Motorola 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2015 ANNUAL REPORT

TO STOCKHOLDERS

Table of contents

-

Page 1

2015 ANNUAL REPORT TO STOCKHOLDERS -

Page 2

...-1115800 (I.R.S. Employer Identification No.) (Address of principal executive offices) 1303 East Algonquin Road, Schaumburg, Illinois 60196 (847) 576-5000 (Registrant's telephone number) Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which... -

Page 3

... 2. Properties Item 3. Legal Proceedings Item 4. Mine Safety Disclosures Executive Officers of the Registrant PART II Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities Item 6. Selected Financial Data Item 7. Management's Discussion... -

Page 4

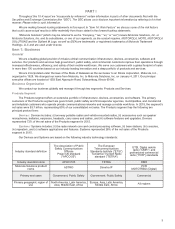

... Solutions, Inc. on January 4, 2011. Our principal executive offices are located at 1303 East Algonquin Road, Schaumburg, Illinois 60196. Business Organization We conduct our business globally and manage it through two segments: Products and Services. Products Segment The Products segment offers... -

Page 5

... our services offerings including Managed & Support services; and (v) expanding our direct sales and channel partner programs both geographically and across new commercial verticals. We believe we have the scale and global presence to continue to maintain a leadership position in our core products... -

Page 6

... support services position us well for success. We experience widespread competition from a growing number of existing and new competitors, including large system integrators and manufacturers of private and public wireless network equipment and devices. Traditional Land Mobile Radio competitors... -

Page 7

.... We provide custom products which require the stocking of inventories and a large variety of piece parts and replacement parts in order to meet delivery and warranty requirements. To the extent suppliers' product life cycles are shorter than ours, stocking of lifetime buy inventories is required to... -

Page 8

... electronic products. During 2015, compliance with these U.S. federal, state, and local, and international laws did not have a material effect on our capital expenditures, earnings, or competitive position. Radio spectrum is required to provide wireless voice, data, and video communications service... -

Page 9

... 31, 2015, we had approximately 14,000 employees, compared to 15,000 employees at December 31, 2014. Material Dispositions • On October 27, 2014, we completed the sale of certain assets and liabilities of the Enterprise business to Zebra Technologies Corporation ("Zebra"). The financial results of... -

Page 10

... governance documents may also be obtained without charge by contacting Investor Relations, Motorola Solutions, Inc., Corporate Offices, 1303 East Algonquin Road, Schaumburg, Illinois 60196, E-mail: [email protected]. This annual report on Form 10-K and Definitive Proxy Statement... -

Page 11

... to procurement integrity, export control, U.S. government security regulations, employment practices, protection of criminal justice data, protection of the environment, accuracy of records, proper recording of costs, foreign corruption and the False Claims Act. Generally, U.S. government contracts... -

Page 12

... the costs to fulfill contracts awarded to us, which could have adverse consequences on our future profitability. Many government customers, including most U.S. government customers, award business through a competitive bidding process, which results in greater competition and increased pricing... -

Page 13

... are outsourced. In connection with the sale of our Enterprise business to Zebra, we transferred ownership of a number of our enterprise legacy information systems including components of our Enterprise Resource Planning (ERP) system to Zebra. We are currently in a transition services agreement to... -

Page 14

... to timely obtain an adequate delivery of quality materials, parts, and components, as well as services and software from our suppliers. In addition, certain supplies, including for some of our critical components, are available only from a single source or limited sources and we may not be able to... -

Page 15

... to use the Motorola Marks if we do not comply with the terms of the license agreement. Such a loss could negatively affect our business, results of operations and financial condition. Furthermore, MTH has the right to license the brand to thirdparties and either Motorola Mobility or licensed third... -

Page 16

... to acquire or maintain the quality of the materials, components, subsystems and services they supply, or secure preferred warranty and indemnity coverage from their suppliers which might result in greater product returns, service problems, warranty claims and costs and regulatory compliance issues... -

