LG 2000 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2000 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

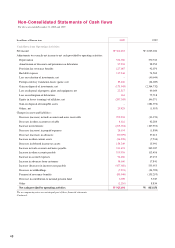

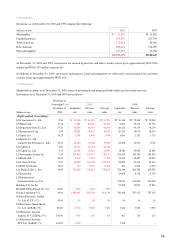

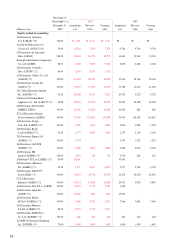

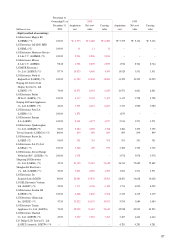

In millions of Korean won 2000 1999

Cash flows from Operating Activities :

Net income W 502,183 W 2,005,021

Adjustments to reconcile net income to net cash provided by operating activities :

Depreciation 524,050 370,763

Amortization of discounts and premiums on debentures 27,234 28,250

Provision for severance benefits 127,087 92,070

Bad debt expense 117,546 74,569

Loss on valuation of investments, net –(40,644)

Foreign currency translation losses (gains), net 85,460 (24,089)

Gain on disposal of investments, net (171,045) (2,364,752)

Loss on disposal of property, plant and equipment, net 22,317 49,069

Loss on redemption of debentures 664 75,718

Equity in losses (earnings) of affiliates, net (287,368) 146,371

Gain on disposal of intangible assets –(281,392)

Others, net 29,429 (1,953)

Changes in assets and liabilities :

Decrease (increase) in trade accounts and notes receivable 272,942 (33,953)

Decrease in other accounts receivable 4,116 42,284

Increase in inventories (265,654) (107,553)

Decrease (increase) in prepaid expenses 28,654 (1,884)

Decrease (increase) in advances (90,079) 37,213

Increase in other current assets (24,598) (7,534)

Decrease in deferred income tax assets 134,249 15,991

Increase in trade accounts and notes payable 121,455 242,387

Increase in other accounts payable 199,956 113,456

Increase in accrued expenses 54,286 47,153

Increase in advances from customers 58,660 17,841

Increase (decrease) in income taxes payable (457,980) 533,953

Decrease in withholdings (7,523) (24,709)

Payment of severance benefits (85,046) (135,293)

Decrease in contribution to national pension fund 6,709 5,947

Other (2,210) 8,854

Net cash provided by operating activities W 925,494 W 883,154

The accompanying notes are an integral part of these financial statements

Continued;

48

Non-Consolidated Statements of Cash flows

For the years ended December 31, 2000 and 1999