LG 2000 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2000 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

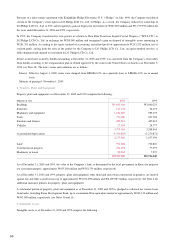

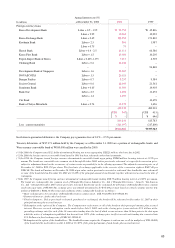

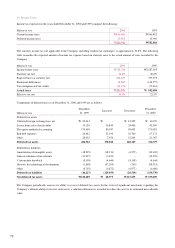

At December 31, 2000 and 1999, the Company has received guarantees approximating W58,767 million and W874,078 million,

respectively, from various banks for the repayment of certain debentures of the Company.

On December 21, 2000, the Company entered into a treasury stock sales and call option contract with Credit Suisse First Boston

International (“CSFB”). The terms and conditions of the contract are as follows :

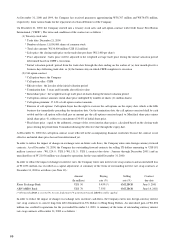

(1) Treasury stock sales

* Trade date: December 21, 2000

* Number of shares: 11,000,000 shares of common stock

* Total sales amount: W136,400 million (US$ 112 million)

* Sales price: the closing trade price on the trade date per share (W12,400 per share)

* Price adjustment : Sales price will be adjusted to the weighted average trade price during the initial valuation period

determined based on CSFB’s executions.

* Initial valuation period: period from the trade date through the date ending on the earlier of (a) four month plus five

business days following trade date; or (b) the business day on which CSFB completes its execution

(2) Call option contract

* Call option buyer: the Company

* Call option seller: CSFB

* Effective date : the last day of the initial valuation period

* Termination date: 3 years and 6 months after effective date

* Initial share price : the weighted average trade price of shares during the initial valuation period

* Call option contract amounts: initial share price multiplied by number of shares (11 million shares)

* Call option premium: 17.34% of call option contract amounts

* Exercise of call options: Call option buyer has the right to exercise the call options on the expiry date, which is the fifth

business day immediately preceding the termination date. On the termination date, the call options exercised shall be cash

settled and the call option seller shall pay an amount per the call options exercised equal to: Max(final share price minus

initial share price, 0), subject to a maximum of 30.0% of initial share price.

* Final share price : equal to the arithmetic average of the seven interim share prices, calculated based on the closing trade

prices during the period from 36 months following the effective date through the expiry date.

At December 31, 2000, the call option contract is not reflected in the accompanying financial statements because the contract is not

effective and initial share price has not been determined yet.

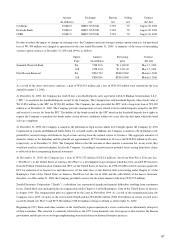

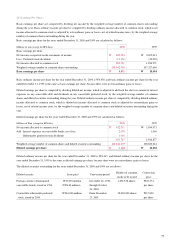

In order to reduce the impact of changes in exchange rates on future cash flows, the Company enters into foreign currency forward

contracts. As of December 31, 2000, the Company has outstanding forward contracts for selling US dollars amounting to US$ 181

million (contract rates : W1,124.0 : US$ 1~W1,131.5 : US$ 1, contract due dates : January through December 2001) and an

unrealized loss of W 21,936 million was charged to operations for the year ended December 31, 2000.

In order to reduce the impact of changes in interest rates, the Company enters into interest rate swap contracts and an unrealized loss

of W1,091 million was recorded as a capital adjustment. A summary of the terms of outstanding interest rate swap contracts at

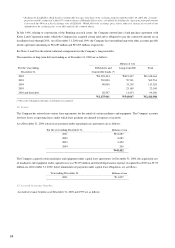

December 31, 2000 is as follows (see Note 18) :

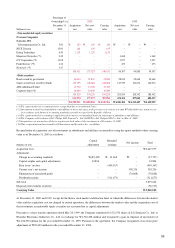

Amount Buying Selling Contract

(In million) rate (%) rate (%) due date

Korea Exchange Bank US$ 50 5.45%(*) 6M LIBOR June 5, 2001

ABN AMRO Bank US$ 70 7.35% 6M LIBOR June 14, 2002

(*) If 6 month LIBOR is over 6.25%, the rate deducting 0.1% point from 6 month LIBOR would be applied.

In order to reduce the impact of changes in exchange rates on future cash flows, the Company enters into foreign currency interest

rate swap contracts to convert long-term debt denominated in US Dollars to Hong Kong Dollars. An unrealized gain of W1,896

million was credited to operations for the year ended December 31, 2000. A summary of the terms of outstanding currency interest

rate swap contracts at December 31, 2000 is as follows :

66