MasterCard 2015 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2015 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

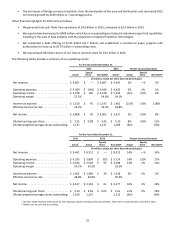

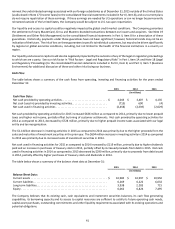

The following table summarizes the primary drivers of net revenue growth:

For the Years Ended December 31,

Volume Foreign Currency 1Acquisitions Other 2Total

2015 2014 2015 2014 2015 2014 2015 2014 2015 2014

Domestic assessments . . . . . 12% 13% (6)% (1)% —% —% (3)% 3(4)% 33% 8%

Cross-border volume fees. . . 14% 15% (5)% — % —% —% (3)% (3)% 6% 12%

Transaction processing fees . 11% 9% (6)% — % —% 1% 3 % 4 % 8% 14%

Other revenues . . . . . . . . . . . ** ** (6)% (1)% 8% 7% 16 % 421 % 418% 27%

Rebates and incentives . . . . . 6% 9% (6)% (1)% —% —% 20 % 53%

520% 11%

Net revenue . . . . . . . . . . . . . . 12% 12% (6)% (1)% 2% 2% (6)% 1 % 2% 14%

** Not applicable

1 Reflects translation from the euro and Brazilian real to the U.S. dollar.

2 Includes impact from pricing, local foreign currency impact from billing and other fees.

3 Includes impact of the allocation of revenue to service deliverables, which are recorded in other revenue when services are performed.

4 Includes impacts from Advisor fees, safety and security fees, loyalty and reward solution fees and other payment-related products and services.

5 Includes the impact from timing of new, renewed and expired agreements.

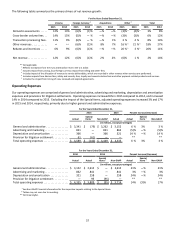

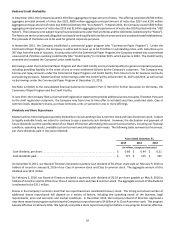

Operating Expenses

Our operating expenses are comprised of general and administrative, advertising and marketing, depreciation and amortization

expenses and provisions for litigation settlements. Operating expenses increased 6% in 2015 compared to 2014, and increased

14% in 2014 compared to 2013. Excluding the impact of the Special Items, adjusted operating expenses increased 3% and 17%

in 2015 and 2014, respectively, primarily due to higher general and administrative expenses.

For the Years Ended December 31,

2015 2014 Percent Increase (Decrease)

Actual

Special

Items 1Non-GAAP Actual Actual

Special

Items 1Non-GAAP

(in millions, except percentages)

General and administrative . . . . . . . . . . . . . . . . $ 3,341 $ (79) $ 3,262 $ 3,152 6 % 3% 3 %

Advertising and marketing . . . . . . . . . . . . . . . . . 821 — 821 862 (5)% —% (5)%

Depreciation and amortization . . . . . . . . . . . . . 366 — 366 321 14 % —% 14 %

Provision for litigation settlement. . . . . . . . . . . 61 (61) — — ** **

Total operating expenses . . . . . . . . . . . . . . . . . . $ 4,589 $ (140) $ 4,449 $ 4,335 6 % 3% 3 %

For the Years Ended December 31,

2014 2013 Percent Increase (Decrease)

Actual Actual

Special

Items 1Non-GAAP Actual

Special

Items 1Non-GAAP

(in millions, except percentages)

General and administrative . . . . . . . . . . . . . . . . $ 3,152 $ 2,615 $ — $ 2,615 21% —% 21%

Advertising and marketing . . . . . . . . . . . . . . . . . 862 841 — 841 3% —% 3%

Depreciation and amortization . . . . . . . . . . . . . 321 258 — 258 24% —% 24%

Provision for litigation settlement. . . . . . . . . . . — 95 (95) — ** **

Total operating expenses . . . . . . . . . . . . . . . . . . $ 4,335 $ 3,809 $ (95) $ 3,714 14% (3)% 17%

1 See Non-GAAP Financial Information for the respective impacts relating to the Special Items.

* Tables may not sum due to rounding.

** Not meaningful.