MasterCard 2015 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2015 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.4

including authorization, clearing and settlement, and deliver related products and services. We make payments easier and more

efficient by creating a wide range of payment solutions and services using our family of well-known brands, including MasterCard®,

Maestro® and Cirrus®. We also provide value-added offerings such as loyalty and reward programs, information services and

consulting. Our network is designed to ensure safety and security for the global payments system.

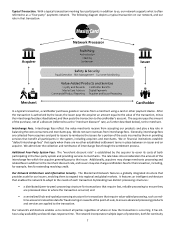

A typical transaction on our network involves four participants in addition to us: cardholder (an individual who holds a card or

uses another device enabled for payment), merchant, issuer (the cardholder’s financial institution) and acquirer (the merchant’s

financial institution). We do not issue cards, extend credit, determine or receive revenue from interest rates or other fees charged

to cardholders by issuers, or establish the rates charged by acquirers in connection with merchants’ acceptance of our branded

cards. In most cases, cardholder relationships belong to, and are managed by, our financial institution customers.

We generate revenue by charging fees to issuers and acquirers for providing transaction processing and other payment-related

products and services, as well as by assessing these customers based primarily on the dollar volume of activity, or gross dollar

volume (“GDV”), on the cards and other devices that carry our brands.

Our Strategy

Our ability to grow our business is influenced by personal consumption expenditure growth, driving cash and check transactions

toward electronic forms of payment, increasing our share in electronic payments and providing value-added products and

services. We achieve our strategy by growing, diversifying and building our business.

Grow. We focus on growing our core businesses globally, including growing our credit, debit, prepaid and commercial products

and solutions and increasing the number of payment transactions we process.

Diversify. We look to diversify our business by focusing on:

• diversifying our customer base in new and existing markets by working with partners such as governments, merchants,

large digital companies and other technology companies, mobile providers and other businesses;

• encouraging use of our products and solutions in areas that provide new opportunities for electronic payments, such

as transit and person-to-person transfers;

• driving acceptance at small business merchants, including those who have not historically accepted electronic payments;

and

• broadening financial inclusion for the unbanked and underbanked.

Build. We build our business by:

• taking advantage of the opportunities presented by the evolving ways consumers interact and transact as physical

and digital payments converge; and

• using our safety and security products and solutions, data analytics and loyalty solutions to add value.

We grow, diversify and build our business through a combination of organic growth and strategic investments, including

acquisitions.

Strategic Partners. We work with a variety of stakeholders. We provide financial institutions with solutions to help them increase

revenue and increase preference for their MasterCard-branded products. We help merchants by delivering data-driven insights

and other services to help them grow and create better and secure purchase experiences for consumers across physical and

digital channels. We partner with large digital companies and other technology companies, mobile providers and

telecommunication companies to support their digital payment solutions with our technology, expertise and security protocols.

We help national and local governments drive increased financial inclusion and efficiency, reduce costs, increase transparency

to reduce crime and corruption and advance social programs. For consumers, we provide better, safer and more convenient

ways to pay.

Recent Business and Legal/Regulatory Developments

Product Innovation. We have launched and extended products and platforms that take advantage of the growing digital economy

(including the Internet of Things), where consumers are increasingly using technology to interact with merchants. Among our

recent developments: