Motorola 2015 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2015 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

We allocate arrangement consideration to multiple software or software-related deliverables, including the sale of software

upgrades or software support agreements to previously sold software, in accordance with software accounting guidance. For

such arrangements, revenue is allocated to the deliverables based on the relative fair value of each element of the software, and

fair value is determined using VSOE. Where VSOE does not exist for the undelivered software element, revenue is deferred until

either the undelivered element is delivered or VSOE is established, whichever occurs first. When the final undelivered software

element is post contract support, service revenue is recognized on a ratable basis over the remaining service period. When

VSOE of a delivered element has not been established, but VSOE exists for the undelivered elements, we use the residual

method to recognize revenue when the fair value of all undelivered elements is determinable. Under the residual method, the fair

value of the undelivered elements is deferred and the remaining portion of the arrangement consideration is allocated to the

delivered elements and is recognized as revenue.

Inventory Valuation

We record valuation reserves on our inventory for estimated excess or obsolescence. The amount of the reserve is equal

to the difference between the cost of the inventory and the estimated market value based upon assumptions about future

demand and market conditions. On a quarterly basis, management performs an analysis based on future demand requirement

estimates of the underlying inventory to identify reserves needed for excess and obsolescence. In addition, we adjust the

carrying value of inventory if the current market value of that inventory is below our cost.

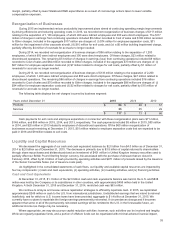

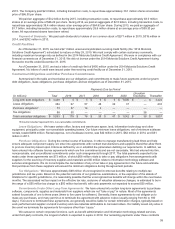

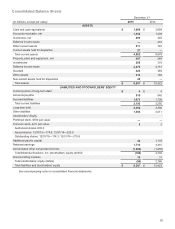

At December 31, 2015 and 2014, Inventories consisted of the following:

December 31 2015 2014

Finished goods $ 151 $163

Work-in-process and production materials 287 313

438 476

Less inventory reserves (142) (131)

$ 296 $345

We balance the need to maintain strategic inventory levels to ensure competitive delivery performance to our customers

against the risk of inventory obsolescence due to rapidly changing technology and customer requirements. As reflected above,

our inventory reserves represented 32% of the gross inventory balance at December 31, 2015, compared to 28% of the gross

inventory balance at December 31, 2014. We have inventory reserves for excess inventory, pending cancellations of product

lines due to technology changes, long-life cycle products, lifetime buys at the end of supplier production runs, business exits,

and a shift of production to outsourced manufacturing.

If future demand or market conditions are less favorable than those projected by management, additional inventory

writedowns may be required.

Income Taxes

We record deferred income tax assets and liabilities based on the estimated future tax effects of differences between the

financial and tax bases of assets and liabilities based on currently enacted tax laws. The Company’s deferred and other tax

balances are based on management’s interpretation of the tax regulations and rulings in numerous taxing jurisdictions. Income

tax expense and liabilities recognized by the Company also reflect our best estimates and assumptions regarding, among other

things, the level of future taxable income, the effect of the Company’s various tax planning strategies and uncertain tax positions.

Future tax authority rulings and changes in tax laws and projected levels of taxable income and future tax planning strategies

could affect the actual effective tax rate and tax balances recorded by the Company. We evaluate deferred income tax asset

balances on a quarterly basis to determine if valuation allowances are required by considering available evidence, including

historical and projected taxable income and tax planning strategies that are both prudent and feasible. Tax related interest and

penalties are classified as a component of interest expense.

Retirement Benefits

Our benefit obligations and net periodic pension cost (benefits) associated with our domestic noncontributory pension

plans (“U.S. Pension Benefit Plans”), our foreign noncontributory pension plans (“Non-U.S. Plans”), as well as our domestic

postretirement health care plan (“Postretirement Health Care Benefits”), are determined using actuarial assumptions. The

assumptions are based on management’s best estimates, after consulting with outside investment advisors and actuaries.

Accounting methodologies use an attribution approach that generally spreads the effects of individual events over the

service lives of the participants in the plan, or estimated average lifetime when almost all of the plan participants are considered

"inactive." Examples of “events” are plan amendments and changes in actuarial assumptions such as discount rate, expected

long-term rate of return on plan assets, and rate of compensation increases.

There are various assumptions used in calculating the net periodic benefit expense and related benefit obligations. One of

these assumptions is the expected long-term rate of return on plan assets. The required use of the expected long-term rate of

return on plan assets may result in recognized pension income that is greater or less than the actual returns of those plan assets

in any given year. Over time, however, the expected long-term returns are designed to approximate the actual long-term returns.

We use a five-year, market-related asset value method of recognizing asset related gains and losses.