LG 2000 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2000 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

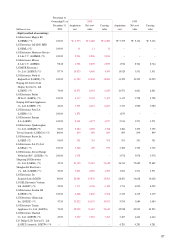

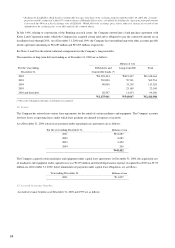

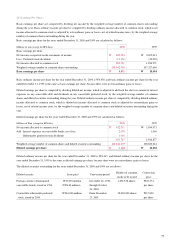

Amount Exchange Buying Selling Contract

(In millions) rate rate rate due date

Citi Bank US$40.0 HK$7.765:US$1 5.35% 7% August 30, 2001

Deutsche Bank US$40.0 HK$7.765:US$1 5.34% 7% August 30, 2001

CSFB US$45.5 HK$7.765:US$1 5.35% 7% August 30, 2001

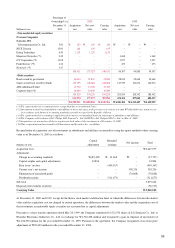

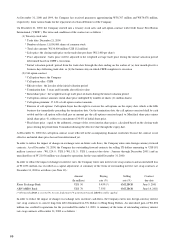

In order to reduce the impact of changes in exchange rates, the Company enters into foreign currency option contracts. An unrealized

loss of W1,434 million was charged to operations for the year ended December 31, 2000. A summary of the terms of outstanding

currency option contracts at December 31, 2000 and 1999 is as follows :

Option Amount Exercising Contract

Type (In millions) price due date

Standard Chartered Bank Put US$ 20.0 W 1,100.00 May 17, 2001

Call US$ 20.0 W 1,211.00 May 17, 2001

Fleet Boston Financial Put US$1.792 EUR 0.8960 March 6, 2001

Call US$0.896 EUR 0.8960 March 6, 2001

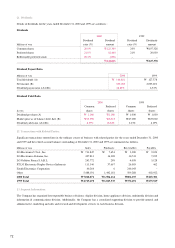

As a result of the above derivatives contracts, a gain of W10,563 million and a loss of W20,338 million were realized for the year

ended December 31, 2000.

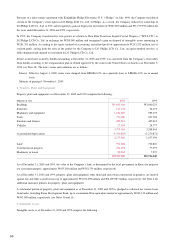

At December 14, 2000, the Company has entered into a leasehold deposits sales agreement with LG Shinhan Securitization L.L.C.

(“SPC”) to securitize the leasehold deposits owned by the Company. The Company has sold leasehold deposits whose book value is

W133,854 million to the SPC for W120,400 million. The Company has also provided the SPC with a long-term loan of W3,300

million as of December 31, 2000. The Company provides management services related to the leasehold deposits owned by the SPC

and receives a service fee from the SPC. The holders of the bonds issued by the SPC based on the leasehold deposits have rights to

request the Company to purchase the bonds under certain adverse conditions within two years after the date upon which the bond

sales are completed.

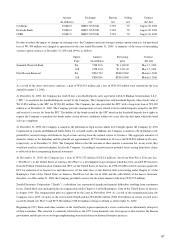

At December 31, 2000, the Company is named as the defendant in legal actions which were brought against the Company by AVS

Corporation in Canada and Mahmood Saleh Abbar Co. in Saudi Arabia. In addition, the Company is named as the defendant or the

plaintiff in various foreign and domestic legal actions arising from the normal course of business. The aggregate amounts of

domestic claims as the defendant and the plaintiff are approximately W7,269 million in 10 cases and W18,891 million in 28 cases,

respectively, as of December 31, 2000. The Company believes that the outcome of these matters is uncertain but, in any event, they

would not result in a material ultimate loss for the Company. Accordingly, no provision for potential losses arising from these claims

is reflected in the accompanying financial statements.

At December 31, 2000, the Company has a loan of W30,725 million (US$ 24 million), due from NextWave Telecom, Inc.

(“NextWave”) in the United States of America. NextWave is a development stage enterprise which has been awarded PCS licenses

from the Federal Communication Commission (FCC) in the United States of America. In 1998, NextWave filed a lawsuit against the

FCC for reduction of its license fees and other issues. At the same time, it also filed for debt restructuring under Chapter 11 of the

Bankruptcy Code of the United States of America. NextWave lost the suit in 2000 and the collectibility of the loan is uncertain,

therefore, as of December 31, 2000, the Company provided a reserve for the entire amount of the loan (W30,725 million).

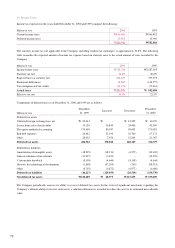

Zenith Electronics Corporation (“Zenith”), a subsidiary, has experienced significant financial difficulties resulting from continuous

losses. Zenith filed a pre-packaged plan of reorganization under Chapter 11 of the Bankruptcy Code of the United States of America

in August 1999. The reorganization plan was approved by the court in November 1999. As a result of the reorganization plan, the

Company owns 100% of equity in the restructured Zenith and has W148,686 million (US$ 118 million) of senior secured notes

issued by Zenith (see Note 7) and W75,582 million (US$ 60 million) of loans to Zenith as of December 31, 2000.

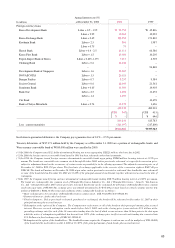

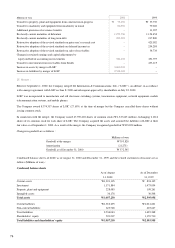

Beginning in 1997, Korea and other countries in the Asia Pacific region experienced a severe contraction in substantially all aspects

of their economies. This situation is commonly referred to as the 1997 Asian financial crisis. In response to this situation, the Korean

government and the private sector began implementing structural reforms to historical business practices.

67