MasterCard 2015 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2015 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

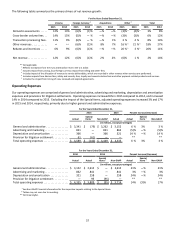

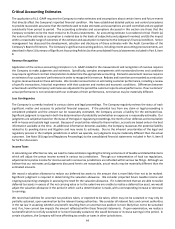

As of December 31, 2015, the majority of derivative contracts to hedge foreign currency fluctuations had been entered into with

customers of MasterCard. MasterCard’s derivative contracts are summarized below:

December 31, 2015 December 31, 2014

Notional Estimated Fair

Value Notional Estimated Fair

Value

(in millions)

Commitments to purchase foreign currency . . . . . . . . . . . . $ 232 $ 1 $ 47 $ 4

Commitments to sell foreign currency . . . . . . . . . . . . . . . . . 1,430 12 614 27

Options to sell foreign currency . . . . . . . . . . . . . . . . . . . . . . 44 1 — —

We use foreign currency denominated debt to hedge a portion of our net investment in foreign operations against adverse

movements in exchange rates, with changes in the value of the debt recorded within currency translation adjustment in

accumulated other comprehensive income (loss). During the fourth quarter of 2015, we designated our euro-denominated debt

as a net investment hedge for a portion of our net investment in European foreign operations. Our euro-denominated debt is

vulnerable to changes in the euro to U.S. dollar exchange rates. The principal amounts of our euro-denominated debt as well

as the effective interest rates and scheduled annual maturities of the principal is included in Note 12 (Debt) to the consolidated

financial statements included in Part II, Item 8.

Our settlement activities are subject to foreign exchange risk resulting from foreign exchange rate fluctuations. This risk is typically

limited to the one business day between setting the foreign exchange rates and clearing the financial transactions.

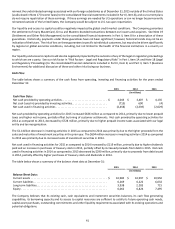

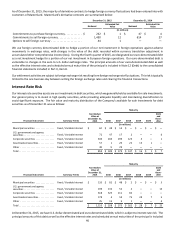

Interest Rate Risk

Our interest rate sensitive assets are our investments in debt securities, which we generally hold as available-for-sale investments.

Our general policy is to invest in high quality securities, while providing adequate liquidity and maintaining diversification to

avoid significant exposure. The fair value and maturity distribution of the Company’s available for sale investments for debt

securities as of December 31 was as follows:

Maturity

Fair Market

Value at

December 31,

2015 2016 2017 2018 2019 2020

2021

and

there-

after

Financial Instrument Summary Terms

(in millions)

Municipal securities . . . . . . . . . . . . . . . Fixed / Variable Interest $ 62 $ 48 $ 14 $ — $ — $ — $ —

U.S. government and agency

securities . . . . . . . . . . . . . . . . . . . . . . . . Fixed / Variable Interest 72 47 17 2 — — 6

Corporate securities . . . . . . . . . . . . . . . Fixed / Variable Interest 630 204 299 123 3 — 1

Asset-backed securities. . . . . . . . . . . . . Fixed / Variable Interest 57 1 20 22 13 1 —

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . Fixed / Variable Interest 38 9 29 ————

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 859 $ 309 $ 379 $ 147 $ 16 $ 1 $ 7

Maturity

Financial Instrument Summary Terms

Fair Market

Value at

December 31,

2014 2015 2016 2017 2018 2019

2020

and

there-

after

(in millions)

Municipal securities . . . . . . . . . . . . . . . Fixed / Variable Interest $ 135 $ 82 $ 48 $ 2 $ — $ — $ 3

U.S. government and agency

securities . . . . . . . . . . . . . . . . . . . . . . . . Fixed / Variable Interest 199 132 52 2 — — 13

Corporate securities . . . . . . . . . . . . . . . Fixed / Variable Interest 618 325 211 82 — — —

Asset-backed securities. . . . . . . . . . . . . Fixed / Variable Interest 178 4 59 75 28 7 5

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . Fixed / Variable Interest 25 15 5 1 — — 4

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,155 $ 558 $ 375 $ 162 $ 28 $ 7 $ 25

At December 31, 2015, we have U.S. dollar-denominated and euro-denominated debt, which is subject to interest rate risk. The

principal amounts of this debt as well as the effective interest rates and scheduled annual maturities of the principal is included