Page 17

...or other commercial system. The offering of managed services involves the integration of multiple services, multiple vendors and multiple technologies, requiring that we partner with other solutions and services providers, often on multiyear projects. In some cases, we must compete with a company in... -

Page 18

... need to be "stop-shipped" or recalled. Depending on the nature of the quality issue and the number of products in the field, it could cause us to incur substantial recall or corrective field action costs, in addition to the costs associated with the potential loss of future orders and the damage to... -

Page 19

...the divested business, such as pension liabilities, taxes, employment, environmental liabilities and litigation. In the case of the sale of our Enterprise business we agreed to a multi-year non-compete which may limit our ability to develop and sell products for our commercial customers. In addition... -

Page 20

... proportion to the cost of our products. Such demands can amount to many times the selling price of our products. Our patent and other intellectual property rights are important competitive tools and may generate income under license agreements. We regard our intellectual property as proprietary and... -

Page 21

... convertible debt securities that may be settled in cash or in shares of common stock could have a material effect on our reported financial results. Under U.S. GAAP, an entity must separately account for the debt component and the embedded conversion option of convertible debt instruments that may... -

Page 22

... of our non-U.S. pension liabilities following our divestitures, including the distribution of Motorola Mobility, the sale of our Networks business and the sale of our Enterprise business. The funding position of our pension plans is affected by the performance of the financial markets, particularly... -

Page 23

... and compliance programs in Europe. Item 1B: Unresolved Staff Comments None. Item 2: Properties Motorola Solutions' principal executive offices are located at 1303 East Algonquin Road, Schaumburg, Illinois 60196. Motorola Solutions also operates manufacturing facilities and sales offices in... -

Page 24

... 2010 to January 2011. Mark S. Hacker; age 44; Executive Vice President, General Counsel and Chief Administrative Officer since January 21, 2015; Senior Vice President and General Counsel from June 2013 to January 2015; Corporate Vice President, Law, Sales and Product Operations, International... -

Page 25

PART II Item 5: Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities Motorola Solutions' common stock is listed on the New York Stock Exchange. The number of stockholders of record of its common stock on February 1, 2016 was 32,725. Information... -

Page 26

... Solutions, Inc., the S&P 500 Index and the S&P Communications Equipment Index. This graph assumes $100 was invested in the stock or the indices on December 31, 2010 and reflects the payment of dividends, including the Company's distribution to its shareholders of one share of Motorola Mobility... -

Page 27

... Net sales Operating earnings (loss) Earnings (loss) from continuing operations, net of tax* Per Share Data (in dollars) Diluted earnings (loss) from continuing operations per common share* Earnings per diluted common share* Diluted weighted average common shares outstanding (in millions) Dividends... -

Page 28

... network monitoring, software maintenance, and cyber security services. Managed service offerings range from partial or full operation of customer owned networks to operation of Motorola Solutions owned networks. Services are provided across all radio network technologies, Command Center Consoles... -

Page 29

... of pension settlement losses were allocated to the Services segment in 2014. Structural highlights • On August 4, 2015, the Board of Directors authorized a modified "Dutch auction" tender offer to repurchase up to $2.0 billion of our outstanding common stock under the previously existing share... -

Page 30

... dividends that were initiated in 2011 as well as the opportunity to return capital to shareholders through share repurchases. Our share repurchase program has approximately $1.0 billion of authority available as of December 31, 2015. Entering 2016, we believe we are well-positioned to compete... -

Page 31

..., except per share amounts) Net sales from products Net sales from services Net sales Costs of product sales Costs of services sales Costs of sales Gross margin Selling, general and administrative expenses Research and development expenditures Other charges Operating earnings (loss) Other income... -

Page 32

... tax rate of 40%. Our effective tax rate in 2015 was lower than the U.S. statutory tax rate of 35% primarily due to lower tax rates on non-U.S. income. Our effective tax rate in 2014 was favorably impacted by: (i) state tax benefits on the pension settlement loss, (ii) $29 million in tax benefits... -

