LG 2000 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2000 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1999

632

3,186

2000

1,031

4,008

Shareholders' Equity

Capital stock

Total shareholders' equity

1998

632

1,834

In billions of Korean won

LGE issued debentures equivalent to W1,101 billion in 2000. As of December 31, 2000,

LGE's outstanding debentures including current maturities reached W3,259 billion, a

27.7% increase from W2,553 billion in 1999.

Total debt (the sum of short-term borrowings, current maturities of long-term debt,

debentures, and long-term debt) amounted to W4.7 trillion. Total debt rose 43.1% from

W3.3 trillion in 1999, mainly due to LGE's buyback of W1.3 trillion in LGIC shares.

The ratio of debt to equity worsened to 117.5% in 2000 from 103.3% in 1999, while the

ratio of liabilities to equity rose to 196.4% from 185.4%. This deterioration resulted

primarily from the LGIC merger but was partially offset by capital increases for the LGIC

share exchange program in September 2000 as well as the issuance of redeemable

preferred stocks in December.

Despite the setback, there are many encouraging points. For example, with a 284.0%

liabilities to equity ratio at the time of the merger, it sought out methods for improvement.

Such methods include a capital increase by issuing redeemable preferred stock equivalent

to W544 billion, the issuance of W107 billion in asset-backed securities, and W136

billion in sales of treasury stock. As a result, its debt-related ratios began to improve in

late 2000. LGE predicts even greater soundness in 2001, primarily through profit growth,

sales of its treasury stock, and gain on property investment. As a result of the excessive

value of LGE's property investment through its CRT manufacturing joint venture with

Philips Electronics, LGE expects to be compensated US$1.1 billion from the new CRT

joint venture in 2001.

Through capital increases generated by the LGIC share exchange program, the issuance of

redeemable preferred stocks, and a net income of W502 billion, shareholders' equity

increased from W3,186 billion in 1999 to W4,008 billion in 2000. The increase was offset

by W876 billion in treasury stock, W177 billion in valuation loss, and W145 billion in

dividend payments. Treasury stock, amounting to 42 million shares at the time of the

merger, decreased from the resale of 11 million shares in 2000.

LGE is now exploring ways to effectively dispose of its treasury stock and minimize its

impact upon the market. Such methods include: granting incentives to employees, the

listing of LGE on over-the-counter stock markets overseas, the issuance of depository

receipts, and other resale methods.

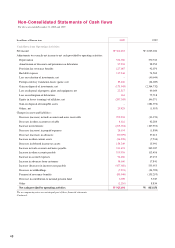

Cash Flow

LGE incessantly strives to maintain proper levels of liquidity. Sustaining such levels is

especially important with regard to its ability to promptly act upon growth opportunities

and unexpected adversities.

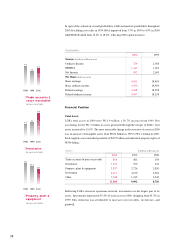

375.0

185.4 196.4

Liabilities to equity

1998 1999 2000

In percent

273.9

103.3 117.5

Debt to equity

1998 1999 2000

In percent

40