LG 2000 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2000 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

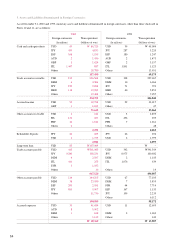

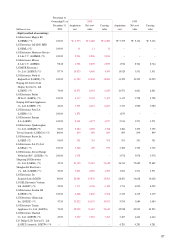

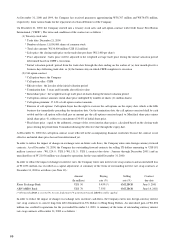

Pursuant to a joint venture agreement with Koninklijke Philips Electronics N.V. (“Philips”) in July 1999, the Company transferred

certain of the Company’s stock rights in LG.Philips LCD Co., Ltd. to Philips. As a result, the Company reduced its ownership of

LG.Philips LCD Co., Ltd. to 50% and recognized a gain on disposal of investment of W247,800 million and W1,179,939 million for

the years ended December 31, 2000 and 1999, respectively.

In 1999, the Company transferred its own patents in relation to Thin Film Transistor Liquid Crystal Displays (“TFT-LCD”) to

LG.Philips LCD Co., Ltd. in exchange for W288,000 million and recognized a gain on disposal of intangible assets amounting to

W281,391 million. According to the equity method of accounting, unrealized profit of approximately W253,252 million, net of

realized profit, arising from the sales of the patents by the Company to LG. Philips LCD Co., Ltd., an equity-method investee, is

fully eliminated and charged to investment in LG. Philips LCD Co., Ltd.

Senior secured note issued by Zenith outstanding at December 31, 2000 and 1999, was converted from the Company’s receivables

from Zenith according to the reorganization plan of Zenith approved by the court in the United States of America on November 5,

1999 (see Note 14). The note’s terms and conditions are as follows :

Interest : Effective August 1, 2000, terms were changed from LIBOR+6.5% on a quarterly basis to LIBOR+3.0% on an annual

basis

Maturity of principal : November 1, 2009

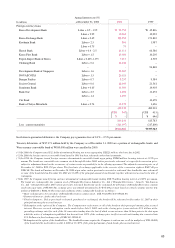

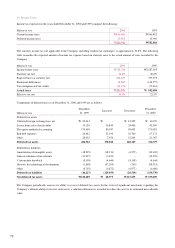

8. Property, Plant and Equipment:

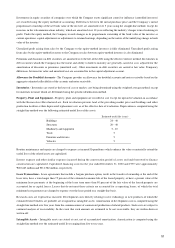

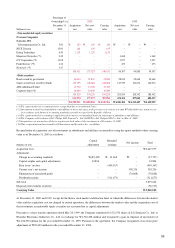

Property, plant and equipment as of December 31, 2000 and 1999 comprise the following :

Millions of won 2000 1999

Buildings W1,095,616 W1,000,223

Structures 107,578 94,673

Machinery and equipment 1,282,603 985,193

Tools 776,989 697,789

Furniture and fixtures 484,019 405,810

Vehicles 27,099 24,777

3,773,904 3,208,465

Accumulated depreciation (1,500,218) (1,270,871)

2,273,686 1,937,594

Land 794,384 702,810

Construction in progress 218,694 77,973

Machinery in transit 50,324 7,872

W3,337,088 W2,726,249

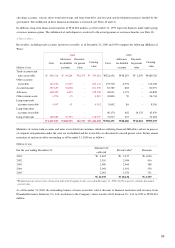

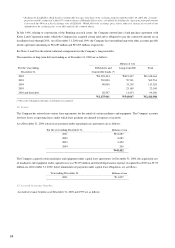

As of December 31, 2000 and 1999, the value of the Company’s land, as determined by the local government in Korea for property

tax assessment purpose, approximates W655,189 million and W581,759 million, respectively.

As of December 31, 2000 and 1999, property, plant and equipment, other than land and certain construction in progress, are insured

against fire and other casualty losses up to approximately W3,871,698 million and W4,009,987 million, respectively. See Note 6 for

additional insurance policies for property, plant and equipment.

A substantial portion of property, plant and equipment as of December 31, 2000 and 1999 is pledged as collateral for various loans

from banks, including Korea Development Bank, up to a maximum Won equivalent amount of approximately W649,139 million and

W583,009 million, respectively (see Notes 10 and 11).

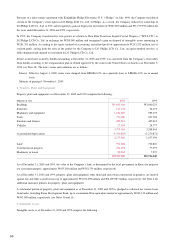

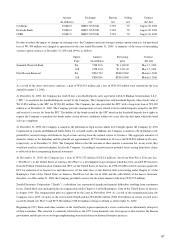

9. Intangible Assets :

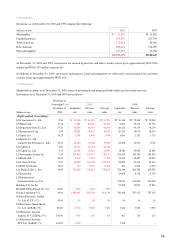

Intangible assets as of December 31, 2000 and 1999 comprise the following :

60