LG 2000 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2000 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

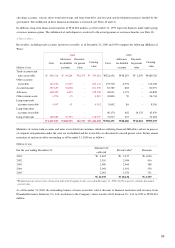

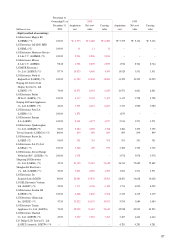

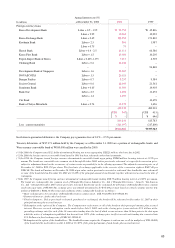

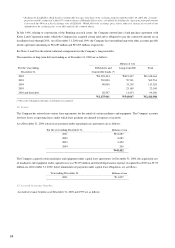

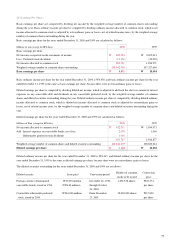

Annual interest rate (%)

In millions at December 31, 2000 2000 1999

Foreign currency loans

Korea Development Bank Libor + 0.5 - 1.95 W 94,753 W 45,816

Libor + 2.95 10,565 12,022

Korea Exchange Bank Libor + 0.45 188,955 171,810

Kookmin Bank Libor + 2.5 896 1,987

Libor + 0.75 79 –

Hanvit Bank Libor + 0.4 - 2.5 11,111 66,386

Korea First Bank Libor + 1.5 15,080 10,205

Export-Import Bank of Korea Libor + 0.625-1.175 7,115 4,503

Chohung Bank Libor + 0.6 34,012 –

––96,848

Development Bank of Singapore Libor + 1.6 12,507 –

NOVASCOTIA Libor + 1.5 26,626 –

Banque Paribas Libor + 0.7 8,257 9,384

Societe General Libor + 0.6 18,443 21,561

Sumitomo Bank Libor + 0.65 11,389 14,903

Bank One Libor + 2.5 4,206 11,472

Libor + 1.4 5,039 –

Citi Bank – –13,678

Bank of Tokyo-Mitsubishi Libor + 0.74 13,479 1,626

462,512 482,201

US$ 367 US$ 415

¥ – ¥ 646

804,244 615,783

Less : current maturities (261,197) (217,800)

W543,047 W397,983

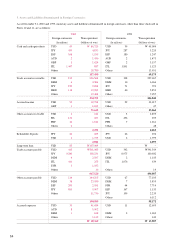

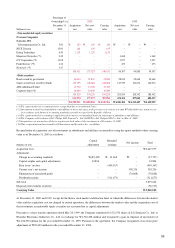

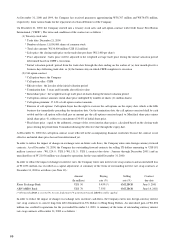

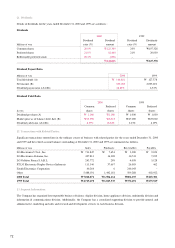

In relation to guaranteed debentures, the Company pays guarantee fees of 0.1% ~ 0.5% per annum.

Treasury debentures of W17,171 million held by the Company as of December 31, 2000 are a portion of exchangeable bonds, and

Won currency convertible bond of W100,000 million was cancelled in 2000.

(*1) In 2000, the Company issued U.S. dollar denominated floating rate notes aggregating US$221 million, which are due in 2002.

(*2) In 2000, the foreign currency convertible bond issued in 1991 has been redeemed earlier than its maturity.

(*3) In 1996, the Company issued foreign currency denominated convertible bonds aggregating US$40 million, bearing interest at 1.25% per

annum. The bonds are convertible into common stock through October 2006, unless previously redeemed, at a specified conversion price,

subject to adjustment based on the occurrence of certain events as provided for in the offering agreement. The adjusted conversion price as of

December 31, 2000 is W22,174 per share. The fixed rate of exchange applicable to the exercise of the conversion rights is W827.40 per

US$1.00. The bonds will mature on November 26, 2006 at par value, unless previously converted or redeemed. Any bondholder may redeem all

or some of the bonds held on November 26, 2001 at 133.20% of the principal amount of such bonds, together with interest accrued to the date of

redemption.

(*4) In 1997, the Company issued foreign currency denominated exchangeable bonds totaling US$ 75 million bearing interest at 0.25% per annum.

The bonds are exchangeable into common stock of Hyundai Electronics Industries Co., Ltd. (“Hyundai Electronics,” formerly “LG Semicon

Co., Ltd.”) through November 2007, unless previously redeemed. Each bond can be exchanged for 250 shares of Hyundai Electronics common

stock with a par value of W5,000. The exchange price was initially determined to be W35,430 per share based on a fixed exchange rate for U.S.

dollars of US$1.00 = W888.30. The terms and conditions of the exchangeable bonds are as follows :

* Basic exchange price for each share of Hyundai Electronics common stock : US$ 39.88 (W35,430 / W888.30)

* Payment of interest : At the end of each year

* Final redemption : Unless previously redeemed, purchased or exchanged, the bonds will be redeemed on December 31, 2007 at their

principal amount, plus accrued interest.

* Redemption at the option of the Company : The Company may redeem any or all of the bonds at their principal amount, plus accrued

interest. However, no such redemption can be made before July 9, 2002, unless the closing price (converted into U.S. dollars at the

prevailing exchange rate) for each of the 30 consecutive trading days, the last of which occurs not more than 30 days prior to the date upon

which the notice of redemption is published, has been at least 135% of the exchange price in effect on each such trading day converted into

U.S. Dollars at a fixed exchange rate of US$1.00 : W888.30.

* Redemption at the option of the bondholders : The bondholders may require the Company to redeem any or all (in multiples of US$ 10,000)

of the bonds held by such holders on July 8, 2002 at 133.67% of the principal amount of such bonds, plus accrued interest.

63

[ ] [ ]