Page 33

... lab sites, and (iv) the movement of employees to lower cost work sites. Other Charges We recorded net charges of $2.0 billion in Other charges in 2014, compared to net charges of $71 million in 2013. The charges in 2014 included: (i) a $1.9 billion charge related to the settlement of a U.S. pension... -

Page 34

... attributable to Motorola Solutions, Inc. of $933 million, or $3.45 per diluted share, in 2013. The decrease in earnings (loss) from continuing operations in 2014, as compared to 2013, was primarily driven by: (i) a $1.9 billion charge related to the settlement of a U.S. pension plan and (ii... -

Page 35

... related to the 2014 settlement of a U.S. pension plan and (ii) lower net sales, resulting in lower gross margin, partially offset by lower SG&A and R&D expenditures as a result of cost savings actions taken to lower variable compensation expenses. Services Segment The Services segment's net sales... -

Page 36

... the net charges incurred by business segment: Years ended December 31 Products Services $ 2015 $ 84 33 117 $ $ 2014 48 25 73 $ $ 2013 57 29 86 Cash payments for exit costs and employee separations in connection with these reorganization plans were $71 million, $148 million, and $59 million in... -

Page 37

...to our U.S. pension plans during 2015, compared to $1.1 billion contributed in 2014 to fund the purchase of group annuity contracts and lump sum distributions from one of our U.S. pension plans, as described in Note 7 to our consolidated financial statements, and $150 million contributed in 2013. In... -

Page 38

... 28, 2011, January 30, 2012, July 25, 2012, July 22, 2013, and November 4, 2014, the Board of Directors has authorized an aggregate share repurchase amount of up to $12.0 billion of our outstanding shares of common stock (the "share repurchase program"). The share repurchase program does not have an... -

Page 39

... on-hand inventory and raw materials attributable to canceled orders. Our liability would only arise in the event we terminate the agreements for reasons other than "cause." We outsource certain corporate functions, such as benefit administration and information technology-related services, under... -

Page 40

... with the sale of equipment. These requests may include all or a portion of the purchase price of the products and services. Our obligation to provide long-term financing may be conditioned on the issuance of a letter of credit in favor of us by a reputable bank to support the purchaser's credit or... -

Page 41

... finalized with the customer. We include shipping charges billed to customers in net revenue, and include the related shipping costs in cost of sales. We sell software and equipment obtained from other companies. We establish our own pricing and retain related inventory risk, are the primary obligor... -

Page 42

... years 2015, 2014, and 2013. When estimates of total costs to be incurred on a contract exceed estimates of total revenue to be earned, a provision for the entire loss on the contract is recorded in the period the loss is determined. Hardware and Software Services Support Revenue under equipment and... -

Page 43

...cancellations of product lines due to technology changes, long-life cycle products, lifetime buys at the end of supplier production runs, business exits, and a shift of production to outsourced manufacturing. If future demand or market conditions are less favorable than those projected by management... -

Page 44

... the Non-U.S. Plans in 2015 compared to 2014. Benefits under the U.S. Pension Plans have been frozen, and therefore future compensation increases are no longer a relevant assumption in the calculation of the benefit obligation on those plans. Historically, the Company utilized health care cost trend... -

Page 45

... in share price, and entity-specific events. For fiscal years 2015, 2014, and 2013, we concluded it was more-likely-than-not that the fair value of each reporting unit exceeded its carrying value. Recent Accounting Pronouncements In May 2014, the Financial Accounting Standards Board ("FASB") issued... -

Page 46

...financial instruments for profit on exchange rate price fluctuations, trading in currencies for which there are no underlying exposures, or entering into transactions for any currency to intentionally increase the underlying exposure. Instruments that are designated as part of a hedging relationship... -

Page 47

...respective underlying derivative financial instruments transactions. The foreign exchange financial instruments are held for purposes other than trading. ® Reg. U.S. Patent & Trademark Office. MOTOROLA MOTO, MOTOROLA SOLUTIONS and the Stylized M Logo, as well as iDEN are trademarks or registered... -

Page 48

... with the standards of the Public Company Accounting Oversight Board (United States), Motorola Solutions, Inc.'s internal control over financial reporting as of December 31, 2015, based on criteria established in Internal Control - Integrated Framework (2013) issued by the Committee of Sponsoring... -

Page 49

Consolidated Statements of Operations Years ended December 31 (In millions, except per share amounts) Net sales from products Net sales from services Net sales Costs of products sales Costs of services sales Costs of sales Gross margin Selling, general and administrative expenses Research and ... -

Page 50

... securities Defined benefit plans Total other comprehensive income (loss) Comprehensive income Less: Earnings attributable to noncontrolling interest Comprehensive income attributable to Motorola Solutions, Inc. common shareholders $ See accompanying notes to consolidated financial statements... -

Page 51

...' Equity Preferred stock, $100 par value Common stock, $.01 par value: Authorized shares: 600.0 Issued shares: 12/31/15-174.5; 12/31/14-220.5 Outstanding shares: 12/31/15-174.3; 12/31/14-219.8 Additional paid-in capital Retained earnings Accumulated other comprehensive loss Total Motorola Solutions... -

Page 52

... 31, 2014 Net earnings Other comprehensive loss Issuance of common stock and stock options exercised Share repurchase program Tax shortfalls from share-based compensation Sale of controlling interest in subsidiary common stock Share-based compensation expense Dividends declared Equity component of... -

Page 53

... other charges (income) Non-U.S. pension curtailment gain Gain on sale of building and land Loss on pension plan settlement Share-based compensation expense Gains on sales of investments and businesses, net Loss from the extinguishment of long-term debt Deferred income taxes Changes in assets and... -

Page 54

...the customer. The Company includes shipping charges billed to customers in net revenue, and includes the related shipping costs in cost of sales. The Company sells software and equipment obtained from other companies. The Company establishes its own pricing and retains related inventory risk, is the... -

Page 55

... years 2015, 2014, and 2013. When estimates of total costs to be incurred on a contract exceed total estimates of revenue to be earned, a provision for the entire loss on the contract is recorded in the period the loss is determined. Hardware and Software Services Support Revenue under equipment and... -

Page 56

... in general market conditions, specific industry and individual company data, the length of time and the extent to which the fair value has been less than cost, the financial condition and the near-term prospects of the entity issuing the security, and the Company's ability and intent to hold the... -

Page 57

... future unit prices for Motorola Solutions over the performance period. Compensation cost for share-based awards is recognized on a straight-line basis over the vesting period. Retirement Benefits: The Company records annual expenses relating to its pension benefit and postretirement plans based on... -

Page 58

... additional tax expense on the sale of the Enterprise business to reflect actual amounts filed in the income tax return. During the year ended December 31, 2015, the Company also settled the working capital true-up with Zebra for $12 million. 3. Other Financial Data Statement of Operations... -

Page 59

...Investment impairments Foreign currency loss Gain (loss) on derivative instruments Gains on equity method investments Other $ Earnings Per Common Share Basic and diluted earnings per common share from both continuing operations and net earnings attributable to Motorola Solutions, Inc. is computed as... -

Page 60

... materials Less inventory reserves $ Other Current Assets Other current assets consist of the following: December 31 Available-for-sale securities Costs and earnings in excess of billings Tax-related refunds receivable Zebra receivable for cash transferred Other $ 2015 $ 401 374 44 - 98 917 $ $ 2014... -

Page 61

... Gains $ - - - 70 70 - - $ 70 $ December 31, 2014 Available-for-sale securities: Government, agency, and government-sponsored enterprise obligations $ Corporate bonds Mutual funds Common stock and equivalents Other investments, at cost Equity method investments $ Cost Basis 14 16 2 1 33 191 22 246... -

