MasterCard 2015 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2015 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

68

obligation for $287 million, which resulted in a pension settlement charge of $79 million recorded in general and administrative

expense during 2015.

The Company maintains a postretirement plan providing health coverage and life insurance benefits for substantially all of its

U.S. employees hired before July 1, 2007 (“U.S. Postretirement Plan”). As of December 31, 2015 and 2014, the U.S. postretirement

plan was unfunded and the Company’s obligation was $59 million and $78 million, respectively, and was recorded in Other

Liabilities. The Company’s total expense for its U.S. postretirement plan was not material to the Company’s consolidated financial

statements.

The Company sponsors pension and postretirement plans for non-U.S. employees (“non-U.S. plans”) that cover various benefits

specific to their country of employment. The Company recognizes the funded status of its defined benefit pension plans and

other postretirement benefit plans, measured as the difference between the fair value of the plan assets and the projected

benefit obligation, in the Consolidated Balance Sheet. The non-U.S. plans do not have a material impact on the Company’s

consolidated financial statements, individually or in the aggregate.

Note 12. Debt

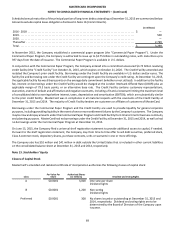

In December 2015, the Company issued €1.65 billion ($1.8 billion as translated at the December 31, 2015 exchange rate) aggregate

principal amount of notes. This offering consisted of €700 million aggregate principal amount of notes due 2022, €800 million

aggregate principal amount of notes due 2027 and €150 million aggregate principal amount of notes due 2030 (collectively the

“Euro Notes”). The net proceeds from the issuance of the Euro Notes, after deducting the underwriting discount and offering

expenses, were $1.723 billion. Interest on the Euro Notes is payable annually on December 1, commencing on December 1,

2016.

In March 2014, the Company issued $500 million aggregate principal amount of notes due April 1, 2019 and $1 billion aggregate

principal amount of notes due April 1, 2024 (collectively the “USD Notes”). The net proceeds from the issuance of the USD Notes,

after deducting the underwriting discount and offering expenses, were $1.484 billion. Interest on the USD Notes is payable semi-

annually on April 1 and October 1.

The Company is not subject to any financial covenants under the Euro Notes and the USD Notes (collectively the “Notes”). The

Notes may be redeemed in whole, or in part, at our option at any time for a specified make-whole amount. The Notes are senior

unsecured obligations and would rank equally with any future unsecured and unsubordinated indebtedness. The proceeds of

the Notes are to be used for general corporate purposes.

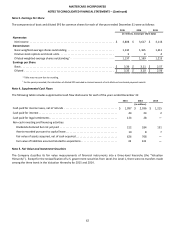

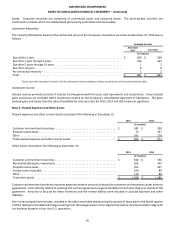

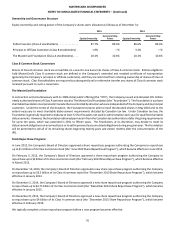

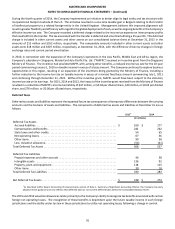

Long-term debt consisted of the following at December 31:

Stated

Interest Rate

Effective

Interest Rate 2015 2014

(in millions, except percentages)

USD Notes

Due 2019 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.000% 2.178% $ 500 $ 500

Due 2024 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.375% 3.484% 1,000 1,000

Euro Notes

Due 2022 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.100% 1.265% 763 —

Due 2027 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.100% 2.189% 872 —

Due 2030 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.500% 2.562% 164 —

3,299 1,500

Less: Unamortized discount . . . . . . . . . . . . . . . . . . . . . . . . . . (12) (6)

Long-term debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3,287 $ 1,494