LG 2000 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2000 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

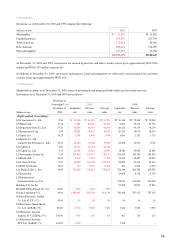

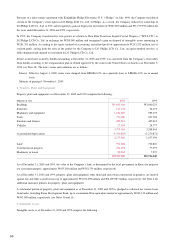

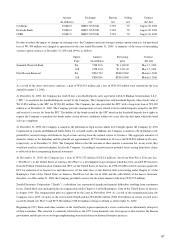

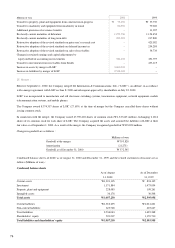

Millions of won 2000 1999

Beginning balance W 434,842 W 456,071

Severance payments (85,046) (135,293)

Transfer-in by merger 66,263 –

Transfer-in from affiliated companies 238 8,854

Provisions 128,943 99,300

Additional provisions –11,907

Conversion to severance insurance deposit 5,997 (5,997)

551,237 434,842

Contribution to National Pension Fund (39,196) (40,277)

Severance insurance deposits (330,830) (265,835)

W 181,211 W 128,730

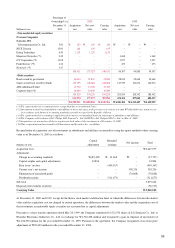

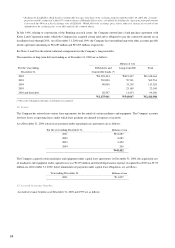

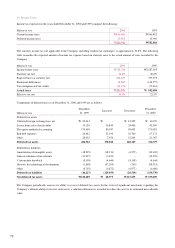

At December 31, 2000 the severance benefits are funded approximately 60% through employees severance insurance plans with

Kyobo Life Insurance Co, Ltd. and other life insurance companies. The amounts funded under employees severance insurance plans

(severance insurance deposits) is presented as deduction from accrued severance benefits.

At December 31, 1999 the severance benefits are funded approximately 65% through group severance insurance plans and

employees severance insurance plans with Kyobo Life Insurance Co, Ltd. and other life insurance companies. The amounts funded

under group severance insurance plans are recorded as long-term financial instruments (Note 3) and the amounts funded under

employees severance insurance plans (severance insurance deposits) are presented as deduction from accrued severance benefits.

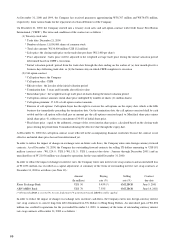

14. Commitments and Contingencies:

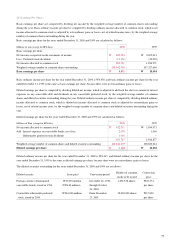

At December 31, 2000, the Company provided several notes and checks to financial institutions as collateral in relation to various

borrowings and guarantees of indebtedness.

At December 31, 2000, the Company has entered into bank overdraft facility agreements with various banks amounting to

W375,000 million.

At December 31, 2000, the outstanding balance of domestic trade notes receivable and export trade accounts receivable sold at

discount to various financial institutions with recourse is W3,825,833 million.

At December 31, 2000, the Company has entered into factoring agreements with LG Capital Co., Ltd. and Shinhan Bank. In relation

to the agreements, at December 31, 2000, the outstanding balance of factored accounts receivable is W 114,416 million.

At December 31, 2000, the Company was a party to various technical assistance agreements with various foreign companies for the

manufacture of certain product lines.

At December 31, 2000, the Company has entered into sales contracts with several companies, which comprise approximately W

65,226 million of sales to LG Telecom, Ltd., W 8,364 million of sales to Korea Telecom, W 41,773 million of sales to SK Telecom

Co., and W 67,278 million of sales to Hanaro Telecom, Inc., and others.

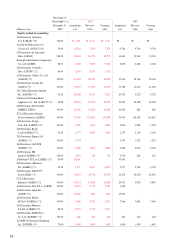

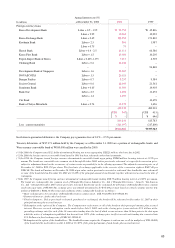

At December 31, 2000 and 1999, the Company was contingently liable for guarantees approximating W1,594,887 million and

1,492,126 million, respectively, on indebtedness of its subsidiaries and affiliates as follows :