Page 62

...2012, July 22, 2013, and November 3, 2014, the Board of Directors has authorized the Company to repurchase in the aggregate up to $12.0 billion of its outstanding shares of common stock (the "share repurchase program"). The share repurchase program does not have an expiration date. On August 4, 2015... -

Page 63

2015, 2014, and 2013 the Company paid $277 million, $318 million, and $292 million, respectively, in cash dividends to holders of its common stock. 62 -

Page 64

... service benefits into Selling, general, and administrative expenses Reclassification adjustment - Other charges Reclassification adjustment - Non-U.S. pension curtailment gain into Selling, general, and administrative expenses Disposition of the Enterprise business retirement benefits Tax expense... -

Page 65

... incurred in connection with the Term Loan. Credit Facilities As of December 31, 2015, the Company had a $2.1 billion unsecured syndicated revolving credit facility, which includes a $450 million letter of credit sub-limit, (the "2014 Motorola Solutions Credit Agreement") scheduled to mature on May... -

Page 66

..., 2015, the Company had a letter of credit sub-limit of $450 million under the 2014 Motorola Solutions Credit Agreement. No letters of credit were issued under the revolving credit facility as of December 31, 2015. 5. Risk Management Foreign Currency Risk The Company uses financial instruments to... -

Page 67

... rate contracts Foreign exchange contracts Total derivatives not designated as hedging instruments $ $ 2015 2014 2013 Statement of Operations Location 1 6 7 $ 1 (5) $ 2 Other income (expense) 6 Other income (expense) 8 $ (4) $ The Company had no instruments designated as hedging instruments... -

Page 68

... earnings and the utilization of available foreign tax credits. In 2013, the Company reorganized certain of its non-U.S. subsidiaries under a holding company structure in order to facilitate the efficient movement of non-U.S. cash and provide a platform to fund foreign investments, such as potential... -

Page 69

... rate Tax on non-U.S. earnings State income taxes, net of federal benefit Recognition of previously unrecognized income tax benefits Other provisions Valuation allowances Section 199 deduction Tax on undistributed non-U.S. earnings Research credits Tax benefit of repatriated non-U.S. earnings $ 2015... -

Page 70

... Malaysia Singapore United Kingdom Tax Years 2008-2015 2002-2015 2010-2015 2008-2015 1997-2015 2012-2015 2011-2015 2010-2015 2013-2015 2008-2015 Although the final resolution of the Company's global tax disputes is uncertain, based on current information, in the opinion of the Company's management... -

Page 71

... other comprehensive loss, net of taxes. The majority of that $87 million decrease was recognized by the end of 2015. In September 2014, the Postretirement Health Care Benefits Plan was then further amended ("the New Amendment") to provide the annual subsidy discussed as part of the Original... -

Page 72

... 31, 2015, 2014, and 2013, $59 million, $50 million, and $43 million of prior service cost credit, respectively, was recognized into the Company's consolidated statements of operations for amendments to the Postretirement Health Care Benefits Plan. Non U.S. Pension Benefit Plans The Company also... -

Page 73

... Lump sum settlements Benefit payments Fair value at December 31 Funded status of the plan Unrecognized net loss Unrecognized prior service benefit Prepaid (accrued) pension cost Components of prepaid (accrued) pension cost: Non-current benefit liability Deferred income taxes Accumulated other... -

Page 74

... determine costs for the plans at the beginning of the fiscal year were as follows: Postretirement Health Care Benefits Plan 2015 3.90% 7.00% 2014 4.65% 7.00% U.S. Pension Benefit Plans 2015 Discount rate Investment return assumption 4.30% 7.00% 2014 5.15% 7.00% Non U.S. Pension Benefit Plans 2015... -

Page 75

... Health Care Benefits Plan $ 19 18 17 16 15 63 Year 2016 2017 2018 2019 2020 2021-2025 U.S. Pension Benefit Plans $ 94 108 124 141 162 1,128 Other Benefit Plans Split-Dollar Life Insurance Arrangements The Company maintains a number of endorsement split-dollar life insurance policies... -

