MasterCard 2015 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2015 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.6

• Russia - Effective in 2015, the Russian government amended its National Payments Systems laws to require all payment

systems to process domestic transactions through a government-owned payment switch. As a result, all MasterCard

domestic transactions in Russia are now processed by that system instead of MasterCard.

• China - In 2015, People’s Bank of China shared preliminary regulations related to international networks’ ability to

process domestic payments in China. The regulations, which could require a capital commitment and on-soil provisions

for switching, data processing and acceptance, are expected to be finalized in 2016. While we await the final regulations,

we continue to execute against our plans to have the infrastructure and technology ready in China to switch domestic

Chinese transactions by the end of 2016. In the meantime, we are working to expand issuance and acceptance in the

market.

• Data Privacy - In 2015, the European Court of Justice invalidated the EU-U.S. Safe Harbor treaty that had permitted

the transfer of personal data between the European Union and the United States. We have adopted an alternative

method of data transfer compliance as a result of this ruling. The situation has not yet been fully resolved and we

continue to monitor any other potential requirements that may result, up to and including the need to establish a data

processing center in Europe.

Capital Structure. In 2015, we completed several key capital structure efforts as part of our capital planning, including entering

into a $3.75 billion credit facility (replacing our previous facility), launching a commercial paper program and completing a euro-

denominated bond issuance of 1.65 billion euros.

See Part I, Item 1A for a more detailed discussion of our legal and regulatory developments and risks.

Our Business

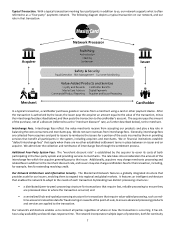

Our Operations and Network

We operate the MasterCard Network, our unique and proprietary global payments network that links issuers and acquirers

around the globe to facilitate the processing of transactions, permitting MasterCard cardholders to use their cards and other

payment devices at millions of merchants worldwide. Our network facilitates an efficient and secure means for merchants to

receive payments, as well as convenient, quick and secure payment method for consumers and businesses that is accepted

worldwide. We process transactions through our network for our issuer customers in more than 150 currencies in more than

210 countries and territories.