LG 2000 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2000 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

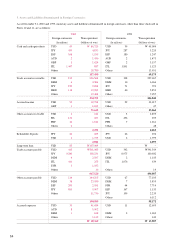

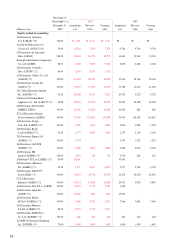

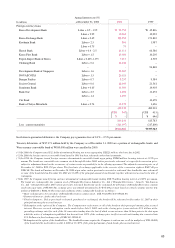

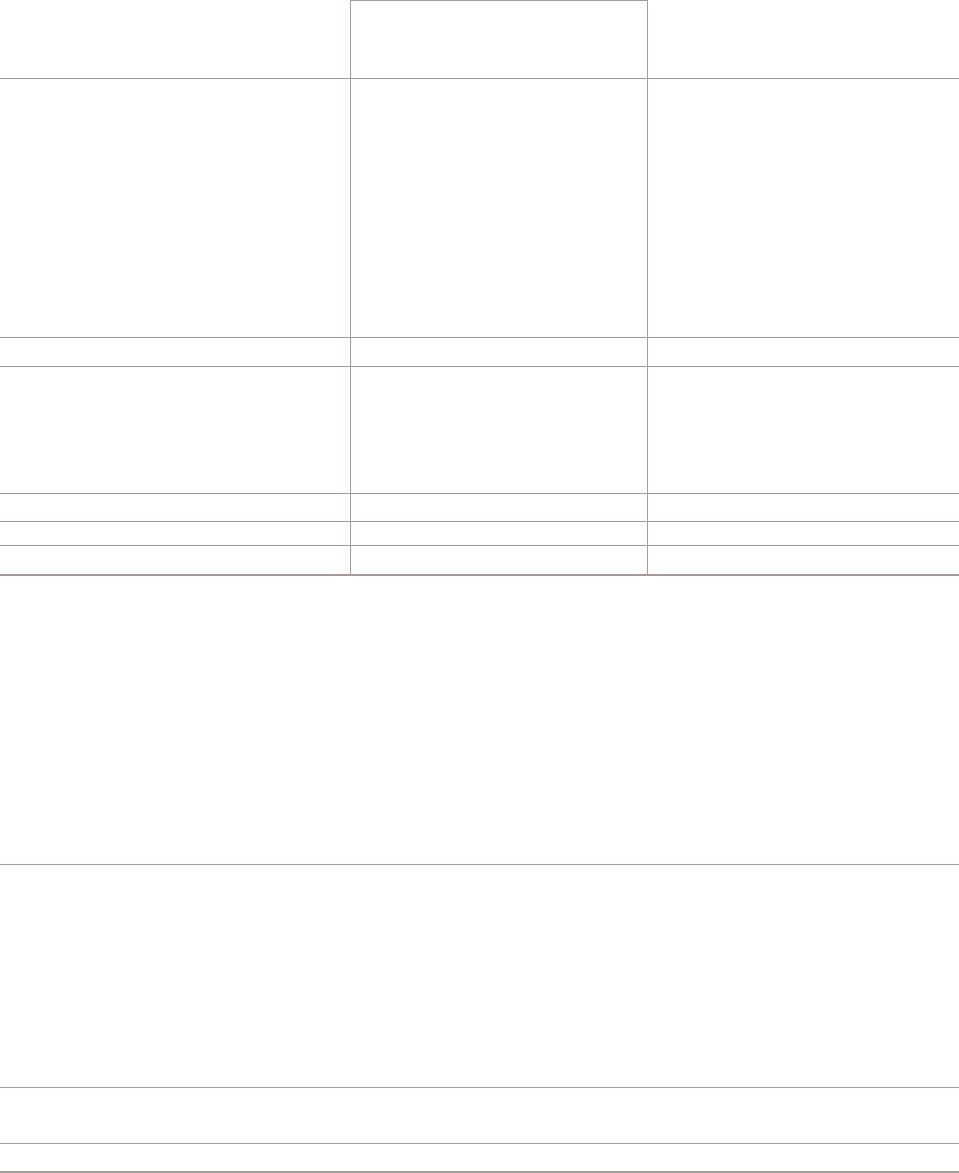

Percentage of

Ownership(%) at 2000 1999

December 31, Acquisition Net asset Carrying Acquisition Net asset Carrying

Millions of won 2000 cost value value cost value value

<Non-marketable equity securities>

Overseas Companies

Nakhodka FEZ

Telecommunication Co., Ltd. 5.00 W 129 W 129 W 129 W – W – W –

NICE Telecom 15.00 105 105 105 – – –

Erlang Technology 8.40 1,129 1,129 1,129 – – –

Mainstreet Networks (*5) 5.45 – – – 1,468 – 1,468

iTV Corporation (*5) 13.08 – – – 1,957 – 1,957

PocketScience (*5) 4.42 – – – 473 – 473

Nextwave (*5) 3.47 – – – – – –

148,431 137,927 148,431 99,397 94,885 99,397

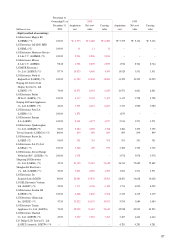

<Debt securities>

Bonds issued by government 30,034 21,843 21,843 58,015 45,668 45,668

Senior secured note issued by Zenith 135,195 148,686 148,686 147,519 142,674 142,674

ABS subordinated bond 13,700 13,700 13,700 – – –

Corporate bond (*6) 10,000 10,000 10,000 – – –

188,929 194,229 194,229 205,534 188,342 188,342

532,974 377,477 387,981 474,151 477,825 482,337

W4,980,951 W4,200,002 W4,210,506 W4,388,302 W4,115,447 W4,119,959

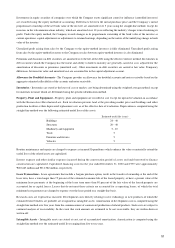

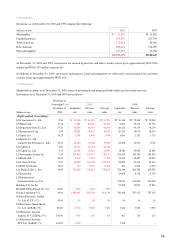

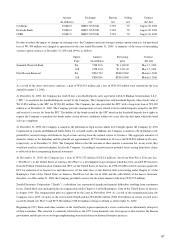

(*1) The equity method of accounting has been suspended due to accumulated losses.

(*2) Investments in small sized subsidiaries and affiliates whose total assets at the previous year-end are less than W7,000 million are stated at cost

in accordance with financial accounting standards generally accepted in the Republic of Korea.

(*3) The equity method of accounting is applied based on most recent unaudited financial statements of subsidiaries and affiliates.

