MasterCard 2015 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2015 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

77

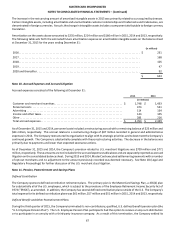

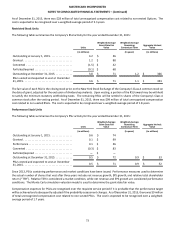

A reconciliation of the beginning and ending balance for the Company’s unrecognized tax benefits for the years ended December

31, is as follows:

2015 2014 2013

(in millions)

Beginning balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 364 $ 320 $ 257

Additions:

Current year tax positions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20 61 80

Prior year tax positions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 19 12

Reductions:

Prior year tax positions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (151) (6) (8)

Settlements with tax authorities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (53) — (2)

Expired statute of limitations. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (9) (30) (19)

Ending balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 181 $ 364 $ 320

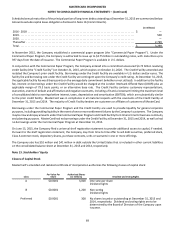

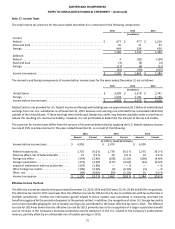

During 2015, there was a reduction to the balance of the Company’s unrecognized tax benefits. This was primarily due to

settlements with tax authorities in multiple jurisdictions. Further, the information gained related to these matters was considered

in measuring uncertain tax benefits recognized for the periods subsequent to the periods settled.

The entire unrecognized tax benefits of $181 million, if recognized, would reduce the effective tax rate. The Company is subject

to tax in the United States, Belgium, Singapore and various other foreign jurisdictions, as well as state and local jurisdictions.

Uncertain tax positions are reviewed on an ongoing basis and are adjusted after considering facts and circumstances, including

progress of tax audits, developments in case law and closing of statutes of limitation. Within the next twelve months, the Company

believes that the resolution of certain federal, foreign and state and local examinations are reasonably possible and that a change

in estimate, reducing unrecognized tax benefits, may occur. While such a change may be significant, it is not possible to provide

a range of the potential change until the examinations progress further or the related statutes of limitation expire. The Company

has effectively settled its U.S. federal income tax obligations through 2008, with the exception of transfer pricing issues which

are settled through 2011. With limited exception, the Company is no longer subject to state and local or foreign examinations

by tax authorities for years before 2006.

It is the Company’s policy to account for interest expense related to income tax matters as interest expense in its statement of

operations, and to include penalties related to income tax matters in the income tax provision. For 2015, 2014 and 2013, the

Company recorded tax-related interest income of $3 million, $2 million and $4 million, respectively, in its consolidated statement

of operations. At December 31, 2015 and 2014, the Company had a net income tax-related interest payable of $12 million and

$15 million, respectively, in its consolidated balance sheet. At December 31, 2015 and 2014, the amounts the Company had

recognized for penalties payable in its consolidated balance sheet were not significant.

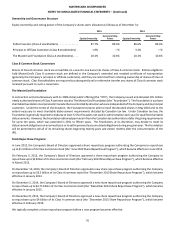

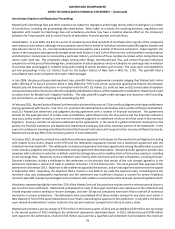

Note 18. Legal and Regulatory Proceedings

MasterCard is a party to legal and regulatory proceedings with respect to a variety of matters in the ordinary course of business.

Some of these proceedings are based on complex claims involving substantial uncertainties and unascertainable damages.

Accordingly, except as discussed below, it is not possible to determine the probability of loss or estimate damages, and therefore,

MasterCard has not established reserves for any of these proceedings. When the Company determines that a loss is both probable

and reasonably estimable, MasterCard records a liability and discloses the amount of the liability if it is material. When a material

loss contingency is only reasonably possible, MasterCard does not record a liability, but instead discloses the nature and the

amount of the claim, and an estimate of the loss or range of loss, if such an estimate can be made. Unless otherwise stated

below with respect to these matters, MasterCard cannot provide an estimate of the possible loss or range of loss based on one

or more of the following reasons: (1) actual or potential plaintiffs have not claimed an amount of monetary damages or the

amounts are unsupportable or exaggerated, (2) the matters are in early stages, (3) there is uncertainty as to the outcome of

pending appeals or motions, (4) there are significant factual issues to be resolved, (5) the existence in many such proceedings of

multiple defendants or potential defendants whose share of any potential financial responsibility has yet to be determined, and/

or (6) there are novel legal issues presented. Furthermore, except as identified with respect to the matters below, MasterCard

does not believe that the outcome of any individual existing legal or regulatory proceeding to which it is a party will have a

material adverse effect on its results of operations, financial condition or overall business. However, an adverse judgment or

other outcome or settlement with respect to any proceedings discussed below could result in fines or payments by MasterCard

and/or could require MasterCard to change its business practices. In addition, an adverse outcome in a regulatory proceeding

could lead to the filing of civil damage claims and possibly result in significant damage awards. Any of these events could have

a material adverse effect on MasterCard’s results of operations, financial condition and overall business.