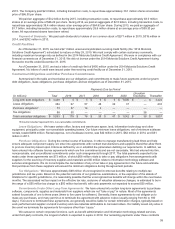

We use long-term historical actual return experience with consideration of the expected investment mix of the plans’

assets, as well as future estimates of long-term investment returns, to develop our expected rate of return assumption used in

calculating the net periodic pension cost and the net retirement healthcare expense. Our investment return assumption for the

U.S. Pension Benefit Plans and Postretirement Healthcare Benefits Plan was 7.00% in both 2015 and 2014. Our investment

return assumption for the Non-U.S. Plan was 5.90% in 2015 and 5.92% in 2014. At December 31, 2015, the pension plans,

including the U.S. Pension Benefit Plans and Non-U.S. Plan, and the Postretirement Health Care Benefits Plan investment

portfolios were both comprised of approximately 37% equity investments.

A second key assumption is the discount rate. The discount rate assumptions used for pension benefits and

postretirement health care benefits reflect, at December 31 of each year, the prevailing market rates for high-quality, fixed-

income debt instruments that, if the obligation was settled at the measurement date, would provide the necessary future cash

flows to pay the benefit obligation when due. Our discount rates for measuring our U.S. pension benefit obligations were 4.73%

and 4.30% at December 2015 and 2014, respectively. Our discount rates for measuring our Non-U.S. Plans were 3.57% and

3.19% at December 2015 and 2014, respectively. Our discount rates for measuring the Postretirement Health Care Benefits

Plan obligation were 4.26% and 3.90% at December 31, 2015 and 2014, respectively.

A final set of assumptions involves the cost drivers of the underlying benefits. The rate of compensation increase is

determined based upon long-term plans for such increases. For the Non-U.S. defined benefit plan, we assumed a weighted

average rate for future compensation increases of 0.41% and 2.54% for 2015 and 2014, respectively. During 2015, the Non-U.S.

defined benefit plan within the United Kingdom was amended to close future benefit accruals to all participants effective

December 31, 2015 resulting in a 0% rate for future compensation, contributing to the decrease within the Non-U.S. Plans in

2015 compared to 2014. Benefits under the U.S. Pension Plans have been frozen, and therefore future compensation increases

are no longer a relevant assumption in the calculation of the benefit obligation on those plans. Historically, the Company utilized

health care cost trend rates to determine the accumulated benefit obligation and net periodic benefit. However, the

Postretirement Health Care Benefits Plan was amended in 2014 such that all eligible participants would receive an annual

subsidy for the purchase of their own health care coverage from private insurance companies and for the reimbursement of

eligible health care expenses. As such, health care costs are no longer considered necessary to determine the accumulated

postretirement benefit obligation.

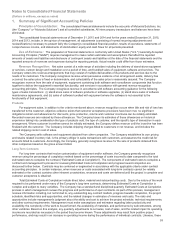

Under relevant accounting rules, when almost all of the plan participants are considered inactive, the amortization period

for certain unrecognized losses changes from the average remaining service period to the average remaining lifetime of the

participant. As such, depending on the specific plan, we amortize gains and losses over periods ranging from eleven to thirty-five

years. Prior service costs are being amortized over periods ranging from two to nine years. Benefits under all pension plans are

valued based on the projected unit credit cost method.

Effective on January 1, 2016, the Company changed the method used to estimate the interest and service cost

components of net periodic cost for defined benefit pension and other post-retirement benefit plans. Historically, the interest and

service cost components were estimated using a single weighted-average discount rate derived from the yield curve used to

measure the projected benefit obligation at the beginning of the period. The Company has elected to use a full yield curve

approach in the estimation of these components of net periodic cost by applying the specific spot rates along the yield curve

used in the determination of the projected benefit obligation to the relevant projected cash flows. The Company made this

change to improve the correlation between projected benefit cash flows and the corresponding yield curve spot rates and to

provide a more precise measurement of interest and service costs. This change does not affect the measurement of total benefit

obligations as the change in interest and service cost is completely offset in the actuarial loss reported in the period. The

Company has concluded that this change is a change in estimate and, accordingly, will account for it prospectively beginning in

2016. The impact of the change estimate is an anticipated reduction of the interest and service cost components within net

periodic cost in 2016 by approximately $20 million for the U.S. Pension Benefit Plans, $6 million for the Non U.S. Pension

Benefit Plans, and $2 million for the Postretirement Health Care Benefits Plan compared to the prior year approach.

Valuation and Recoverability of Goodwill

We assess the recorded amount of goodwill for recovery on an annual basis in the fourth quarter of each fiscal year.

Goodwill is assessed more frequently if an event occurs or circumstances change that would indicate it is more-likely-than-not

that the fair value of a reporting unit is below its carrying amount. We continually assess whether any such events and

circumstances have occurred, which requires a significant amount of judgment. Such events and circumstances may include:

adverse changes in macroeconomic conditions, adverse changes in the industry or market in which we transact, changes in cost

factors negatively impacting earnings and cash flows, negative or declining overall financial performance, events affecting the

carrying value or composition of a reporting unit, or a sustained decrease in share price, among others. Any such adverse event

or change in circumstances could have a significant impact on the recoverability of goodwill and could have a material impact on

our consolidated financial statements.

The goodwill impairment assessment is performed at the reporting unit level. A reporting unit is an operating segment or

one level below an operating segment (referred to as a “component”). A component of an operating segment is a reporting unit if

the component constitutes a business for which discrete financial information is available and segment management regularly

reviews the operating results of that component. When two or more components of an operating segment have similar economic

characteristics, the components are aggregated and deemed a single reporting unit. An operating segment is deemed to be a

reporting unit if all of its components are similar, if none of its components is a reporting unit, or if the segment comprises only a

single component. Based on this guidance, we have determined that our Products and Services segments each meet the

definition of a reporting unit. We performed a qualitative assessment of goodwill and determined that it was not more-likely-than-