MasterCard 2015 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2015 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.44

Critical Accounting Estimates

The application of U.S. GAAP requires the Company to make estimates and assumptions about certain items and future events

that directly affect the Company’s reported financial condition. We have established detailed policies and control procedures

to provide reasonable assurance that the methods used to make estimates and assumptions are well controlled and are applied

consistently from period to period. The accounting estimates and assumptions discussed in this section are those that the

Company considers to be the most critical to its financial statements. An accounting estimate is considered critical if both (a)

the nature of the estimate or assumption is material due to the levels of subjectivity and judgment involved, and (b) the impact

within a reasonable range of outcomes of the estimate and assumption is material to the Company’s financial condition. Senior

management has discussed the development, selection and disclosure of these estimates with the Audit Committee of the

Company’s Board of Directors. The Company’s significant accounting policies, including recent accounting pronouncements, are

described in Note 1 (Summary of Significant Accounting Policies) to the consolidated financial statements included in Part II, Item

8.

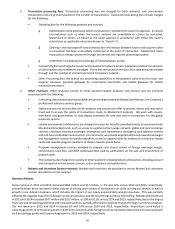

Revenue Recognition

Application of the various accounting principles in U.S. GAAP related to the measurement and recognition of revenue requires

the Company to make judgments and estimates. Specifically, complex arrangements with nonstandard terms and conditions

may require significant contract interpretation to determine the appropriate accounting. Domestic assessment revenue requires

an estimate of our customers’ performance in order to recognize this revenue. Rebates and incentives are recorded as a reduction

to gross revenue based on these estimates. We consider various factors in estimating customer performance, including a review

of specific transactions, historical experience with that customer and market and economic conditions. Differences between

actual results and the Company’s estimates are adjusted in the period the customer reports actual performance. If our customers’

actual performance is not consistent with our estimates of their performance, net revenue may be materially different.

Loss Contingencies

The Company is currently involved in various claims and legal proceedings. The Company regularly reviews the status of each

significant matter and assesses its potential financial exposure. If the potential loss from any claim or legal proceeding is

considered probable and the amount can be reasonably estimated, the Company accrues a liability for the estimated loss.

Significant judgment is required in both the determination of probability and whether an exposure is reasonably estimable. Our

judgments are subjective based on the status of the legal or regulatory proceedings, the merits of our defenses and consultation

with in-house and outside legal counsel. Because of uncertainties related to these matters, accruals are based only on the best

information available at the time. As additional information becomes available, the Company reassesses the potential liability

related to its pending claims and litigation and may revise its estimates. Due to the inherent uncertainties of the legal and

regulatory process in the multiple jurisdictions in which we operate, our judgments may be materially different than the actual

outcomes. See Note 18 (Legal and Regulatory Proceedings) to the consolidated financial statements included in Part II, Item 8

for further discussion.

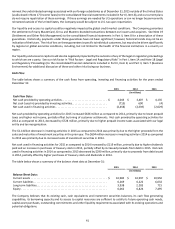

Income Taxes

In calculating our effective tax rate, we need to make estimates regarding the timing and amount of taxable and deductible items

which will adjust the pretax income earned in various tax jurisdictions. Through our interpretation of local tax regulations,

adjustments to pretax income for income earned in various tax jurisdictions are reflected within various tax filings. Although we

believe that our estimates and judgments discussed herein are reasonable, actual results may be materially different than the

estimated amounts.

We record a valuation allowance to reduce our deferred tax assets to the amount that is more likely than not to be realized.

Significant judgment is required in determining the valuation allowance. We consider projected future taxable income and

ongoing tax planning strategies in assessing the need for the valuation allowance. If it is determined that we are able to realize

deferred tax assets in excess of the net carrying value or to the extent we are unable to realize a deferred tax asset, we would

adjust the valuation allowance in the period in which such a determination is made, with a corresponding increase or decrease

to earnings.

We record tax liabilities for uncertain tax positions taken, or expected to be taken, which may not be sustained or may only be

partially sustained, upon examination by the relevant taxing authorities. We consider all relevant facts and current authorities

in the tax law in assessing whether any benefit resulting from an uncertain tax position is more likely than not to be sustained

and, if so, how current law impacts the amount reflected within these financial statements. If upon examination, we realize a

tax benefit which is not fully sustained or is more favorably sustained, this would decrease or increase earnings in the period. In

certain situations, the Company will have offsetting tax credits or taxes in other jurisdictions.