LG 2000 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2000 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

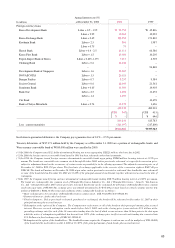

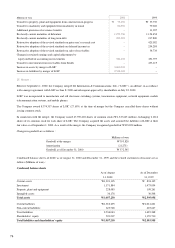

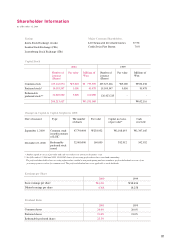

20. Earnings Per Share:

Basic earnings per share are computed by dividing net income by the weighted average number of common shares outstanding

during the year. Basic ordinary income per share is computed by dividing ordinary income allocated to common stock, which is net

income allocated to common stock as adjusted by extraordinary gains or losses, net of related income taxes, by the weighted average

number of common shares outstanding during the year.

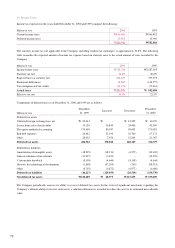

Basic earnings per share for the years ended December 31, 2000 and 1999 are calculated as follows:

Millions of won (except for EPS data) 2000 1999

Basic earnings per share

Net income as reported on the statements of income W 502,183 W 2,005,021

Less : Preferred stock dividends (19,472) (20,050)

Net income allocated to common stock 482,711 1,984,971

Weighted average number of common shares outstanding 108,942,560 107,327,666

Basic earnings per share W 4,431 W 18,494

Basic ordinary income per share for the year ended December 31, 2000 is W4,430, and basic ordinary income per share for the year

ended December 31, 1999 is the same as basic earnings per share, because there were no extraordinary gains or losses.

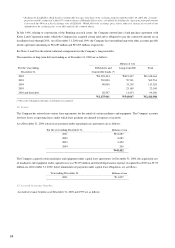

Diluted earnings per share is computed by dividing diluted net income, which is adjusted to add back the after-tax amount of interest

expenses on any convertible debt and dividends on any convertible preferred stock, by the weighted average number of common

shares and diluted securities outstanding during the year. Diluted ordinary income per share is computed by dividing diluted ordinary

income allocated to common stock, which is diluted net income allocated to common stock as adjusted by extraordinary gains or

losses, net of related income taxes, by the weighted average number of common shares and diluted securities outstanding during the

year.

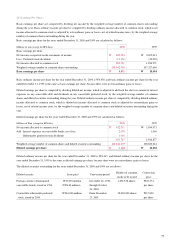

Diluted earnings per share for the years ended December 31, 2000 and 1999 are calculated as follows:

Millions of Won (except for EPS data) 2000 1999

Net income allocated to common stock W 482,711 W 1,984,971

Add : Interest expenses on convertible bonds, net of tax 2,070 1,906

Redeemable preferred stock dividends 1,006 –

485,787 1,986,877

Weighted average number of common shares and diluted securities outstanding 111,224,159 108,820,224

Diluted earnings per share W 4,368 W 18,258

Diluted ordinary income per share for the year ended December 31, 2000 is W4,367, and diluted ordinary income per share for the

year ended December 31, 1999 is the same as diluted earnings per share, because there were no extraordinary gains or losses.

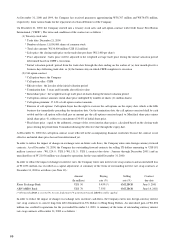

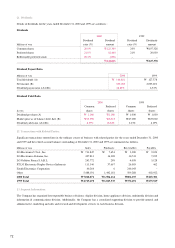

The diluted securities outstanding for the years ended December 31, 2000 and 1999 are as follows :

Number of common Conversion

Diluted security Issue price Conversion period stocks to be issued price

Foreign currency denominated W33,096 million December 26, 1996 1,492,558 shares W22,174

convertible bonds, issued in 1996 (US$ 40 million) through October per share

26, 2006

Convertible redeemable preferred W544,000 million From December 32,000,000 shares W17,000

stock, issued in 2000 23, 2001 per share

71