MasterCard 2015 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2015 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

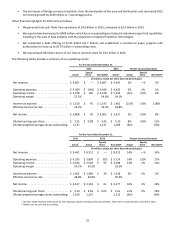

During the fourth quarter of 2015, MasterCard repurchased a total of approximately 8.1 million shares for $793 million at an

average price of $97.43 per share of Class A common stock. The Company’s repurchase activity during the fourth quarter of

2015 consisted of open market share repurchases and is summarized in the following table:

Period

Tota l Number

of Shares

Purchased

Average Price

Paid per Share

(including

commission cost)

Total Number of

Shares Purchased as

Part of Publicly

Announced Plans or

Programs

Dollar Value of

Shares that may yet

be Purchased under

the Plans or

Programs 1

October 1 – 31 . . . . . . . . . . . . . . . . . . . . . . . . 1,912,149 $ 94.07 1,912,149 $ 1,119,663,418

November 1 – 30 . . . . . . . . . . . . . . . . . . . . . . 2,837,992 $ 99.42 2,837,992 $ 837,513,192

December 1 – 31 . . . . . . . . . . . . . . . . . . . . . . 3,388,704 $ 97.67 3,388,704 $ 4,506,532,273

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,138,845 $ 97.43 8,138,845

1 Dollar value of shares that may yet be purchased under the December 2014 Share Repurchase Program and the December 2015 Share Repurchase

Program is as of the end of the period.

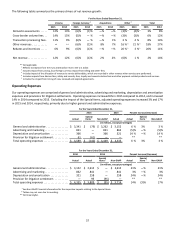

ITEM 6. SELECTED FINANCIAL DATA

The statement of operations data presented below for the years ended December 31, 2015, 2014 and 2013, and the balance

sheet data as of December 31, 2015 and 2014, were derived from the audited consolidated financial statements of MasterCard

Incorporated included in Part II, Item 8. The statement of operations data presented below for the years ended December 31,

2012 and 2011, and the balance sheet data as of December 31, 2013, 2012 and 2011, were derived from audited consolidated

financial statements not included in this Report. The data set forth below should be read in conjunction with, and are qualified

by reference to, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7 and

our consolidated financial statements and notes thereto included in Part II, Item 8.

Years Ended December 31,

2015 2014 2013 2012 2011

(in millions, except per share data)

Statement of Operations Data:

Net revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 9,667 $ 9,441 $ 8,312 $ 7,391 $ 6,714

Total operating expenses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,589 4,335 3,809 3,454 4,001

Operating income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,078 5,106 4,503 3,937 2,713

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,808 3,617 3,116 2,759 1,906

Basic earnings per share . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.36 3.11 2.57 2.20 1.49

Diluted earnings per share. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.35 3.10 2.56 2.19 1.48

Balance Sheet Data:

Total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 16,269 $ 15,329 $ 14,242 $ 12,462 $ 10,693

Long-term debt. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,287 1,494 — — —

Equity. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,062 6,824 7,495 6,929 5,877

Cash dividends declared per share . . . . . . . . . . . . . . . . . . . . . . 0.67 0.49 0.29 0.12 0.06

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

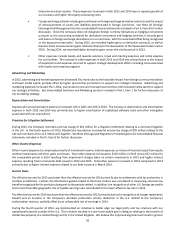

The following discussion should be read in conjunction with the consolidated financial statements and notes of MasterCard

Incorporated and its consolidated subsidiaries, including MasterCard International Incorporated (“MasterCard International”)

(together, “MasterCard” or the “Company”), included elsewhere in this Report. Certain prior period amounts have been reclassified

to conform to the 2015 presentation. For 2014 and 2013, net revenue and general and administrative expenses were revised to

correctly classify $32 million and $34 million, respectively, of customer incentive expenses as contra revenue instead of general

and administrative expenses. This revision had no impact on net income. Percentage changes provided throughout

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” were calculated on amounts rounded

to the nearest thousand.