MasterCard 2015 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2015 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

64

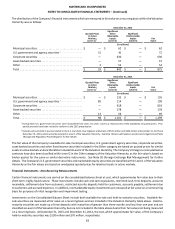

Debt

The Company estimates the fair value of its long-term debt using the market pricing approach which applies market assumptions

for relevant though not directly comparable undertakings. Long-term debt is classified as Level 2 of the Valuation Hierarchy. At

December 31, 2015 the carrying value and fair value of long-term debt was $3.3 billion. At December 31, 2014, the carrying

value and fair value of long-term debt was $1.5 billion.

Settlement and Other Guarantee Liabilities

The Company estimates the fair value of its settlement and other guarantees using the market pricing approach which applies

market assumptions for relevant though not directly comparable undertakings, as the latter are not observable in the market

given the proprietary nature of such guarantees. At December 31, 2015 and 2014, the carrying value and fair value of settlement

and other guarantee liabilities were not material. Settlement and other guarantee liabilities are classified as Level 3 of the

Valuation hierarchy as their valuation requires substantial judgment and estimation of factors that are not currently observable

in the market. For additional information regarding the Company’s settlement and other guarantee liabilities, see Note 19

(Settlement and Other Risk Management).

Non-Financial Instruments

Certain assets are measured at fair value on a nonrecurring basis for purposes of initial recognition and impairment testing. The

Company’s non-financial assets measured at fair value on a nonrecurring basis include property, plant and equipment, goodwill

and other intangible assets. These assets are subject to fair value adjustments in certain circumstances, such as when there is

evidence of impairment.

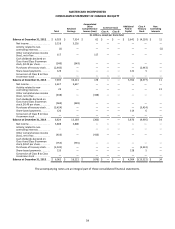

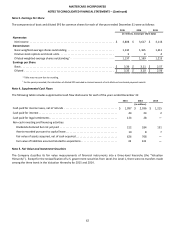

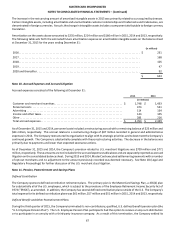

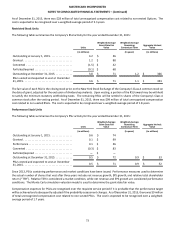

Amortized Costs and Fair Values – Available-for-Sale Investment Securities

The major classes of the Company’s available-for-sale investment securities, for which unrealized gains and losses are recorded

as a separate component of other comprehensive income on the consolidated statement of comprehensive income, and their

respective amortized cost basis and fair values as of December 31, 2015 and 2014 were as follows:

December 31, 2015

Amortized

Cost

Gross

Unrealized

Gain

Gross

Unrealized

Loss

Fair

Value

(in millions)

Municipal securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 62 $ — $ — $ 62

U.S. government and agency securities . . . . . . . . . . . . . . . . 72 — — 72

Corporate securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 631 — (1) 630

Asset-backed securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 57 — — 57

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39 1 — 40

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 861 $ 1 $ (1) $ 861

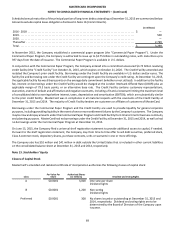

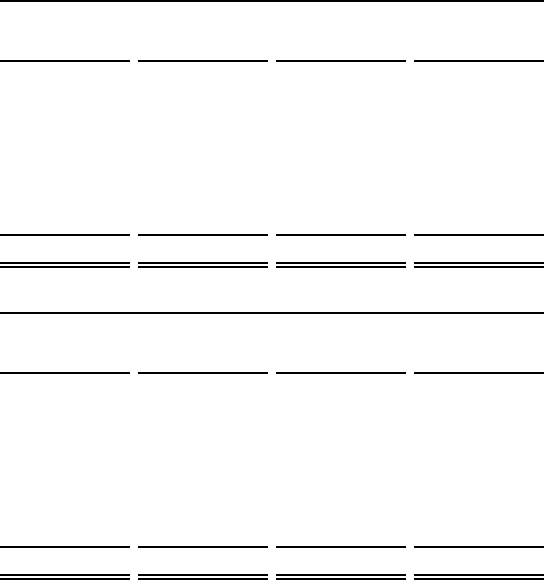

December 31, 2014

Amortized

Cost

Gross

Unrealized

Gain

Gross

Unrealized

Loss

Fair

Value

(in millions)

Municipal securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 135 $ — $ — $ 135

U.S. government and agency securities . . . . . . . . . . . . . . . . 199 — — 199

Corporate securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 619 — (1) 618

Asset-backed securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 178 — — 178

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41 1 (4) 38

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,172 $ 1 $ (5) $ 1,168

The municipal securities are primarily comprised of tax-exempt bonds and are diversified across states and sectors. The U.S.

government and agency securities are primarily invested in U.S. government bonds and U.S. government sponsored agency