Motorola 2015 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2015 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

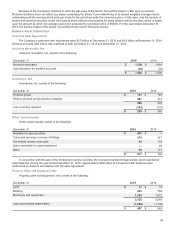

4. Debt and Credit Facilities

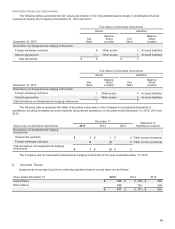

Long-Term Debt

December 31 2015 2014

2% Senior Convertible Notes due 2020 993 —

3.5% senior notes due 2021 396 395

3.75% senior notes due 2022 748 748

3.5% senior notes due 2023 595 594

4.0% senior notes due 2024 590 589

6.5% debentures due 2025 118 118

7.5% debentures due 2025 346 346

6.5% debentures due 2028 36 36

6.625% senior notes due 2037 54 54

5.5% senior notes due 2044 400 400

5.22% debentures due 2097 91 91

Other long-term debt 29 36

4,396 3,407

Adjustments for unamortized gains on interest rate swap terminations (6) (7)

Less: current portion (4) (4)

Long-term debt $4,386$ 3,396

On August 25, 2015, the Company entered into an agreement with Silver Lake Partners to issue $1.0 billion of 2% Senior

Convertible Notes which mature in September 2020. Interest on these notes is payable semiannually. The notes are convertible

anytime on or after two years from their issuance date, except in certain limited circumstances. The notes are convertible based

on a conversion rate of 14.5985 per $1,000 principal amount (which is equal to an initial conversion price of $68.50 per share).

The value by which the Senior Convertible Notes exceeded their principal amount if converted as of December 31, 2015 was

$21 million. In the event of conversion, the Company intends to settle the principal amount of the Senior Convertible Notes in

cash.

The Company has recorded a debt liability associated with the Senior Convertible Notes by determining the fair value of an

equivalent debt instrument without a conversion option. Using a discount rate of 2.4%, which was determined based on a review

of relevant market data, the Company has calculated the debt liability to be $992 million, indicating an $8 million discount to be

amortized over the expected life of the debt instrument. As of December 31, 2015, the remaining unamortized debt discount was

$7 million, which will be amortized over two years as a component of interest expense. For the year ended December 31, 2015,

total interest expense relating to both the contractual interest coupon and amortization of debt discount was $8 million. The total

of proceeds received in excess of the fair value of the debt liability of $8 million has been recorded within Additional paid-in

capital.

During the year ended December 31, 2014, the Company redeemed $400 million aggregate principal amount outstanding

of its 6.000% Senior Notes due November 2017 for an aggregate purchase price of approximately $456 million. After

accelerating the amortization of debt issuance costs, debt discounts, and hedge adjustments, the Company recognized a loss of

$37 million related to the redemption within Other income (expense) in the consolidated statement of operations. During the year

ended December 31, 2014, the Company issued an aggregate principal amount of $1.4 billion consisting of: (i) $600 million of

4.000% Senior Notes due 2024, of which, after debt issuance costs and debt discounts, the Company recognized net proceeds

of $583 million, (ii) $400 million of 3.500% Senior Notes due 2021, of which, after debt issuance costs and debt discounts, the

Company recognized net proceeds of $393 million, and (iii) $400 million of 5.500% Senior Notes due 2044, of which, after debt

issuance costs and debt discounts, the Company recognized net proceeds of $394 million.

Aggregate requirements for long-term debt maturities during the next five years are as follows: 2016—$4 million; 2017—

$5 million; 2018—$5 million; 2019—$5 million; and 2020—$1 billion.

In connection with the completion of the acquisition of Airwave, the Company entered into a new term loan credit

agreement (the “Term Loan Agreement”), under which the Company borrowed a term loan (the “Term Loan”) with an initial

principal amount of $675 million. Interest on the Term Loan is variable and indexed to LIBOR. No additional borrowings are

permitted under the Term Loan Agreement and amounts borrowed and repaid or prepaid may not be re-borrowed. The

Company's borrowing capacity under the 2014 Motorola Solutions Credit Agreement may be partially limited at the end of the

first quarter of 2016 due to the additional indebtedness incurred in connection with the Term Loan.

Credit Facilities

As of December 31, 2015, the Company had a $2.1 billion unsecured syndicated revolving credit facility, which includes a

$450 million letter of credit sub-limit, (the “2014 Motorola Solutions Credit Agreement”) scheduled to mature on May 29, 2019.

The Company must comply with certain customary covenants, including a maximum leverage ratio as defined in the 2014