(*4) The Company sold its shares of LG. Philips LCD Taiwan Co., Ltd. (LGPLT) to LG. Philips LCD Co., Ltd. on May 31, 2000.

(*5) Acquisition cost was written off due to negative net book value of the investment as of December 31, 2000.

(*6) This corporation bond was issued by LG Investment and Securities Inc., an affiliate.

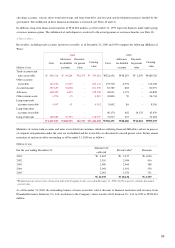

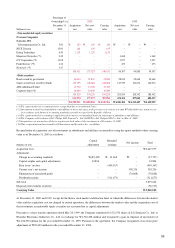

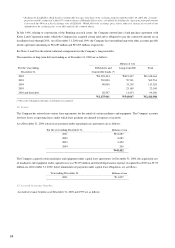

Reconciliation of acquisition cost of investments in subsidiaries and affiliates accounted for using the equity method to their carrying

value as of December 31, 2000 is as follows :

Capital Retained

Millions of won adjustment earnings Net income Total

Acqusition Cost W4,447,977

Adjustment :

Change in accounting standards W(89,425) W 31,668 W – (57,757)

Capital surplus and capital adjustments 12,894 – – 12,894

Prior years’ net loss – (499,567) – (499,567)

Current year’s net income – – 358,236 358,236

Elimination of unrealized profit – – (70,868) (70,868)

Dividends income – (311,673) – (311,673)

Sub total 3,879,242

Disposal of investment securities (56,717)

Carrying Value W3,822,525

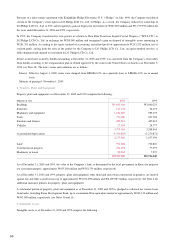

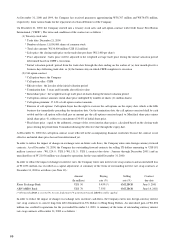

At December 31, 2000 and 1999, except for the Korea stock market stabilization fund, of which the differences between the market

value and the acquisition cost are charged to current operations, the differences between the market value and the acquisition cost of

the investments in marketable equity securities are accounted for as capital adjustments.

Pursuant to a share transfer agreement dated May 20, 1999, the Company transferred 61,512,076 shares of LG Semicon Co., Ltd. to

Hyundai Electronics Industries Co., Ltd. in exchange for W1,726,208 million and recognized a gain on disposal of investment of

W1,102,930 million for the year ended December 31, 1999. Pursuant to the agreement, the Company recognized a loss from price

adjustment of W59,600 million for the year ended December 31, 2000.

59