MasterCard 2015 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2015 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.11

customers. Our advertising plays an important role in building brand visibility, usage and overall preference among cardholders

globally. Our “Priceless®” advertising campaign, which has run in 53 languages in 112 countries worldwide, promotes MasterCard

usage benefits and acceptance, markets MasterCard payment products and solutions and provides MasterCard with a consistent,

recognizable message that supports our brand around the globe. We have extended Priceless to create experiences through

three platforms to drive brand preference - Priceless Cities® provides cardholders across all of our regions with access to special

experiences and offers in various cities, Priceless Causes® provides cardholders with opportunities to support philanthropic

causes, and Priceless Surprises® provides cardholders with unexpected and unique surprises.

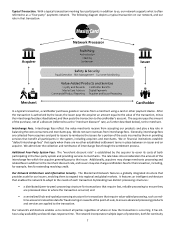

Our Revenue Sources

We generate revenues by assessing our customers primarily based on GDV on the cards and other devices that carry our brands

and from the fees we charge to our customers for providing transaction processing and other payment-related products and

services. Our net revenues are classified into five categories: domestic assessment fees, cross-border volume fees, transaction

processing fees, other revenues and rebates and incentives (contra-revenue).

See “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Revenues” in Part II, Item 7 for

more detail about our revenue, GDV and processed transactions.

Intellectual Property

We own a number of valuable trademarks that are essential to our business, including MasterCard, Maestro and Cirrus, through

one or more affiliates. We also own numerous other trademarks covering various brands, programs and services offered by

MasterCard to support our payment programs. Trademark and service mark registrations are generally valid indefinitely as long

as they are used and/or properly maintained. Through license agreements with our customers, we authorize the use of our

trademarks in connection with our customers’ issuing and merchant acquiring businesses. In addition, we own a number of

patents and patent applications relating to payments solutions, transaction processing, smart cards, contactless, mobile,

electronic commerce, security systems and other matters, many of which are important to our business operations. Patents are

of varying duration depending on the jurisdiction and filing date.

Competition

We compete in the global payments industry against all forms of payment including:

• cash and checks;

• card-based payments, including credit, charge, debit, ATM and prepaid products, as well as limited-use products such

as private label;

• contactless, mobile and e-commerce payments, as well as cryptocurrency; and

• other electronic payments, including wire transfers, electronic benefits transfers, bill payments and automated clearing

house payments (ACH).

We face a number of competitors both within and outside the global payments industry:

• Cash and Check. Cash and check continue to represent the most widely used forms of payment, constituting

approximately 85% of the world’s retail payment transactions.

• General Purpose Payment Networks. We compete worldwide with payment networks such as Visa, American Express

and Discover, among others. Among global networks, Visa has significantly greater volume than we do. Outside of the

United States, networks such as JCB in Japan and UnionPay in China have leading positions in their domestic markets.

In the case of UnionPay, it operates the sole domestic payment switch in China. In addition, several governments are

promoting, or considering promoting, local networks for domestic processing. See our risk factors related to payments

system regulation and government actions that may prevent us from competing effectively for a more detailed

discussion.