MasterCard 2015 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2015 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

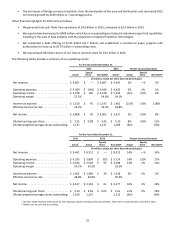

42

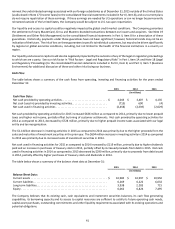

Debt and Credit Availability

In December 2015, the Company issued €1.65 billion aggregate principal amount of notes. This offering consisted of €700 million

aggregate principal amount of notes due 2022, €800 million aggregate principal amount of notes due 2027 and €150 million

aggregate principal amount of notes due 2030 (collectively the “Euro Notes”). In March 2014, the Company issued $500 million

aggregate principal amount of notes due 2019 and $1 billion aggregate principal amount of notes due 2024 (collectively the “USD

Notes”). The Company is not subject to any financial covenants under the Euro Notes and the USD Notes (collectively the “Notes”).

The Notes are senior unsecured obligations and would rank equally with any future unsecured and unsubordinated indebtedness.

The proceeds of the Notes are to be used for general corporate purposes.

In November 2015, the Company established a commercial paper program (the “Commercial Paper Program”). Under the

Commercial Paper Program, the Company is authorized to issue up to $3.75 billion in outstanding notes, with maturities up to

397 days from the date of issuance. In conjunction with the Commercial Paper Program, the Company entered into a committed

unsecured $3.75 billion revolving credit facility (the “Credit Facility”) in October 2015, which expires in 2020. The Credit Facility

amended and restated the Company’s prior credit facility.

Borrowings under the Commercial Paper Program and the Credit Facility are to provide liquidity for general corporate purposes,

including providing liquidity in the event of one or more settlement failures by the Company’s customers. The Company may

borrow and repay amounts under the Commercial Paper Program and Credit Facility from time to time for business continuity

and planning purposes. MasterCard had no borrowings under the Credit Facility at December 31, 2015 and 2014, as well as had

no borrowings under the Commercial Paper Program at December 31, 2015.

See Note 12 (Debt) to the consolidated financial statements included in Part II, Item 8 for further discussion on the Notes, the

Commercial Paper Program and the Credit Facility.

In June 2015, the Company filed a universal shelf registration statement to provide additional access to capital, if needed. Pursuant

to the shelf registration statement, the Company may from time to time offer to sell debt securities, preferred stock, Class A

common stock, depository shares, purchase contracts, units or warrants in one or more offerings.

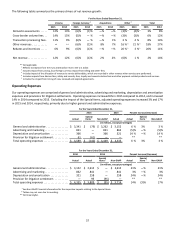

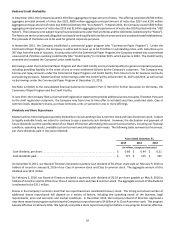

Dividends and Share Repurchases

MasterCard has historically paid quarterly dividends on its outstanding Class A common stock and Class B common stock. Subject

to legally available funds, we intend to continue to pay a quarterly cash dividend. However, the declaration and payment of

future dividends is at the sole discretion of our Board of Directors after taking into account various factors, including our financial

condition, operating results, available cash and current and anticipated cash needs. The following table summarizes the annual,

per share dividends paid in the years reflected:

Years Ended December 31,

2015 2014 2013

(in millions, except per share data)

Cash dividend, per share . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 0.64 $ 0.44 $ 0.21

Cash dividends paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 727 $ 515 $ 255

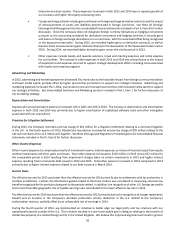

On December 8, 2015, our Board of Directors declared a quarterly cash dividend of $0.19 per share paid on February 9, 2016 to

holders of record on January 8, 2016 of our Class A common stock and Class B common stock. The aggregate amount of this

dividend was $212 million.

On February 2, 2016, our Board of Directors declared a quarterly cash dividend of $0.19 per share payable on May 9, 2016 to

holders of record on April 8, 2016 of our Class A common stock and Class B common stock. The aggregate amount of this dividend

is estimated to be $211 million.

Shares in the Company’s common stock that are repurchased are considered treasury stock. The timing and actual number of

additional shares repurchased will depend on a variety of factors, including the operating needs of the business, legal

requirements, price and economic and market conditions. In December 2015, the Company’s Board of Directors approved a

new share repurchase program authorizing the Company to repurchase up to $4 billion of its Class A common stock. This program

became effective in February 2016. We typically complete a share repurchase program before a new program becomes effective.