LG 2000 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2000 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

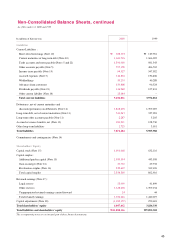

1999

130

1,366

981

1,495

3,972

1,399

398

137

1,934

5,906

2000

658

1,664

1,391

1,583

5,296

1,848

543

185

2,576

7,872

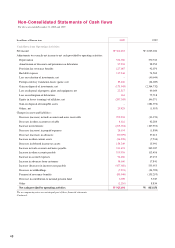

Liabilities

Short-term borrowings

Current maturities of long-term debt

Trade accounts & notes payable

Other current liabilities

Debentures

Long-term debt

Other noncurrent liabilities

1998

507

1,381

741

694

3,323

2,562

573

418

3,553

6,876

In billions of Korean won

Trade accounts & notes receivable increased from W481 billion to W800 billion. Based

on average receivables, net sales to receivables turnover improved from 19 times in 1999

to 23 times in 2000, despite high growth in sales. This improvement was in response to

the diversity of LGE's receivables collection policies and its efforts to secure proper

liquidity from its ordinary operations. Inventories doubled from W550 billion to W1,192

billion, comprised of LGIC inventories amounting to W373 billion, ready-manufactured

air conditioners worth W105 billion, and IT-related inventories totaling W99 billion.

Inventory turnover (the ratio of the cost of goods sold to average inventory) dropped to 17

times in 2000 while overall fixed assets efficiency improved. To maintain adequate

inventory levels, LGE is doing its utmost to reduce procurement and manufacturing lead-

time and restructure its logistics network.

Regarding the composition of the W4.2 trillion in investments in 2000, W760 billion was

due to equity investment in LG. Philips LCD, W991 billion resulted from equity

investment in Dacom, and W149 billion was due to investment in senior secured notes

issued by Zenith.

F u n d i n g

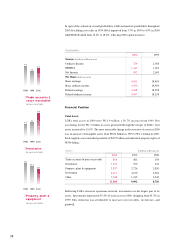

The total of current and long-term liabilities in 2000 was W7,872 billion in 2000, 33.3%

higher than W5,906 billion in 1999. Mirroring the results of 1999, current liabilities and

long-term liabilities represented 67.3% and 32.7% of total liabilities, respectively.

With regard to current liabilities, trade accounts & notes payable increased from W981

billion to W1,391 billion. This increase was largely the result of an additional W278

billion from the LGIC merger and a W173 billion rise in foreign currency payables.

Foreign currency payables increased due to a boost in sales of products that are highly

dependent upon overseas materials such as PCs, CD-ROM drives, monitors, CRTs, and

air conditioners.

Investments

Reflecting LGE's extensive

operations network,

investments are the largest

part of its assets.

Investments represented

35.4% of total assets in

2000, dropping from 45.3%

in 1999. This reduction was

attributable to increases of

receivables, inventories, and

g o o d w i l l .

5,023

3,293

4,713

Debt

1998 1999 2000

In billions of Korean won

39