MasterCard 2015 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2015 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

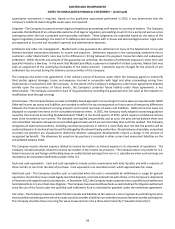

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

57

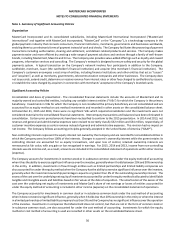

Use of estimates - The preparation of financial statements in conformity with GAAP requires management to make estimates

and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at

the date of the financial statements and the reported amounts of revenue and expenses during the reporting periods. Future

events and their effects cannot be predicted with certainty; accordingly, accounting estimates require the exercise of judgment.

The accounting estimates used in the preparation of the Company’s consolidated financial statements may change as new events

occur, as more experience is acquired, as additional information is obtained and as the Company’s operating environment changes.

Actual results may differ from these estimates.

Revenue recognition - Revenue is recognized when persuasive evidence of an arrangement exists, delivery has occurred or services

have been rendered, the price is fixed or determinable, and collectibility is reasonably assured. Revenue is generally derived

from transactional information accumulated by our systems or reported by our customers. The Company’s revenue is based on

the volume of activity on cards that carry the Company’s brands, the number of transactions processed or the nature of other

payment-related products and services.

Volume-based revenue (domestic assessments and cross-border volume fees) is recorded as revenue in the period it is earned,

which is when the related volume is generated on the cards. Certain volume-based revenue is based upon information reported

to us by our customers. Transaction-based revenue (transaction processing fees) is primarily based on the number and type of

transactions and is recognized as revenue in the same period as the related transactions occur. Other payment-related products

and services are recognized as revenue in the same period as the related transactions occur or services are rendered.

MasterCard has business agreements with certain customers that provide for rebates or other support when the customers meet

certain volume hurdles as well as other support incentives such as marketing, which are tied to performance. Rebates and

incentives are recorded as a reduction of revenue either when the revenue is recognized by the Company or at the time the

rebate or incentive is earned by the customer. Rebates and incentives are calculated based upon estimated performance and

the terms of the related business agreements. In addition, MasterCard may make payments to a customer directly related to

entering into an agreement, which are generally deferred and amortized over the life of the agreement on a straight-line basis.

Business combinations - The Company accounts for business combinations under the acquisition method of accounting. The

Company measures the tangible and intangible identifiable assets acquired, liabilities assumed, and any non-controlling interest

in the acquiree, at their fair values at the acquisition date. Acquisition-related costs are expensed as incurred and are included

in general and administrative expenses. Any excess of purchase price over the fair value of net assets acquired, including

identifiable intangible assets, is recorded as goodwill.

Intangible assets - Intangible assets consist of capitalized software costs, trademarks, tradenames, customer relationships and

other intangible assets, which have finite lives, and customer relationships which have indefinite lives. Intangible assets with

finite useful lives are amortized over their estimated useful lives, on a straight-line basis, which range from one to ten years.

Capitalized software includes internal and external costs incurred directly related to the design, development and testing phases

of each capitalized software project.

Impairment of assets - Long-lived assets, other than goodwill and indefinite-lived intangible assets, are tested for impairment

whenever events or circumstances indicate that their carrying amount may not be recoverable. If the carrying value of the asset

cannot be recovered from estimated future cash flows, undiscounted and without interest, the fair value of the asset is calculated

using the present value of estimated net future cash flows. If the carrying amount of the asset exceeds its fair value, an impairment

is recorded.

Goodwill and indefinite-lived intangible assets are not amortized and are tested annually for impairment in the fourth quarter,

or sooner when circumstances indicate an impairment may exist. Goodwill is tested for impairment at the reporting unit level.

The impairment evaluation utilizes a quantitative assessment using a two-step impairment test. The first step is to compare the

reporting unit’s carrying value, including goodwill, to the fair value. If the fair value exceeds the carrying value, then no potential

impairment is considered to exist. If the carrying value exceeds the fair value, the second step is performed to determine if the

implied fair value of the reporting unit’s goodwill exceeds the carrying value of the reporting unit. An impairment charge would

be recorded if the carrying value exceeds the implied fair value. Impairment charges, if any, are recorded in general and

administrative expenses.

The impairment test for indefinite-lived intangible assets consists of a qualitative assessment to evaluate all relevant events and

circumstances that could affect the significant inputs used to determine the fair value of indefinite-lived intangible assets. If the

qualitative assessment indicates that it is more likely than not that indefinite-lived intangible assets are impaired, then a