MasterCard 2015 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2015 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.39

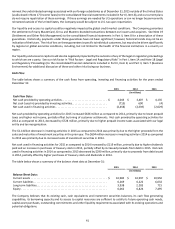

telecommunication system. These expenses increased in both 2015 and 2014 due to capacity growth of

our business and higher third party processing costs.

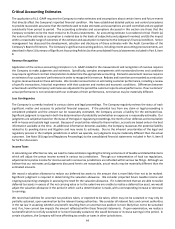

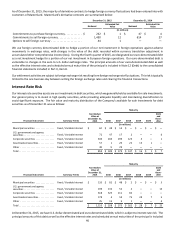

• Foreign exchange activity includes gains and losses on foreign exchange derivative contracts and the impact

of remeasurement of assets and liabilities denominated in foreign currencies. See Note 20 (Foreign

Exchange Risk Management) to the consolidated financial statements included in Part II, Item 8 for further

discussion. Since the Company does not designate foreign currency derivatives as hedging instruments

pursuant to the accounting standards for derivative instruments and hedging activities, it records gains

and losses on foreign exchange derivatives on a current basis, with the associated offset being recognized

as the exposures materialize. During 2015, we recorded higher gains on derivative contracts, as well as

balance sheet remeasurement gains related primarily to the devaluation of the Venezuelan bolivar versus

2014. During 2014, we recorded higher derivative gains versus the similar period in 2013.

• Other expenses include loyalty and rewards solutions, travel and meeting expenses and rental expense

for our facilities. The increase in other expenses in both 2015 and 2014 was primarily due to the impact

of acquisitions and expenses incurred to support strategic development efforts including costs associated

with loyalty and rewards programs.

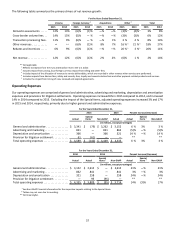

Advertising and Marketing

In 2015, advertising and marketing expenses decreased 5%, mainly due to the favorable impact from foreign currency translation

and lower media spend, partially offset by higher sponsorship promotions to support our strategic initiatives. Advertising and

marketing expenses increased 3% in 2014, mainly due to new and renewed sponsorships and increased media spend to support

our strategic initiatives. See Value-Added Solutions and Marketing sections included in Part I, Item 1 for further discussion of

our marketing strategy.

Depreciation and Amortization

Depreciation and amortization expenses increased 14% in 2015 and 24% in 2014. The increase in depreciation and amortization

expense in both 2015 and 2014 was primarily due to higher amortization of capitalized software costs and other intangibles

associated with our acquisitions.

Provision for Litigation Settlement

During 2015, the Company recorded a pre-tax charge of $61 million for a litigation settlement relating to a merchant litigation

in the U.K. In the fourth quarter of 2013, MasterCard recorded an incremental net pre-tax charge of $95 million related to the

opt-out merchants in the U.S. Merchant Litigation. See Note 18 (Legal and Regulatory Proceedings) to the consolidated financial

statements included in Part II, Item 8 for further discussion.

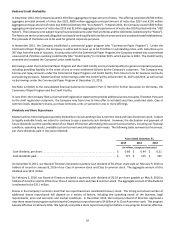

Other Income (Expense)

Other income (expense) is comprised primarily of investment income, interest expense, our share of income (losses) from equity

method investments and other gains and losses. Total other expense increased to $120 million in 2015 versus $27 million for

the comparable period in 2014 resulting from impairment charges taken on certain investments in 2015 and higher interest

expense resulting from incremental debt issued in 2014 and 2015. Total other expense increased in 2014 compared to 2013

primarily due to higher interest expense related to our debt issuance in March 2014.

Income Taxes

The effective tax rate for 2015 was lower than the effective tax rate for 2014 primarily due to settlements with tax authorities in

multiple jurisdictions. Further, the information gained related to the these matters was considered in measuring uncertain tax

benefits recognized for the periods subsequent to the periods settled. In addition, the recognition of other U.S. foreign tax credits

and a more favorable geographic mix of taxable earnings also contributed to the lower effective tax rate in 2015.

The effective tax rate for 2014 was lower than the effective tax rate for 2013 primarily due to the recognition of a larger repatriation

benefit and an increase in the Company’s domestic production activity deduction in the U.S. related to the Company’s

authorization revenue, partially offset by an unfavorable mix of earnings in 2014.

During the fourth quarter of 2014, we implemented an initiative to better align our legal entity and tax structure with our

operational footprint outside of the U.S. This initiative resulted in a one-time taxable gain in Belgium relating to the transfer of

intellectual property to a related foreign entity in the United Kingdom. We believe this improved alignment will result in greater