MasterCard 2015 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2015 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.47

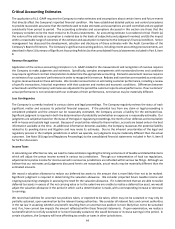

in Note 12 (Debt) to the consolidated financial statements included in Part II, Item 8. See “Future Obligations” for estimated

interest payments due by period relating to the U.S. dollar-denominated and euro-denominated debt.

At December 31, 2015, we have a credit facility which provides liquidity for general corporate purposes, including providing

liquidity in the event of one or more settlement failures by the Company’s customers. This credit facility has variable rates, which

are applied to the borrowing based on terms and conditions set forth in the agreement. In conjunction with the credit facility,

we have established a Commercial Paper Program. See Note 12 (Debt) to the consolidated financial statements in Part II, Item

8 for additional information on the Company’s current and prior credit facilities and Commercial Paper Program. With the

exception for business continuity planning, we did not borrow under the prior or current credit facilities as of December 31, 2015

and 2014 and there were no outstanding borrowings under the Commercial Paper Program as of December 31, 2015.

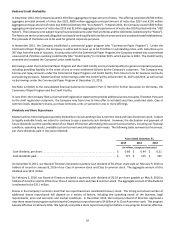

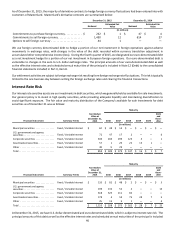

Equity Price Risk

The Company did not have significant equity price risk as of December 31, 2015 and 2014.