MasterCard 2015 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2015 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

67

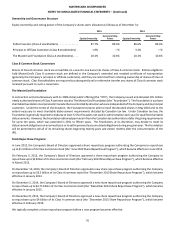

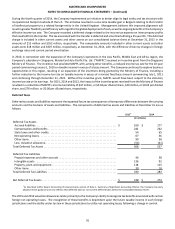

The increase in the net carrying amount of amortized intangible assets in 2015 was primarily related to our acquired businesses.

Certain intangible assets, including amortizable and unamortizable customer relationships and trademarks and tradenames, are

denominated in foreign currencies. As such, the change in intangible assets includes a component attributable to foreign currency

translation.

Amortization on the assets above amounted to $235 million, $214 million and $166 million in 2015, 2014 and 2013, respectively.

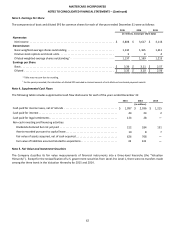

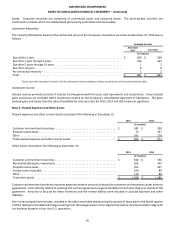

The following table sets forth the estimated future amortization expense on amortizable intangible assets on the balance sheet

at December 31, 2015 for the years ending December 31:

(in millions)

2016 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 231

2017 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 168

2018 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 105

2019 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47

2020 and thereafter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 92

$ 643

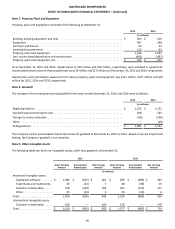

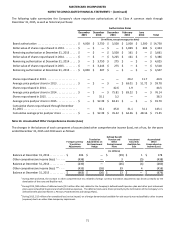

Note 10. Accrued Expenses and Accrued Litigation

Accrued expenses consisted of the following at December 31:

2015 2014

(in millions)

Customer and merchant incentives . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,748 $ 1,433

Personnel costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 473 531

Advertising . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 114 154

Income and other taxes. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 143 105

Other. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 285 216

Total accrued expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,763 $ 2,439

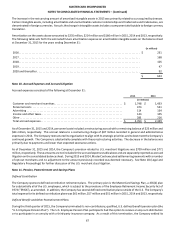

As of December 31, 2015 and 2014, personnel costs included a restructuring accrual with a remaining balance of $25 million and

$84 million, respectively. This accrual relates to a restructuring charge of $87 million recorded in general and administrative

expenses in 2014. The Company restructured its organization to align with its strategic priorities and to best meet the Company’s

continued growth. The Company is substantially complete with these restructuring activities. The decrease in the balance was

primarily due to payments and lower than expected severance actions.

As of December 31, 2015 and 2014, the Company’s provision related to U.S. merchant litigations was $709 million and $771

million, respectively. These amounts are not included in the accrued expenses table above and are separately reported as accrued

litigation on the consolidated balance sheet. During 2015 and 2014, MasterCard executed settlement agreements with a number

of opt-out merchants and no adjustment to the amount previously recorded was deemed necessary. See Note 18 (Legal and

Regulatory Proceedings) for further discussion of the U.S. merchant class litigation.

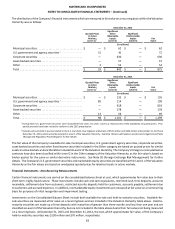

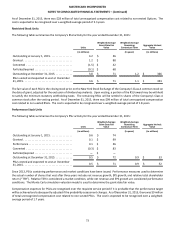

Note 11. Pension, Postretirement and Savings Plans

Defined Contribution

The Company sponsors defined contribution retirement plans. The primary plan is the MasterCard Savings Plan, a 401(k) plan

for substantially all of the U.S. employees, which is subject to the provisions of the Employee Retirement Income Security Act of

1974 (“ERISA”), as amended. In addition, the Company has several defined contribution plans outside of the U.S. The Company’s

total expense for its defined contribution plans was $61 million, $57 million and $51 million in 2015, 2014 and 2013, respectively.

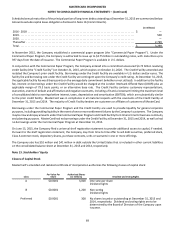

Defined Benefit and Other Postretirement Plans

During the third quarter of 2015, the Company terminated its non-contributory, qualified, U.S. defined benefit pension plan (the

“U.S. Employee Pension Plan”). The U.S. Employee Pension Plan participants had the option to receive a lump sum distribution

or to participate in an annuity with a third-party insurance company. As a result of this termination, the Company settled its