LG 2000 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2000 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

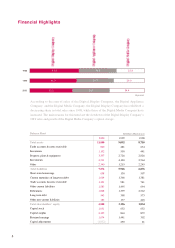

9,853

10,546

14,836

Sales

1998 1999 2000

LGE’s total sales in 2000

amounted to W14,836 billion,

increases of 40.7% and

50.6% from 1999 and 1998,

respectively.

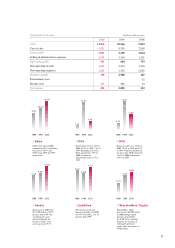

1998 1999 2000

1.3%

22.5%

4.8%

79.9%

14.0%

ROA

1998 1999 2000

Return on assets was 4.8% in

2000, 22.5% in 1999, 1.3% in

1998. Excluding asset sales,

ROA amounted to 4.9% in

2000, a significant

improvement from 3.7% in

1999.

ROE

Return on equity was 14.0% in

2000, 79.9% in 1999 and 6.7%

in 1998. Without consideration

for asset sales, ROE lowered to

18.2% in 2000, following an

19.4% in 1999.

8,710 9,092

11,880

6,876

5,906

7,872

1,834

3,186

4,008

Assets

1998 1999 2000

Total assets in 2000 were

W11,880 billion, a 30.7%

increase from 1999. Not

accounting for assets

generated through the

merger of LGIC, total

assets increased 15.8%.

Liabilities

The total of current and

long-term liabilities in 2000

was W7,872 billion, a 33.3%

increase from 1999.

Shareholders’ Equity

1998 1999 2000

Shareholders’ equity

increased to W4,008 billion

in 2000 through capital

increases generated by

the LGIC share exchange

program, the issuance of

redeemable preferred

stocks, and a net income of

W502 billion.

1998 1999 2000

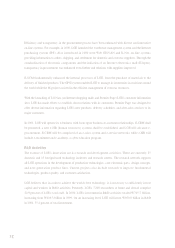

Statements of Income

Sales

Cost of sales

Gross profit

Selling & administrative expenses

Operating profit

Non-operating income

Non-operating expenses

Ordinary profit

Extraordinary loss

Income taxes

Net income

1998

9,853

7,809

2,044

1,291

753

1,496

2,082

167

12

43

112

1999

10,546

8,356

2,190

1,506

684

3,224

1,320

2,588

-

583

2,005

2000

14,836

11,821

3,015

2,094

921

1,042

1,234

729

-

227

502

In billions of Korean won

6.7%

5