MasterCard 2015 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2015 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

63

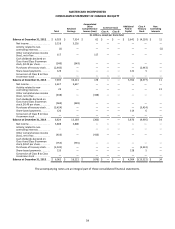

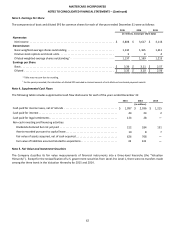

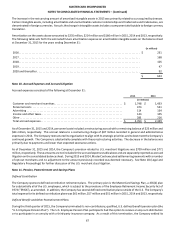

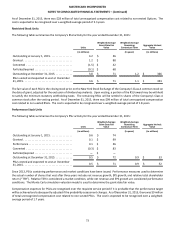

The distribution of the Company’s financial instruments which are measured at fair value on a recurring basis within the Valuation

Hierarchy was as follows:

December 31, 2015

Quoted Prices

in Active

Markets

(Level 1) 1

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Fair

Value

(in millions)

Municipal securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ — $ 62 $ — $ 62

U.S. government and agency securities 2. . . . . . . . . . . . . . . . . . . 31 41 — 72

Corporate securities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 630 — 630

Asset-backed securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 57 — 57

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 52 — 54

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 33 $ 842 $ — $ 875

December 31, 2014

Quoted Prices

in Active

Markets

(Level 1) 1

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Fair

Value

(in millions)

Municipal securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ — $ 135 $ — $ 135

U.S. government and agency securities 2. . . . . . . . . . . . . . . . . . . 85 114 — 199

Corporate securities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 618 — 618

Asset-backed securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 178 — 178

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13 56 — 69

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 98 $ 1,101 $ — $ 1,199

1 During 2015, U.S. government securities were reclassified from Level 2 to Level 1 due to a reassessment of the availability of quoted prices. Prior

period amounts have been revised to conform to the 2015 presentation.

2 Excludes amounts held in escrow related to the U.S. merchant class litigation settlement of $541 million and $540 million at December 31, 2015 and

December 31, 2014, which would be included in Level 1 of the Valuation Hierarchy. See Note 10 (Accrued Expenses and Accrued Litigation) and Note

18 (Legal and Regulatory Proceedings) for further details.

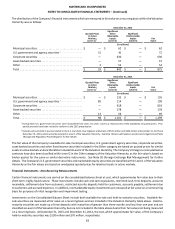

The fair value of the Company’s available-for-sale municipal securities, U.S. government agency securities, corporate securities,

asset-backed securities and other fixed income securities included in the Other category are based on quoted prices for similar

assets in active markets and are therefore included in Level 2 of the Valuation Hierarchy. The Company’s foreign currency derivative

contracts have also been classified within Level 2 in the Other category of the Valuation Hierarchy, as the fair value is based on

broker quotes for the same or similar derivative instruments. See Note 20 (Foreign Exchange Risk Management) for further

details. The Company’s U.S. government securities and marketable equity securities are classified within Level 1 of the Valuation

Hierarchy as the fair values are based on unadjusted quoted prices for identical assets in active markets.

Financial Instruments - Non-Recurring Measurements

Certain financial instruments are carried on the consolidated balance sheet at cost, which approximates fair value due to their

short-term, highly liquid nature. These instruments include cash and cash equivalents, restricted cash, time deposits, accounts

receivable, settlement due from customers, restricted security deposits held for customers, accounts payable, settlement due

to customers and accrued expenses. In addition, nonmarketable equity investments are measured at fair value on a nonrecurring

basis for purposes of initial recognition and impairment testing.

Investments on the Consolidated Balance Sheet include both available-for-sale and held-to-maturity securities. Available-for-

sale securities are measured at fair value on a recurring basis and are included in the Valuation Hierarchy table above. Held-to-

maturity securities are made up of time deposits with maturities of greater than three months and less than one year and are

classified as Level 2 of the Valuation Hierarchy, but are not included in the table above due to their fair values not being measured

on a recurring basis. At December 31, 2015 and December 31, 2014, the cost, which approximates fair value, of the Company’s

held-to-maturity securities was $130 million and $70 million, respectively.