MasterCard 2015 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2015 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.31

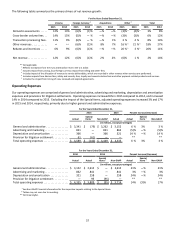

Non-GAAP Financial Information

Non-GAAP financial information is defined as a numerical measure of a company’s performance that excludes or includes amounts

so as to be different than the most comparable measure calculated and presented in accordance with accounting principles

generally accepted in the United States (“GAAP”). This report on Form 10-K contains non-GAAP financial measures that exclude

the impact of the following special items (“Special Items”):

• U.S. Employee Pension Plan Settlement Charge - in 2015, the Company recorded a settlement charge of $79 million ($50

million after tax or $0.04 per diluted share) relating to the termination of its qualified U.S. defined benefit pension plan

in general and administrative expenses. See Note 11 (Pension, Postretirement and Savings Plans) to the consolidated

financial statements included in Part II, Item 8 for further discussion.

• U.K. Merchant Litigation Settlement Provision - in 2015, the Company recorded a provision for a litigation settlement

of $61 million ($44 million after tax or $0.04 per diluted share) relating to a merchant litigation in the U.K. See Note 18

(Legal and Regulatory Proceedings) to the consolidated financial statements included in Part II, Item 8 for further

discussion.

• Provision for settlements relating to U.S. Merchant Litigations - in 2013, the Company recorded an incremental net

charge of $95 million ($61 million after tax or $0.05 per diluted share) related to the opt-out merchants, representing

a change in its estimate of probable losses relating to these matters. See Note 18 (Legal and Regulatory Proceedings)

for further discussion to the consolidated financial statements included in Part II, Item 8.

MasterCard excludes these Special Items because its management monitors significant one-time items separately from ongoing

operations and evaluates ongoing performance without these amounts. MasterCard presents non-GAAP financial measures to

enhance an investor’s understanding of MasterCard’s ongoing operating results and to facilitate meaningful comparison of its

results between periods. MasterCard’s management uses these non-GAAP financial measures to, among other things, evaluate

its ongoing operations in relation to historical results, for internal planning and forecasting purposes and in the calculation of

performance-based compensation. See “Overview” and “Financial Results” sections for the tables that provide a reconciliation

of the operating results and growth to the most directly comparable GAAP measure. The presentation of non-GAAP financial

measures should not be considered in isolation or as a substitute for the Company’s related financial results prepared in

accordance with GAAP.

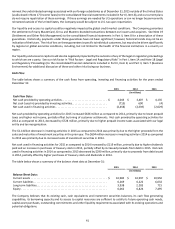

Overview

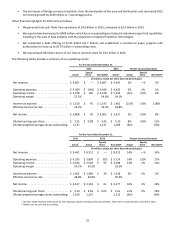

We recorded net income of $3.8 billion, or $3.35 per diluted share in 2015 versus net income of $3.6 billion, or $3.10 per diluted

share in 2014. Reported net income grew 5% in 2015 versus the comparable period in 2014.

Excluding the impact of the Special Items, we had adjusted net income of $3.9 billion, or $3.43 per adjusted diluted share in

2015. Adjusted net income increased 8% in 2015 versus the comparable period in 2014. The increase in adjusted net income

was driven by:

• Net revenue growth of 2%, primarily driven by increases across our revenue categories and the impact from acquisitions,

which contributed 2 percentage points of growth, partially offset by higher rebates and incentives and the impact from

foreign currency translation, which decreased growth by 6 percentage points. In 2015, our processed transactions

increased 12% versus the comparable period in the prior year. In 2015, our gross dollar volumes increased 13% and

our cross-border volume increased 16%, both on a local currency basis, versus the comparable period in the prior year,

respectively.

• Excluding the impact of Special Items, adjusted operating expenses in 2015 increased 3%, primarily due to higher general

and administrative expenses as a result of acquisitions and higher data processing costs, partially offset by improved

cost control initiatives and the favorable impact of foreign currency translation and transaction gains. Including the

impact of Special Items, operating expenses increased 6% in 2015 versus the comparable period in 2014.

• Total other expense increased to $120 million in 2015 versus $27 million for the comparable period in 2014, resulting

from impairment charges taken on certain investments in 2015 and higher interest expense resulting from incremental

debt issued in 2014 and 2015.

• An improved effective tax rate of 23.2% in 2015 versus an effective tax rate of 28.8% in the comparable period in 2014,

due to the recognition of discrete tax benefits in 2015 resulting from the favorable impact of settlements with tax

authorities and the recognition of U.S. foreign tax credit benefits.