Motorola 2015 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2015 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

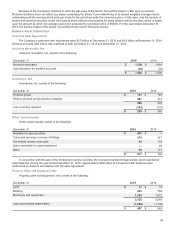

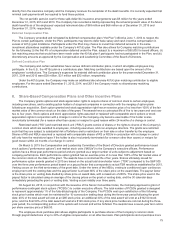

Differences between income tax expense (benefit) computed at the U.S. federal statutory tax rate of 35% and income tax

expense (benefit) as reflected in the consolidated statements of operations are as follows:

Years ended December 31 2015 2014 2013

Income tax expense (benefit) at statutory rate $ 321 35.0 % $ (406) 35.0 % $ 308 35.0 %

Tax on non-U.S. earnings (46) (5.0)% (27) 2.3 % 17 1.9 %

State income taxes, net of federal benefit 24 2.6 % (30) 2.6 % 8 0.9 %

Recognition of previously unrecognized income tax

benefits 10.1% (29) 2.5 % 6 0.7 %

Other provisions 14 1.6 % 9 (0.7)% (4) (0.5)%

Valuation allowances (9) (1.0)% 55 (4.7)% (3) (0.3)%

Section 199 deduction (19) (2.1)% (12) 1.0 % (14) (1.6)%

Tax on undistributed non-U.S. earnings (7) (0.8)% (19) 1.6 % (22) (2.5)%

Research credits (5) (0.5)% (6) 0.5 % (18) (2.0)%

Tax benefit of repatriated non-U.S. earnings ——% — — % (337) (38.3)%

$ 274 29.9 % $ (465) 40.1 % $ (59) (6.7)%

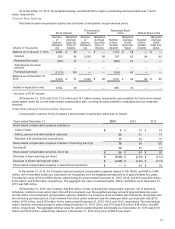

Gross deferred tax assets were $3.5 billion and $3.6 billion at December 31, 2015 and 2014, respectively. Deferred tax

assets, net of valuation allowances, were $3.4 billion at both December 31, 2015 and 2014, respectively. Gross deferred tax

liabilities were $1.2 billion and $774 million at December 31, 2015 and 2014, respectively.

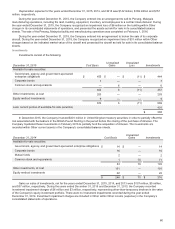

Significant components of deferred tax assets (liabilities) are as follows:

December 31 2015 2014

Inventory $30$34

Accrued liabilities and allowances 136 148

Employee benefits 612 799

Capitalized items 357 379

Tax basis differences on investments 14 (10)

Depreciation tax basis differences on fixed assets 19 52

Undistributed non-U.S. earnings (19) (18)

Tax carryforwards 1,028 1,246

Business reorganization 20 22

Warranty and customer liabilities 20 19

Deferred revenue and costs 146 136

Valuation allowances (129) (226)

Deferred charges 41 39

Other 3(38)

$2,278$ 2,582

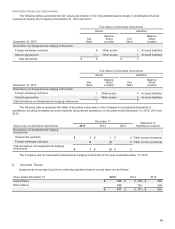

At December 31, 2015 and 2014, the Company had valuation allowances of $129 million and $226 million, respectively,

against its deferred tax assets, including $98 million and $195 million, respectively, relating to deferred tax assets for non-U.S.

subsidiaries. The Company’s valuation allowances for its non-U.S. subsidiaries had a net decrease of $97 million during 2015

and a net increase of $17 million during 2014. The decrease in the valuation allowance relating to deferred tax assets of non-

U.S. subsidiaries during 2015 relates to the expiration of net operating losses, the release of a Singapore valuation allowance,

and the change in the value of net deferreds related to pension in the United Kingdom. The increase in the valuation allowance

relating to deferred tax assets of non-U.S. subsidiaries during 2014 related to deferred tax assets considered to be not more-

likely-than-not to be realizable based on estimates of future taxable income.

The Company’s U.S. valuation allowance did not change during 2015 compared to a net increase of $9 million during

2014. The U.S. valuation allowance of $31 million as of December 31, 2015 primarily relates to state tax carryforwards. The

Company believes that the remaining deferred tax assets are more-likely-than-not to be realizable based on estimates of future

taxable income and the implementation of tax planning strategies.