Motorola 2015 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2015 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

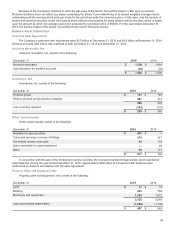

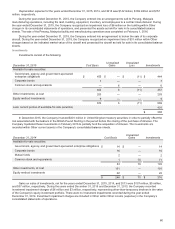

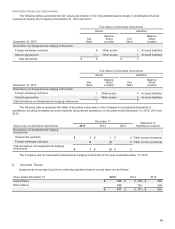

Accumulated Other Comprehensive Loss

The following table displays the changes in Accumulated other comprehensive loss, including amounts reclassified into income,

and the affected line items in the consolidated statements of operations during the years ended December 31, 2015, 2014, and

2013:

Years ended December 31

2015 2014 2013

Foreign Currency Translation Adjustments:

Balance at beginning of period $(204)$(96)$(92)

Other comprehensive loss before reclassification adjustment (82) (58) (11)

Tax benefit 20 97

Other comprehensive income before reclassification adjustment, net of tax (62) (49) (4)

Reclassification adjustment into Earnings from discontinued operations —(75) —

Tax expense —16 —

Reclassification adjustment into Earnings from discontinued operations, net of tax —(59) —

Other comprehensive loss, net of tax (62) (108) (4)

Balance at end of period $(266)$ (204) $ (96)

Derivative instruments:

Balance at beginning of period $—$(1)$ 1

Other comprehensive income before reclassification adjustment ———

Tax expense ——(1)

Other comprehensive income before reclassification adjustment, net of tax ——(1)

Reclassification adjustment into Cost of sales —1(1)

Tax expense ———

Reclassification adjustment into Cost of sales, net of tax —1(1)

Other comprehensive income, net of tax —1(2)

Balance at end of period $—$—$(1)

Available-for-Sale Securities:

Balance at beginning of period $44$(2)$ 2

Other comprehensive income before reclassification adjustment (15) 72 1

Tax benefit (expense) 5(26) (2)

Other comprehensive income (loss) before reclassification adjustment, net of tax (10) 46 (1)

Reclassification adjustment into Gains on sales of investments and businesses, net (61) —(4)

Tax expense 24 —1

Reclassification adjustment into Gains on sales of investments and businesses, net of tax (37) —(3)

Other comprehensive income, net of tax (47) 46 (4)

Balance at end of period $(3)$ 44 $ (2)

Defined Benefit Plans:

Balance at beginning of period (1,695) (2,188) (3,211)

Other comprehensive income (loss) before reclassification adjustment 108 (1,165) 1,524

Tax benefit (expense) 12 447 (571)

Other comprehensive income (loss) before reclassification adjustment, net of tax 120 (718) 953

Reclassification adjustment - Actuarial net losses into Selling, general, and administrative

expenses 71 118 159

Reclassification adjustment - Prior service benefits into Selling, general, and administrative

expenses (62) (57) (49)

Reclassification adjustment - Other charges —1,883 —

Reclassification adjustment - Non-U.S. pension curtailment gain into Selling, general, and

administrative expenses (32) ——

Disposition of the Enterprise business retirement benefits —(1) —

Tax expense (benefit) 1(732) (40)

Reclassification adjustment into Selling, general, and administrative expenses, net of tax (22) 1,211 70

Other comprehensive income, net of tax 98 493 1,023

Balance at end of period $ (1,597) $ (1,695) $ (2,188)

Total Accumulated other comprehensive loss $ (1,866) $ (1,855) $ (2,287)