LG 2000 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2000 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

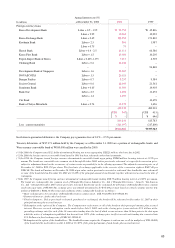

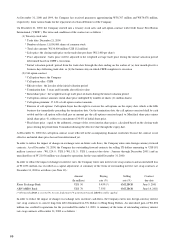

16. Capital Surplus:

In cases where the net assets of the combined enterprises exceed the consideration paid, the Company records the excess amount as a

gain on merger.

The Company revalued a substantial portion of its property, plant and equipment, effective January 1, 1981 and 1993, and October 1,

1998, in accordance with the Korean Asset Revaluation Law and obtained relevant governmental approval. As of December 31,2000

and 1999, the revaluation increments of W339,619 million and W339,676 million, respectively, net of tax, transfer to capital stock

and offset against deferred foreign currency translation losses, are credited to revaluation surplus.

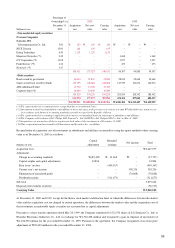

17. Retained Earnings :

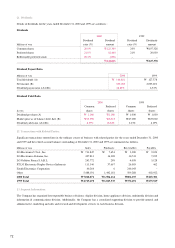

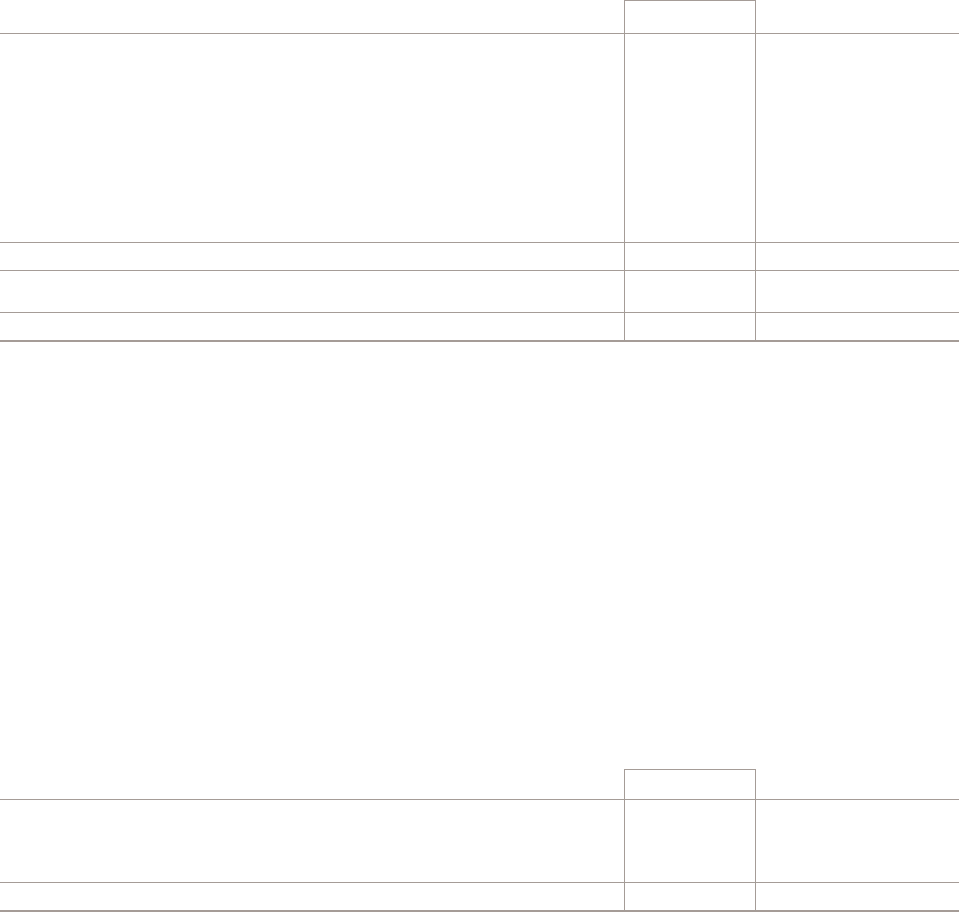

Retained earnings as of December 31, 2000 and 1999 are as follows:

Millions of won 2000 1999

Legal reserve (*1) W 55,999 W 41,499

Other reserves

Reserve for business rationalization (*2) 281,065 326,180

Reserve for improvement of financial structure (*3) 84,458 84,458

Reserve for technological development (*4) 708,680 974,516

Reserve for export loss (*4) –14,000

Reserve for redemption of redeemable preferred stock 544,000 –

1,618,203 1,399,154

Unappropriated retained earnings carried forward to subsequent year 24 44

W1,674,226 W1,440,697

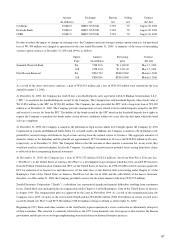

(*1) The Commercial Code of the Republic of Korea requires the Company to appropriate, as a legal reserve, an amount equal to a minimum of 10%

of cash dividends paid until such reserve equals 50% of its issued capital stock. The reserve is not available for payment of cash dividends, but

may be transferred to capital stock through an appropriate resolution by the Company’s board of directors or used to reduce accumulated

deficit, if any, through appropriate resolution by the Company’s shareholders.

(*2) Pursuant to the Tax Exemption and Reduction Control Law, the Company is required to appropriate, as a reserve for business rationalization, a

portion of retained earnings equal to tax reductions arising from investment and other tax credits. This reserve is not available for dividends but

may be transferred to capital stock through an appropriate resolution by the Company’s board of directors or used to reduce accumulated

deficit, if any, through appropriate resolution by the Company’s shareholders.

(*3) In accordance with the regulations regarding securities’ issuance and disclosure (formerly, the provisions of the Financial Control Regulation

for publicly listed companies), the Company is required to appropriate, as a reserve for improvement of financial structure, a portion of

retained earnings equal to a minimum of 10% of its annual income plus at least 50% of the net gain from the disposal of property, plant and

equipment after deducting related taxes, until equity equals 30% of total assets. This reserve is not available for dividends, but may be

transferred to capital stock through an appropriate resolution by the Company’s board of directors or used to reduce accumulated deficit, if

any, through an appropriate resolution by the Company’s shareholders.

(*4) Pursuant to the Tax Exemption and Reduction Control Law, the Company is allowed to appropriate retained earnings as a reserve for

technological development and export loss. These reserves are not available for dividends until used for the specified purposes or reversed.

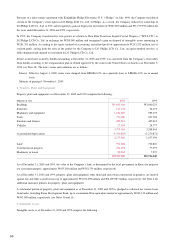

18. Capital Adjustments:

As of December 31, 2000 and 1999, capital adjustments are as follows:

Millions of won 2000 1999

Treasury stock W (875,604) W –

Gain (Loss) on valuation of investment securities (175,462) 250,430

Gain (Loss) on valuation of derivative financial instruments (Note 14) (1,091) 171

W(1,052,157) W250,601

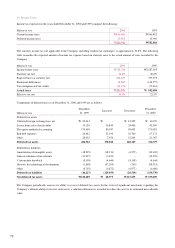

In 2000, the Company purchased its own stocks amounting to 40,835,200 shares of common stock and 1,508,876 shares of preferred

stock mainly in relation to specified money trust agreements and the stock repurchase request option executed by shareholders who

objected to the merger with LGIC. As of December 31, 2000, the Company retains treasury stocks amounting to 29,729,300 shares

of common stock and 1,508,876 shares of preferred stock. The Company has intention to sell the treasury stock in the future.

69