Motorola 2015 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2015 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82

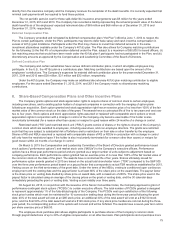

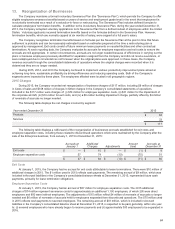

December 31, 2014

Total

Long-term

Receivable

Past Due Over

90 Days

Municipal leases secured tax exempt $14$—

Commercial loans and leases secured 35 12

Total gross long-term receivables, including current portion $49$12

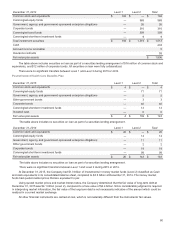

The Company uses an internally developed credit risk rating system for establishing customer credit limits. This system is

aligned with and comparable to the rating systems utilized by independent rating agencies.

The Company’s policy for valuing the allowance for credit losses is to review all customer financing receivables for

collectibility on an individual receivable basis. For those receivables where collection risk is probable, the Company calculates

the value of impairment based on the net present value of expected future cash flows from the customer.

The Company had a total of $1 million of financing receivables over 90 days past due as of December 31, 2015 in relation

to one loan. As of December 31, 2015, the Company is not accruing interest on this loan, and the past due amount is adequately

reserved.

11. Commitments and Contingencies

Lease Obligations

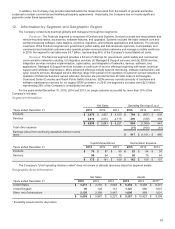

The Company leases certain office, factory and warehouse space, land, and information technology and other equipment

under principally non-cancelable operating leases. Rental expense, net of sublease income, for the years ended December 31,

2015, 2014 and 2013 was $42 million, $62 million, and $51 million, respectively.

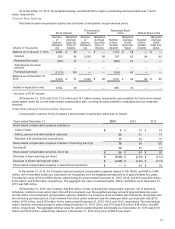

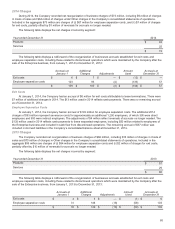

At December 31, 2015, future minimum lease obligations, net of minimum sublease rentals, for the next five years and

beyond are as follows:

(in millions) 2016 2017 2018 2019 2020 Beyond

$67$57$48$42$37$233

Purchase Obligations

During the normal course of business, in order to manage manufacturing lead times and help ensure adequate component

supply, the Company enters into agreements with contract manufacturers and suppliers that either allow them to procure

inventory based upon criteria as defined by the Company or establish the parameters defining the Company’s requirements. In

addition, we have entered into software license agreements which are firm commitments and are not cancelable. As of

December 31, 2015, the Company had entered into firm, noncancelable, and unconditional commitments under such

arrangements through 2017. The Company expects to make total payments of $73 million under these arrangements as follows:

$57 million in 2016, $14 million in 2017, and $2 million in 2018.

The Company outsources certain corporate functions, such as benefit administration and information technology related

services, under various contracts, the longest of which is expected to expire in 2019. The remaining payments under these

contracts are approximately $246 million over the remaining life of the contracts. However, these contracts can be terminated.

Termination would result in a penalty substantially less than the remaining annual contract payments. The Company would also

be required to find another source for these services, including the possibility of performing them in-house.

Legal

The Company is a defendant in various lawsuits, claims, and actions that arise in the normal course of business. While the

outcome of these matters is currently not determinable, the Company does not expect the ultimate disposition of these matters

to have a material adverse effect on the Company’s consolidated financial position, liquidity or results of operations.

Indemnifications

The Company is a party to a variety of agreements pursuant to which it is obligated to indemnify the other party with

respect to certain matters. In indemnification cases, payment by the Company is conditioned on the other party making a claim

pursuant to the procedures specified in the particular contract, which procedures typically allow the Company to challenge the

other party's claims. In some instances, the Company may have recourse against third-parties for certain payments made by

the Company.

Some of these obligations arise as a result of divestitures of the Company's assets or businesses and require the

Company to indemnify the other party against losses arising from breaches of representations and warranties and covenants

and, in some cases, the settlement of pending obligations. The Company's obligations under divestiture agreements for

indemnification based on breaches of representations and warranties are generally limited in terms of duration, and for amounts

for breaches of such representations and warranties in connection with prior divestitures not in excess of a percentage of the

contract value. The Company had no pending claims at December 31, 2015.