Page 76

... 401(k) plan matching contribution to eligible employees. For the years ended December 31, 2015, 2014, and 2013 the Company made no discretionary matching contributions. 8. Share-Based Compensation Plans and Other Incentive Plans The Company grants options and stock appreciation rights to acquire... -

Page 77

... Company's stock on the close of the first trading day or last trading day of the purchase period. The plan has two purchase periods, the first from October 1 through March 31 and the second from April 1 through September 30. For the years ended December 31, 2015, 2014 and 2013, employees purchased... -

Page 78

... awards to employees and non-employee directors. Total Share-Based Compensation Expense Compensation expense for the Company's share-based compensation plans was as follows: Years ended December 31 Share-based compensation expense included in: Costs of sales Selling, general and administrative... -

Page 79

..., 2014 Assets: Foreign exchange derivative contracts Available-for-sale securities: Government, agency, and government-sponsored enterprise obligations Corporate bonds Mutual funds Common stock and equivalents Liabilities: Foreign exchange derivative contracts Interest agreement derivative contracts... -

Page 80

... on loan as part of a securities lending arrangement. There were no significant transfers between Level 1 and Level 2 during 2015 or 2014. Non-U.S. Pension Benefit Plans December 31, 2015 Common stock and equivalents Commingled equity funds Government, agency, and government-sponsored enterprise... -

Page 81

... corporate bonds. All securities on loan were fully collateralized. There were no significant transfers between Level 1 and Level 2 during 2015 or 2014. Postretirement Health Care Benefits Plan December 31, 2015 Common stock and equivalents Commingled equity funds Government, agency, and government... -

Page 82

..., 2015, the Company had retained servicing obligations for $668 million of long-term receivables, compared to $496 million of long-term receivables at December 31, 2014. Servicing obligations are limited to collection activities of sold accounts receivables and long-term receivables. Credit Quality... -

Page 83

... secured tax exempt Commercial loans and leases secured Total gross long-term receivables, including current portion Total Long-term Receivable $ $ 14 35 49 Past Due Over 90 Days $ $ - 12 12 The Company uses an internally developed credit risk rating system for establishing customer credit limits... -

Page 84

... breach of general warranties contained in certain commercial and intellectual property agreements. Historically, the Company has not made significant payments under these agreements. 12. Information by Segment and Geographic Region The Company conducts its business globally and manages it through... -

Page 85

..., 2014, and 2013 the Company continued to implement various productivity improvement plans aimed at achieving long-term, sustainable profitability by driving efficiencies and reducing operating costs. Both of the Company's segments were impacted by these plans. The employees affected were located in... -

Page 86

...December 31 Products Services $ 2014 $ 48 25 73 The following table displays a rollforward of the reorganization of businesses accruals established for exit costs and employee separation costs, including those related to discontinued operations which were maintained by the Company after the sale of... -

Page 87

... Company accounts for acquisitions using purchase accounting with the results of operations for each acquiree included in the Company's consolidated financial statements for the period subsequent to the date of acquisition. The pro forma effects of the acquisitions completed in 2015, 2014, and 2013... -

Page 88

... including macroeconomic conditions, industry and market conditions, cost factors, overall financial performance, changes in share price, and entity-specific events. For fiscal years 2015, 2014, and 2013, the Company concluded it was more-likely-than-not that the fair value of each reporting unit... -

Page 89

... for the years ended December 31, 2015, 2014, and 2013: Balance at January 1 2015 Allowance for doubtful accounts Inventory reserves 2014 Allowance for doubtful accounts Inventory reserves 2013 Allowance for doubtful accounts Inventory reserves * Adjustments include translation adjustments Charged... -

Page 90

... Operating Results Net sales Costs of sales Gross margin Selling, general and administrative expenses Research and development expenditures Other charges Operating earnings (loss) Earnings (loss) from continuing operations* Net earnings* Per Share Data (in dollars) Earnings (loss) from Continuing... -

