MasterCard 2015 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2015 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

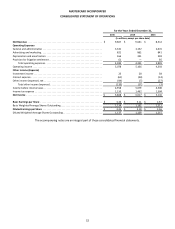

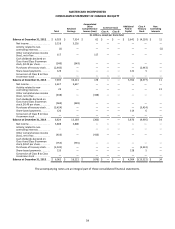

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

62

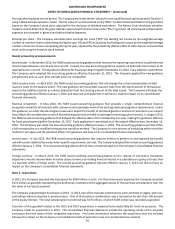

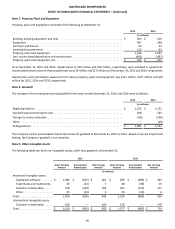

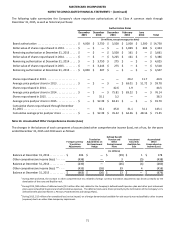

Note 3. Earnings Per Share

The components of basic and diluted EPS for common shares for each of the years ended December 31 were as follows:

2015 2014 2013

(in millions, except per share data)

Numerator:

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3,808 $ 3,617 $ 3,116

Denominator:

Basic weighted-average shares outstanding. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,134 1,165 1,211

Dilutive stock options and stock units . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 4 4

Diluted weighted-average shares outstanding 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,137 1,169 1,215

Earnings per Share

Basic . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3.36 $ 3.11 $ 2.57

Diluted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3.35 $ 3.10 $ 2.56

* Table may not sum due to rounding.

1 For the years presented, the calculation of diluted EPS excluded a minimal amount of anti-dilutive share-based payment awards.

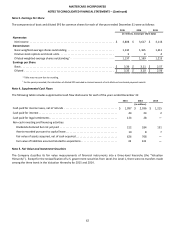

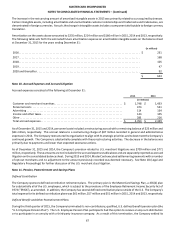

Note 4. Supplemental Cash Flows

The following table includes supplemental cash flow disclosures for each of the years ended December 31:

2015 2014 2013

(in millions)

Cash paid for income taxes, net of refunds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,097 $ 2,036 $ 1,215

Cash paid for interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44 24 2

Cash paid for legal settlements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 124 28 —

Non-cash investing and financing activities:

Dividends declared but not yet paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 212 184 131

Assets recorded pursuant to capital lease. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 8 7

Fair value of assets acquired, net of cash acquired . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 626 768 —

Fair value of liabilities assumed related to acquisitions . . . . . . . . . . . . . . . . . . . . . . . . . . 42 141 —

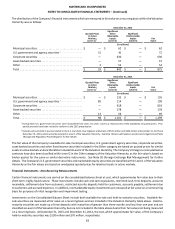

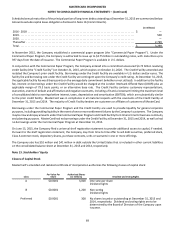

Note 5. Fair Value and Investment Securities

The Company classifies its fair value measurements of financial instruments into a three-level hierarchy (the “Valuation

Hierarchy”). Except for the reclassification of U.S. government securities from Level 2 to Level 1, there were no transfers made

among the three levels in the Valuation Hierarchy for 2015 and 2014.