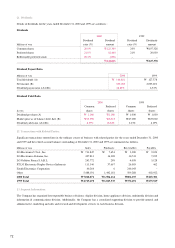

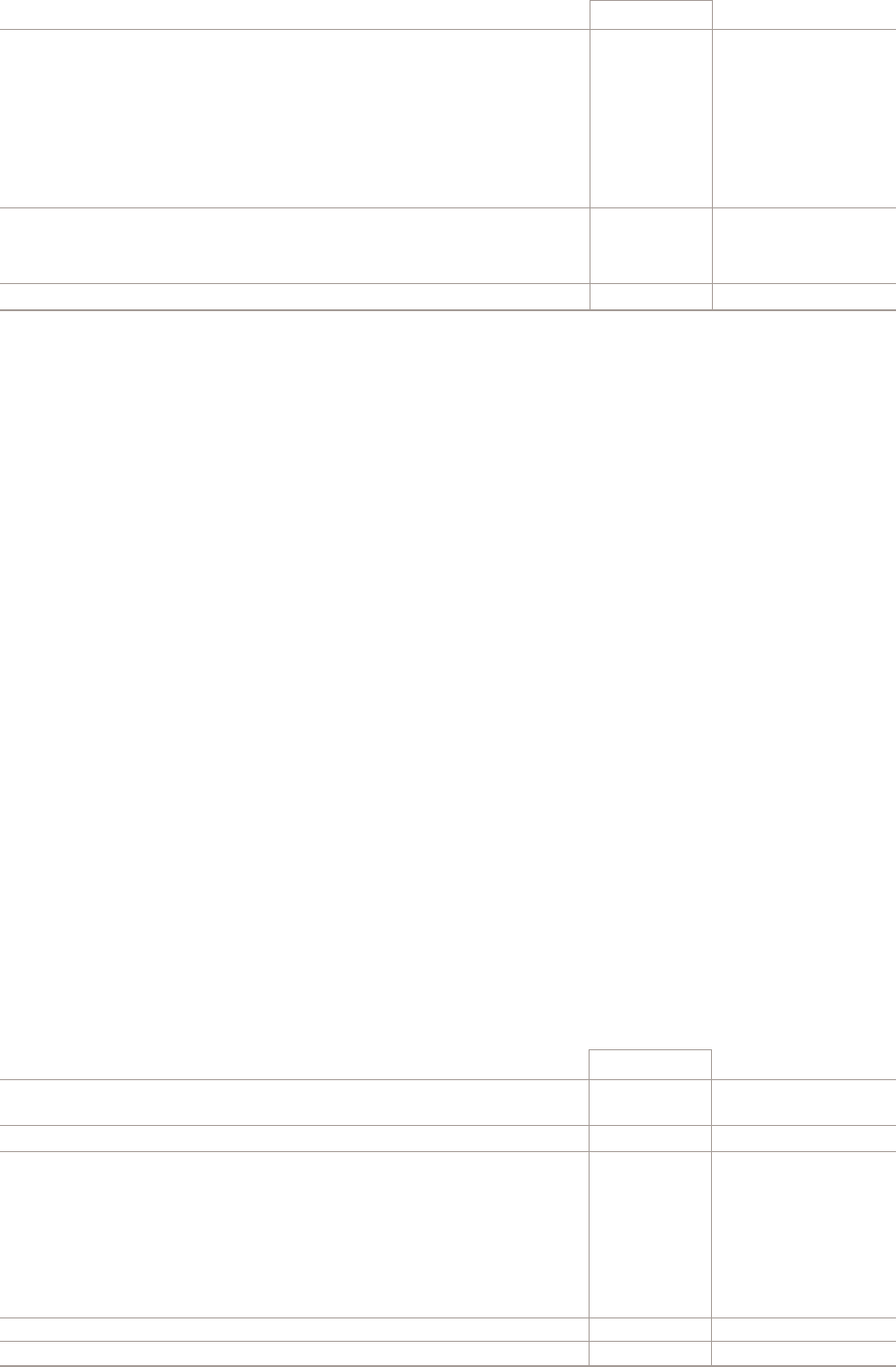

Millions of won 2000 1999

Domestic companies LG Telecom, Ltd. W 125,970 W 114,540

Other 26,465 31,738

152,435 146,278

Overseas companies LG Electronics Wales Ltd. 252,225 264,759

PT LG Electronics Display Device Indonesia 130,829 127,630

LG Electronics Alabama Inc. 205,331 166,083

LG Electronics U.S.A., Inc. 144,865 116,831

LG Electronics North of England Ltd. 40,847 80,873

Shuguang LG Electronics Co., Ltd. 78,605 74,577

Other 589,750 515,095

1,442,452 1,345,848

Total W 1,594,887 W 1,492,126

65