MasterCard 2015 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2015 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.These are only a few examples of how we’re

growing our core business and increasing the

number of transactions we process.

DIVERSIFYING CUSTOMERS

AND GEOGRAPHIES

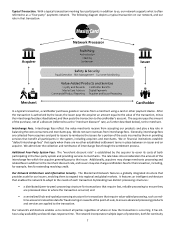

Half a century ago, our business was formed as

an association for banks. Today, while our focus

remains strong with our bank partners, we’re

adding to our customer

base and expanding

markets by working

with governments,

merchants, digital

giants, other technology

companies and more.

We’re driving

acceptance with small

business merchants,

and we’re creating

new opportunities for

electronic payments with person-to-person transfers

and transit partners. With 70 percent of the world’s

population expected to live in cities by 2050, we’re

bringing our technology to the world’s megacities

—

making commuters’ lives simpler and easier and

government transit systems more efficient in cities

like London, Chicago and St. Petersburg.

With two billion people around the world without

a bank account, our work with governments,

telcos and other partners brings more people into

the financial fold. A year ago, we stood with the

World Bank to do well and do good, making a

commitment to bring an additional 500 million

people access to financial tools and services. Our

progress is significant, with more than 200 million

already connected through 1,000-plus government

and NGO programs in 60 countries. Here are

three of our latest examples:

• Through a country-wide program in Egypt,

more than 54 million citizens can receive

government benefits and salaries as well as

make payments with a mobile wallet linked

to the national digital ID. It’s a model we’re

replicating in other countries.

• Our MasterCard Aid Network solution helps

refugees in time of need, transforming the way

non-governmental and other aid agencies can

deliver support.

• Recently MasterCard and UN Women formed a

partnership to drive financial inclusion of women,

beginning with a Nigerian

pilot program, which

aims to provide 500,000

women with ID cards

enabled with electronic

payments functionality.

With more than half

of our revenue coming

from outside the U.S.,

we continue to expand

into new markets. While

waiting for China’s final domestic market regulations,

we’re working closely with our customers to launch

single-branded card programs and expand into

the digital space, using our token and cloud-based

technologies and fraud prevention solutions. In

Russia, working alongside the government, we

became the first network to transition domestic

processing to their platform. We continue to

expand value-added services through this partnership,

winning new business. It’s this type of innovative

thinking that sets us up for a strong tomorrow.

BUILDING FOR THE FUTURE

The new digital world we live in has driven

more payments innovation in the past five years

than the previous 50. This rate of change,

combined with consumer demand for a seamless,

omni-channel experience, presents the ideal

opportunity to reimagine payments. And 2015

was a busy year for us in this space. We’re

pleased with our progress on MasterPass™

, now

in 29 markets, and we also launched 64 new

WE’RE ADDING TO OUR

CUSTOMER BASE AND

EXPANDING MARKETS BY

WORKING WITH GOVERNMENTS,

MERCHANTS, DIGITAL GIANTS,

OTHER TECHNOLOGY

COMPANIES AND MORE.

2