LG 2000 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2000 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

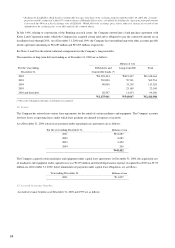

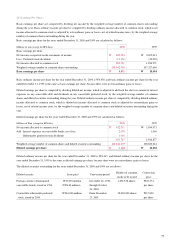

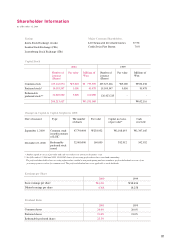

Millions of won 2000 1999

Transfer to property, plant and equipment from construction in progress W 75,196 W 35,735

Transfer to machinery and equipment from machinery in transit 86,596 79,602

Additional provision of severance benefits –11,907

Reclassify current maturities of debenture 1,275,736 1,154,450

Reclassify current maturities of long-term debt 223,923 217,800

Retroactive adoption of the revised standards on prior year’s research cost –425,582

Retroactive adoption of the revised standards on deferred income tax –254,280

Retroactive adoption of the revised standards on sales of receivables –34,734

Changes in retained earnings and capital adjustments by

equity method of accounting on investments 304,103 251,797

Transfer to investments from receivables from Zenith –433,119

Increase in assets by merger of LGIC 3,060,233 –

Increase in liabilities by merger of LGIC 2,534,043 –

25. Merger :

Effective September 1, 2000, the Company merged LG Information & Communications, Ltd., (“LGIC”), an affiliate, in accordance

with a merger agreement with LGIC on June 8, 2000 and subsequent approval by shareholders on July 22, 2000.

LGIC was incorporated to manufacture and sell electronic switching systems, transmission equipment, network equipment, mobile

telecommunication systems, and mobile phones.

The Company owned 8,374,357 shares of LGIC (27.10%) at the time of merger but the Company cancelled those shares without

issuing common stock.

In connection with the merger, the Company issued 47,790,404 shares of common stock (W1,347,645 million) exchanging 2.1216

shares of its common stock for each share of LGIC. The Company acquired the assets and assumed the liabilities of LGIC at their

fair value as of September 1, 2000. As a result of the merger, the Company recognized goodwill of W393,820 million.

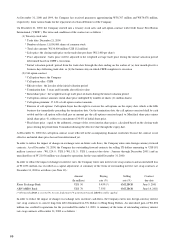

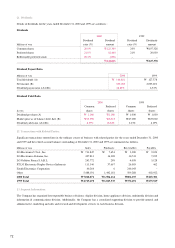

Changes in goodwill are as follows :

Millions of won

Goodwill at the merger W 393,820

Amortization (21,275)

Goodwill as of December 31, 2000 W 372,545

Condensed balance sheets of LGIC as of August 31, 2000 and December 31, 1999 and the related statements of income are as

follows (Millions of won) :

Condensed balance sheets

As of August As of December

31, 2000 31, 1999

Current assets W1,221,105 W 894,135

Investment 1,571,884 1,473,054

Property, plant and equipment 228,085 198,261

Intangible assets 36,176 30,508

Total assets W3,057,250 W2,595,958

Current liablities W1,910,295 W1,021,601

Non-current liabilities 623,748 403,647

Total liabilities 2,534,043 1,425,248

Shareholders’ equity 523,207 1,170,710

Total liabilities and shareholders’ equity W3,057,250 W2,595,958

74