LG 2000 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2000 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

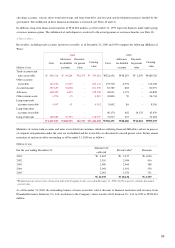

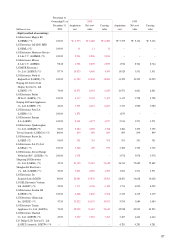

Investments in equity securities of companies over which the Company exerts significant control or influence (controlled investees)

are recorded using the equity method of accounting. Differences between the initial purchase price and the Company’s initial

proportionate ownership of the net book value of the investee are amortized over 5 years using the straight-line method, except for

investees in the telecommunications industry, which are amortized over 10 years reflecting the industry’s longer term of realizing its

profit. Under the equity method, the Company records changes in its proportionate ownership of the book value of the investee as

current operations, capital adjustments or adjustments to retained earnings, depending on the nature of the underlying change in book

value of the investee.

Unrealized profit arising from sales by the Company to the equity-method investees is fully eliminated. Unrealized profit arising

from sales by the equity-method investees to the Company or sales between equity-method investees is also eliminated.

Premiums and discounts on debt securities are amortized over the life of the debt using the effective interest method. Investments in

debt securities which the Company has the intent and ability to hold to maturity are generally carried at cost, adjusted for the

amortization of discounts or premiums (amortized cost). Other investments in debt securities are carried at fair value. Temporary

differences between fair value and amortized cost are accounted for in the capital adjustment account.

Allowance for Doubtful Accounts - The Company provides an allowance for doubtful accounts and notes receivable based on the

aggregate estimated collectibility of the accounts and notes receivable.

Inventories - Inventories are stated at the lower of cost or market, cost being determined using the weighted average method, except

for materials in transit which are determined using the specific identification method.

Property, Plant and Equipment - Property, plant and equipment are recorded at cost except for upward revaluation in accordance

with the Korean Asset Revaluation Law. Such revaluation presents land at the prevailing market price and buildings and other

production facilities at their depreciated replacement cost, as of the effective date of revaluation. Depreciation is computed using the

straight-line method over the following estimated useful lives of the assets.

Estimated useful life (years)

Buildings 20 - 40

Structures 20 - 40

Machinery and equipment 5 - 10

Tools 5

Furniture and fixtures 5

Vehicles 5

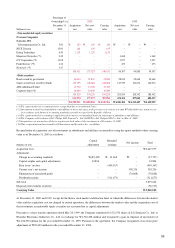

Routine maintenance and repairs are charged to expense as incurred. Expenditures which enhance the value or materially extend the

useful lives of the related assets are capitalized.

Interest expense and other similar expenses incurred during the construction period of assets on funds borrowed to finance

construction are capitalized. Capitalized financing costs for the year ended December 31, 2000 and 1999 were approximately

W20,643 million and W11,982 million, respectively.

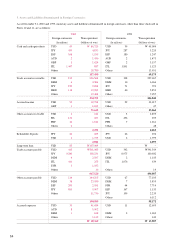

Lease Transactions - Lease agreements that include a bargain purchase option, result in the transfer of ownership at the end of the

lease term, have a term longer than 75 percent of the estimated economic life of the leased property, or have a present value of the

minimum lease payments at the beginning of the lease term more than 90 percent of the fair value of the leased property are

accounted for as capital leases. Leases that do not meet these criteria are accounted for as operating leases, of which the total

minimum lease payments are charged to expense over the lease period on a straight-line basis.

Research costs are expensed as incurred. Development costs directly relating to new technology or new products of which the

estimated future benefits are probable are recognized as intangible assets. Amortization of development costs is computed using the

straight-line method over five years from the commencement of commercial production of related products. Such costs are subject to

continual analysis of recoverability. In the event that such amounts are estimated to be not recoverable, they are written-down or

written-off.

Intangible Assets - Intangible assets are stated at cost, net of accumulated amortization. Amortization is computed using the

straight-line method over the estimated useful lives ranging from five to ten years.

51