LG 2000 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2000 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Regarding slow-down of the information technology industry, it is forecasted that the

Digital Media Company will have 13% sales growth in 2001 despite having 50% year-on-

year growth in 2000. The Digital Appliance Company, a cash generator for LGE, will

reach 5% sales growth in 2001. Sales of the Digital Appliance Company will be heavily

supported by air conditioners and refrigerators.

LGE expects that the LGIC merger will create further synergies in 2001, providing the

telecommunication division with advancements, enabling it to reach a W3.9 trillion sales

target. Through the cultivation of new telecommunication markets, progress will

primarily be created through the Digital Handset Company.

In addition to earnings generated from ordinary business operations, a 4-5% recurring

margin is expected due to a depreciating won.

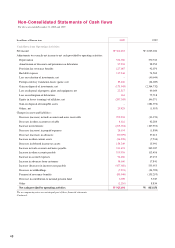

In 2001, LGE will focus its energies on cash-flow-oriented management and financial

soundness. Cash inflow is expected to be generated from net income, continuous shedding

of treasury stock, and ongoing disposition of non-strategic operations. Cash outflow will

primarily be utilized for investment in digital TVs, plasma display panels, and IMT 2000

equipment. With an expected net cash flow in 2001, LGE is striving to improve its

financial soundness to a new height.

42