LG 2000 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2000 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

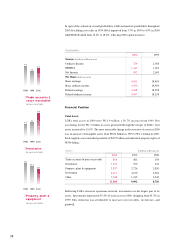

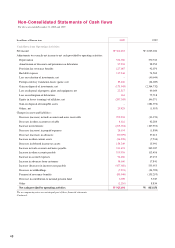

From its operating activities in 2000, LGE had cash and cash equivalent in the amount of

W925 billion. This was then utilized for investment (W229 billion) and financial activities

(W612 billion). During the year, LGE expended a total of W1,585 billion for facilities

investment and R&D, a significant increase from W954 billion in 1999. Cash and cash

equivalents rose from W86 billion in 1999 to W171 billion in 2000, and will improve

even more in 2001 with cash inflow from the new CRT Joint Venture, treasury stock

disposition, and expansion of LGE operations.

Risk Management

Material Challenges

As LGE expands its operations throughout the world, its risks and uncertainties become

more complicated. In order to maintain control, LGE continuously analyzes its business

environment and anticipates possible challenges.

Material challenges that LGE may face in 2001 include, but are not limited to, an increase

in the price of oil, depreciation of the euro, and a sudden setback in the Korean economy.

To mitigate such impacts, LGE has prepared for a variety of situations and focuses on

manufacturing high-value-added products.

Foreign Exchange Risk

To manage foreign exchange volatility within acceptable limits, LGE is engaged in a

variety of hedging transactions. The net cash flow of foreign currencies maturing within

one year is hedged through hedging transactions with value dates up to three months. For

more effective management of its medium- and long-term profitability, LGE is currently

involved in hedging transactions with value dates up to six months and has increased its

minimum hedge ratio.

Preparation for Anti-Dumping Lawsuits

With the rise of its market share in major commercial markets, LGE is prepared for the

possibility of anti-dumping lawsuits. In order to keep the likelihood to a minimum, LGE

monitors its cost structures, market positions, and the performance of its competitors. As

well, it pursues strategic alliances with local manufacturers and distributors while

increasing construction of local manufacturing sites.

Outlook for 2001

LGE will not be exempt from the effects of worldwide economic deterioration. Although

strong fundamentals enabled 40% growth last year, an adverse economic situation in

combination with the proposed spin-off of its cathode ray tube manufacturing business

have compelled LGE to lower its 2001 target sales increase rate to 13%.

Risk Management

Material challenges that LGE

may face in 2001 include,

but are not limited to, an

increase in the price of oil,

depreciation of the Euro, and

a sudden setback in the

Korean economy. To

mitigate such impacts, LGE

has prepared for a variety of

situations and focuses on

manufacturing high-value-

added products.

1999

954

86

2000

1,585

171

Cash Flow

Capital expenditure

Cash flow

1998

998

260

In billions of Korean won

41