Page 91

... our Securities and Exchange Commission ("SEC") reports (i) is recorded, processed, summarized and reported within the time periods specified in SEC rules and forms, and (ii) is accumulated and communicated to Motorola Solutions' management, including our chief executive officer and chief financial... -

Page 92

... REGISTERED PUBLIC ACCOUNTING FIRM The Board of Directors and Stockholders Motorola Solutions, Inc.: We have audited Motorola Solutions, Inc.'s internal control over financial reporting as of December 31, 2015, based on criteria established in Internal Control - Integrated Framework (2013) issued by... -

Page 93

... Deferred Compensation in 2015," "Retirement Plans," "Pension Benefits in 2015," "Employment Contracts," and "Termination of Employment and Change in Control Arrangements," of the Proxy Statement. Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder... -

Page 94

... Exhibit Index attached hereto, which is incorporated herein by this reference. Exhibit numbers 10.7 through 10.71, listed in the attached Exhibit Index, are management contracts or compensatory plans or arrangements required to be filed as exhibits to this form by Item 15(b) hereof. (b) Exhibits... -

Page 95

... of the years in the three-year period ended December 31, 2015, and the effectiveness of internal control over financial reporting as of December 31, 2015, which reports appear in the December 31, 2015 annual report on Form 10-K of Motorola Solutions, Inc. Chicago, Illinois February 22, 2016 94 -

Page 96

...INC. By: /S/ GREGORY Q. BROWN Gregory Q. Brown Chairman and Chief Executive Officer February 22, 2016 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of Motorola Solutions, Inc. and in the capacities and on the... -

Page 97

.... 2 to the Form 10 Registration Statement filed on October 8, 2010 by Motorola Mobility Holdings, Inc. (formerly Motorola SpinCo Holdings Corporation (File No. 1-34805)). 10.6 Stock Purchase Agreement, dated as of November 4, 2014, by and among Motorola Solutions, Inc. and ValueAct (incorporated by... -

Page 98

... Option Award Agreement (non-CEO) (incorporated by reference to Exhibit 10.3 to Motorola Solutions' Current Report on Form 8-K filed on August 26, 2015 (File No. 1-7221)). 10.10 Form of Motorola Solutions, Inc. Award Document-Terms and Conditions Related to Employee Nonqualified Stock Options... -

Page 99

... Deferred Stock Units Award between Motorola Solutions, Inc. and its non-employee directors under the Motorola Solutions Omnibus Incentive Plan of 2006 or any successor plan for grants on or after January 1, 2012 (incorporated by reference to Exhibit 10.40 to Motorola Solutions' Annual Report on... -

Page 100

... *10.57 Description of Insurance covering non-employee directors and their spouses (including a description incorporated by reference from the information under the caption "Director Retirement Plan and Insurance Coverage" of the Motorola Solutions' Proxy Statement. 10.58 Employment Agreement dated... -

Page 101

.... 1-7221)). *12 Statement regarding Computation of Ratio of Earnings to Fixed Charges. *21 Subsidiaries of Motorola Solutions, Inc. 23 Consent of Independent Registered Public Accounting Firm, see page 94 of the Annual Report on Form 10-K of which this Exhibit Index is a part. *31.1 Certification of... -

Page 102

... Wells Fargo Shareowner Services 1110 Centre Pointe Curve, Suite 101 Mendota Heights, MN 55120 U.S.A. Toll-free: +1 800 704 4098 International: +1 651 450 4064 Website: www.shareowneronline.com Common Stock Motorola Solutions common stock is listed on the New York Stock Exchange. Annual Meeting of... -

Page 103

...LLC and are used under license. All other trademarks are the property of their respective owners. © 2016 Motorola Solutions, Inc. All rights reserved. Motorola Solutions, Inc. trades under the symbol MSI and is proud to meet the listing requirements of the NYSE, the world's leading equities market.