MasterCard 2015 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2015 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7

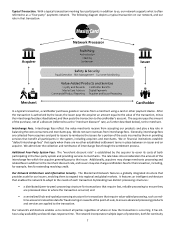

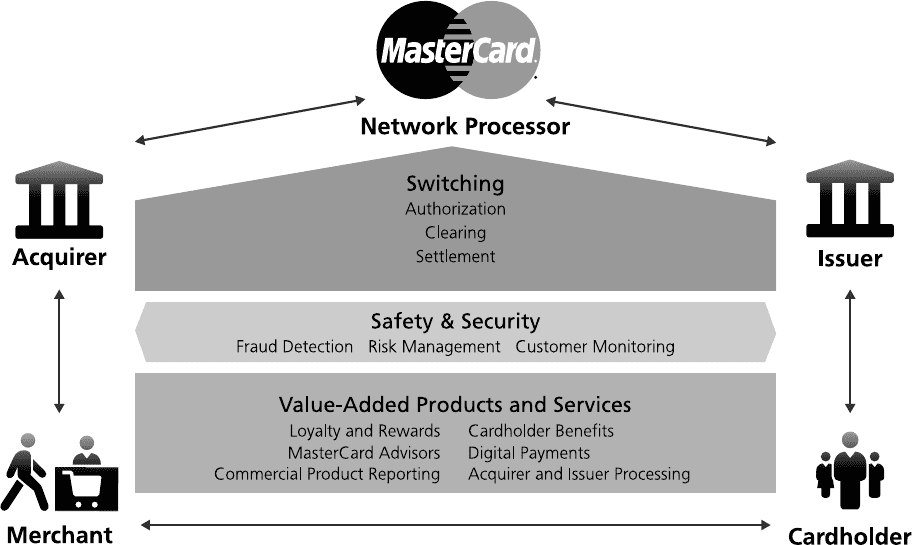

Typical Transaction. With a typical transaction involving four participants in addition to us, our network supports what is often

referred to as a “four-party” payments network. The following diagram depicts a typical transaction on our network, and our

role in that transaction:

In a typical transaction, a cardholder purchases goods or services from a merchant using a card or other payment device. After

the transaction is authorized by the issuer, the issuer pays the acquirer an amount equal to the value of the transaction, minus

the interchange fee (described below), and then posts the transaction to the cardholder’s account. The acquirer pays the amount

of the purchase, net of a discount (referred to as the “merchant discount” rate, as further described below), to the merchant.

Interchange Fees. Interchange fees reflect the value merchants receive from accepting our products and play a key role in

balancing the costs consumers and merchants pay. We do not earn revenues from interchange fees. Generally, interchange fees

are collected from acquirers and paid to issuers to reimburse the issuers for a portion of the costs incurred by them in providing

services that benefit all participants in the system, including acquirers and merchants. We or financial institutions establish

“default interchange fees” that apply when there are no other established settlement terms in place between an issuer and an

acquirer. We administer the collection and remittance of interchange fees through the settlement process.

Additional Four-Party System Fees. The “merchant discount rate” is established by the acquirer to cover its costs of both

participating in the four-party system and providing services to merchants. The rate takes into consideration the amount of the

interchange fee which the acquirer generally pays to the issuer. Additionally, acquirers may charge merchants processing and

related fees in addition to the merchant discount rate, and issuers may also charge cardholders fees for the transaction, including,

for example, fees for extending revolving credit.

Our Network Architecture and Information Security. The MasterCard Network features a globally integrated structure that

provides scale for our issuers, enabling them to expand into regional and global markets. It features an intelligent architecture

that enables the network to adapt to the needs of each transaction by blending two distinct processing structures:

• a distributed (peer-to-peer) processing structure for transactions that require fast, reliable processing to ensure they

are processed close to where the transaction occurred; and

• a centralized (hub-and-spoke) processing structure for transactions that require value-added processing, such as real-

time access to transaction data for fraud scoring or rewards at the point-of-sale, to ensure advanced processing products

and services are applied to the transaction.

Our network’s architecture enables us to connect all parties regardless of where or how the transaction is occurring. It has 24-

hour a day availability and world-class response time. The network incorporates multiple layers of protection, both for continuity