MasterCard 2015 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2015 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

73

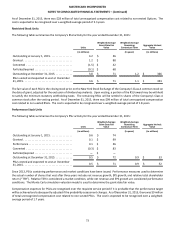

As of December 31, 2015, there was $28 million of total unrecognized compensation cost related to non-vested Options. The

cost is expected to be recognized over a weighted-average period of 2.3 years.

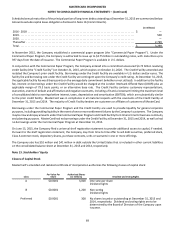

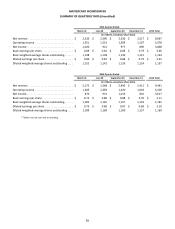

Restricted Stock Units

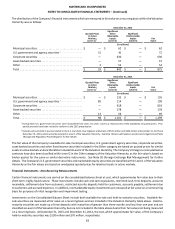

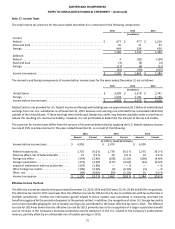

The following table summarizes the Company’s RSU activity for the year ended December 31, 2015:

Units

Weighted-Average

Grant-Date Fair

Value

Weighted-Average

Remaining

Contractual Term

Aggregate Intrinsic

Value

(in millions) (in years) (in millions)

Outstanding at January 1, 2015 . . . . . . . . . . . . . . . . 4.2 $ 56

Granted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.2 $ 88

Converted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1.5) $ 42

Forfeited/expired . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.1) $ 68

Outstanding at December 31, 2015. . . . . . . . . . . . . 3.8 $ 71 1.2 $ 366

RSUs vested and expected to vest at December

31, 2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.6 $ 71 1.1 $ 353

The fair value of each RSU is the closing stock price on the New York Stock Exchange of the Company’s Class A common stock on

the date of grant, adjusted for the exclusion of dividend equivalents. Upon vesting, a portion of the RSU award may be withheld

to satisfy the minimum statutory withholding taxes. The remaining RSUs will be settled in shares of the Company’s Class A

common stock after the vesting period. As of December 31, 2015, there was $99 million of total unrecognized compensation

cost related to non-vested RSUs. The cost is expected to be recognized over a weighted-average period of 1.8 years.

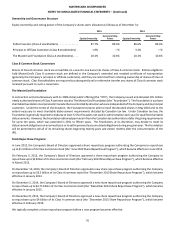

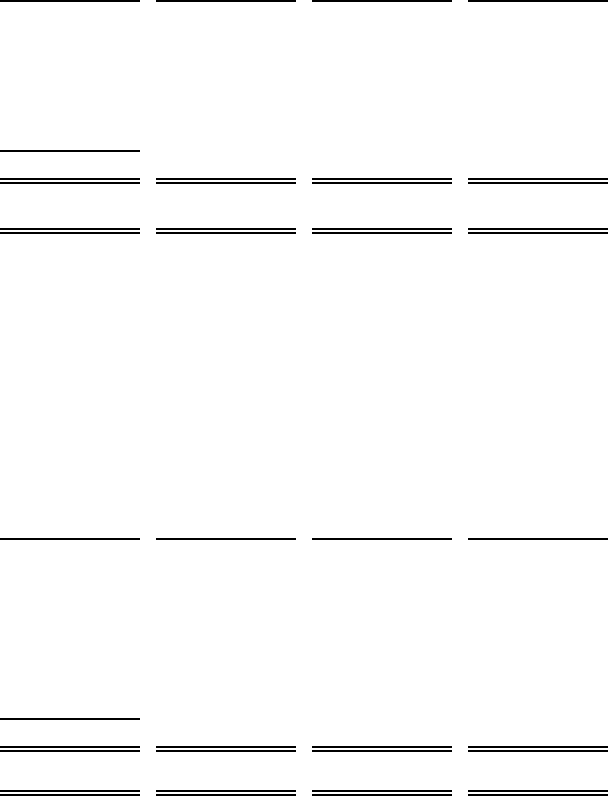

Performance Stock Units

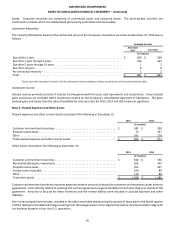

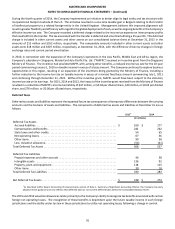

The following table summarizes the Company’s PSU activity for the year ended December 31, 2015:

Units

Weighted-Average

Grant-Date Fair

Value

Weighted-Average

Remaining

Contractual Term

Aggregate Intrinsic

Value

(in millions) (in years) (in millions)

Outstanding at January 1, 2015 . . . . . . . . . . . . . . . . 0.6 $ 74

Granted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.1 $ 99

Performance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.1 $ 56

Converted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.3) $ 83

Forfeited/expired . . . . . . . . . . . . . . . . . . . . . . . . . . . — $ —

Outstanding at December 31, 2015. . . . . . . . . . . . . 0.5 $ 72 0.9 $ 53

PSUs vested and expected to vest at December

31, 2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.5 $ 71 0.9 $ 52

Since 2013, PSUs containing performance and market conditions have been issued. Performance measures used to determine

the actual number of shares that vest after three years include net revenue growth, EPS growth, and relative total shareholder

return (“TSR”). Relative TSR is considered a market condition, while net revenue and EPS growth are considered performance

conditions. The Monte Carlo simulation valuation model is used to determine the grant-date fair value.

Compensation expenses for PSUs are recognized over the requisite service period if it is probable that the performance target

will be achieved and subsequently adjusted if the probability assessment changes. As of December 31, 2015, there was $9 million

of total unrecognized compensation cost related to non-vested PSUs. The cost is expected to be recognized over a weighted-

average period of 1.7 years.