MasterCard 2015 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2015 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

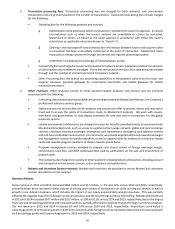

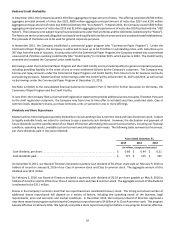

The following table summarizes the Company’s share repurchase authorizations of its Class A common stock through

December 31, 2015, as well as historical purchases:

Authorization Dates

December 2015 December 2014 December 2013 Total

(in millions, except average price data)

Board authorization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 4,000 $ 3,750 $ 3,500 $ 11,250

Remaining authorization at December 31, 2014. . . . . . . . . $ — $ 3,750 $ 275 $ 4,025

Dollar-value of shares repurchased in 2015. . . . . . . . . . . . . $ — $ 3,243 $ 275 $ 3,518

Remaining authorization at December 31, 2015. . . . . . . . . $ 4,000 $ 507 $ — $ 4,507

Shares repurchased in 2015 . . . . . . . . . . . . . . . . . . . . . . . . . — 35.1 3.2 38.3

Average price paid per share in 2015 . . . . . . . . . . . . . . . . . . $ — $ 92.39 $ 84.31 $ 91.70

See Note 13 (Stockholders’ Equity) to the consolidated financial statements included in Part II, Item 8 for further discussion.

Off-Balance Sheet Arrangements

MasterCard has no off-balance sheet debt, other than lease arrangements and other commitments as presented in the Future

Obligations table that follows.

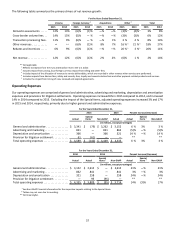

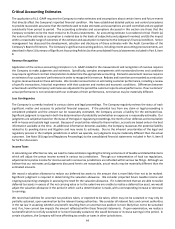

Future Obligations

The following table summarizes our obligations as of December 31, 2015 that are expected to impact liquidity and cash flow in

future periods. We believe we will be able to fund these obligations through cash generated from operations and our cash

balances.

Payments Due by Period

Total 2016 2017 - 2018 2019 - 2020 2021 and

thereafter

(in millions)

Debt. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3,309 $ 10 $ — $ 500 $ 2,799

Interest on debt . . . . . . . . . . . . . . . . . . . . . . . . . . 664 77 149 134 304

Capital leases . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11 6 5 — —

Operating leases. . . . . . . . . . . . . . . . . . . . . . . . . . 224 38 74 54 58

Other long-term obligations 1. . . . . . . . . . . . . . . . . . .

Sponsorship, licensing and other 2. . . . . . . . . . . . 461 242 164 44 11

Employee benefits 3. . . . . . . . . . . . . . . . . . . . . . . . . . . 214 82 27 27 78

Tota l 4. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 4,883 $ 455 $ 419 $ 759 $ 3,250

1 The table does not include the $709 million provision as of December 31, 2015 related to the merchant opt outs and the U.S. merchant class litigation

since the opt outs are not fixed and determinable and the Company has made a payment into escrow to fund the U.S. merchant class litigation. See

Note 18 (Legal and Regulatory Proceedings) to the consolidated financial statements included in Part II, Item 8 for further discussion.

2 Amounts primarily relate to sponsorships to promote the MasterCard brand. Future cash payments that will become due to our customers under

agreements which provide pricing rebates on our standard fees and other incentives in exchange for transaction volumes are not included in the table

because the amounts due are contingent on future performance. We have accrued $2.1 billion as of December 31, 2015 related to customer and

merchant agreements.

3 Amounts relate to severance and expected funding requirements for defined benefit pension and postretirement plans.

4 The Company has recorded a liability for unrecognized tax benefits of $181 million at December 31, 2015. Within the next twelve months, the Company

believes that the resolution of certain federal, foreign and state and local examinations are reasonably possible and that a change in estimate, reducing

unrecognized tax benefits, may occur. It is not possible to provide a range of the potential change until the examinations progress further or the related

statute of limitations expire. These amounts have been excluded from the table since the settlement period of this liability cannot be reasonably

estimated. The timing of these payments will ultimately depend on the progress of tax examinations with the various authorities.

Seasonality

The Company does not experience meaningful seasonality. No individual quarter in 2015, 2014 or 2013 accounted for more

than 30% of net revenue.