LG 2000 Annual Report Download - page 52

Download and view the complete annual report

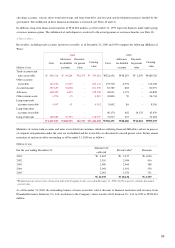

Please find page 52 of the 2000 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Discounts (Premiums) on Debentures - Discounts (premiums) on debentures are amortized using the effective interest rate method

over the repayment period of the debentures. The amortized amount is included in interest expense.

Treasury Debentures - When treasury debentures are acquired, the face value and any discount or premium is subtracted from the

related accounts. The difference between the book value and acquisition cost of the treasury debentures is charged to current

operations as a gain or loss on redemption of debentures.

Treasury stock - Treasury stocks are stated at cost and recorded as capital adjustment in shareholders’ equity. Gain on disposal of

treasury stock is recorded as capital surplus. Any loss on disposal of treasury stock is offset against prior gains on disposal of

treasury stock included in capital surplus. The remaining loss is offset against retained earnings.

Accrued Severance Benefits - Employees and directors with more than one year of service are entitled to receive a lump-sum

severance payment upon termination of their employment with the Company, based on their length of service and rate of pay at the

time of termination. Accrued severance benefits represent the amount which would be payable assuming all eligible employees and

directors were to terminate their employment as of the balance sheet date.

Contributions made under the National Pension Plan and severance insurance deposits are deducted from accrued severance benefits.

Contributed amounts are refunded from the National Pension Plan and the insurance companies to employees on their retirement.

Income Taxes - The Company recognizes deferred income taxes for anticipated future tax consequences resulting from temporary

differences between amounts reported for financial accounting and income tax purposes. Deferred tax assets and liabilities are

computed on such temporary differences by applying enacted statutory tax rates applicable to the years when such differences are

expected to be reversed. Deferred tax assets are recognized to the extent that it is more likely than not that such deferred tax assets

will be realized. The total income tax provision includes current tax expenses under applicable tax regulations and the change in the

balance of deferred tax assets and liabilities.

Tax credits for investments and development of technology and manpower are accounted for using the flow-through method,

whereby they reduce income taxes in the period the assets giving rise to such credits are placed in service. To the extent such credits

are not currently utilized, deferred tax assets, subject to realizability as stated above, are recognized for the carry-forward amount.

Sale of Accounts and Notes Receivables - The Company sells certain accounts or notes receivable to financial institutions at a

discount, and accounts for the transactions as sales of the receivables if the rights and obligations relating to the receivables are

substantially transferred to the buyers. The gains and losses from the sales of the receivables are charged to operations as incurred.

Foreign Currency Translation - Monetary assets and liabilities denominated in foreign currencies are translated into Korean Won

at the basic rates in effect at the balance sheet date, and resulting translation gains and losses are recognized currently.

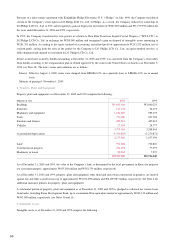

The exchange rates used to translate U.S. Dollar denominated monetary assets and liabilities at December 31, 2000 and 1999 are

W1,259.7 : US$1 and W1,145.4 : US$1, respectively.

Foreign currency dominated convertible bonds are translated at the historical exchange rates prevailing as of the date of issuance.

Derivative Financial Instruments - The Company utilizes several derivative financial instruments (“derivatives”) such as forward

exchanges, swaps and option contracts to reduce its exposure resulting from fluctuations in foreign currency and interest rates. The

derivatives are carried at fair market value. Unrealized gains or losses on derivatives for trading or fair value hedging purposes are

recorded in current operations. Unrealized gains or losses on derivatives for cash flow hedging purposes are recorded in current

operations for the portion of the hedge that is not effective. For the portions of cash flow hedges which are effective, unrealized

gains or losses are accounted for in the capital adjustment account and recorded in operations in the period when underlying

transactions have effect on operations.

Reclassifications - Certain amounts in the 1999 financial statement have been reclassified to conform to the 2000 presentation.

These reclassifications have no effect on previously reported net income or shareholders’ equity.

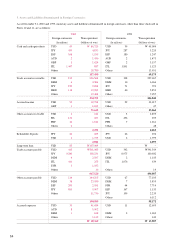

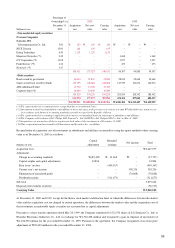

3. Restricted Financial Instruments :

As of December 31, 2000 and 1999, short-term financial instruments of W3,013 million and W5,923 million, respectively, and long-

term financial instruments of W208 million and W6,846 million, respectively, are deposited in connection with maintaining

52